Question: need help with part 1 and 2!! PR 7 -44 (Algo) Break-Even Analysis; Operating Leverage; New Manufacturing Environment (LO 7-1, 7-8, 7-10) [The following information

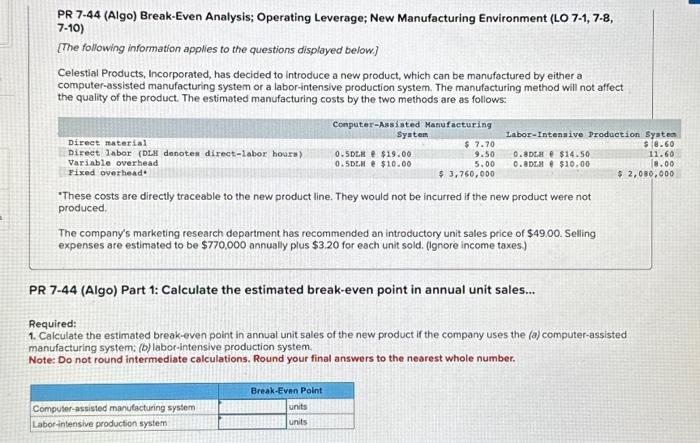

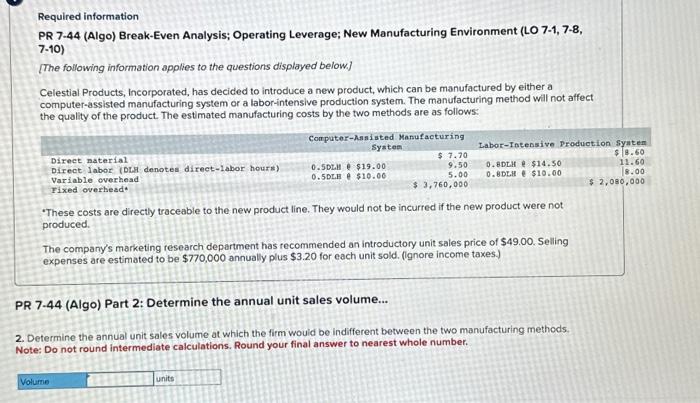

PR 7 -44 (Algo) Break-Even Analysis; Operating Leverage; New Manufacturing Environment (LO 7-1, 7-8, 7-10) [The following information applies to the questions displayed below.] Celestial Products, Incorporated, has decided to introduce a new product, which can be manufactured by either a computer-assisted manufacturing system or a labor-intensive production system. The manufacturing method will not affect the quality of the product. The estimated manufacturing costs by the two methods are as follows: 'These costs are directly traceable to the new product line. They would not be incurred if the new product were not produced. The company's marketing research department has rocommended an introductory unit sales price of $49.00. Selling expenses are estimated to be $770,000 annually plus $3.20 for each unit sold. (ignore income taxes) PR 7-44 (Algo) Part 1: Calculate the estimated break-even point in annual unit sales... Required: 1. Calculate the estimated break-even point in annual unit sales of the new product if the company uses the (a) computer-assisted manufacturing system; (b) labor-intensive production system. Note: Do not round intermediate calculations. Round your final answers to the nearest whole number. Required information PR 7-44 (Algo) Break-Even Analysis; Operating Leverage; New Manufacturing Environment (LO 7-1, 7-8, 7-10) [The following information applies to the questions displayed below.] Celestial Products, Incorporated, has decided to introduce a new product, which can be manufactured by either a computer-assisted manufacturing system or a labor-intensive production system. The manufacturing method will not affect the quality of the product. The estimated manufacturing costs by the two methods are as follows: -These costs are directly traceable to the new product line. They would not be incurred if the new product were not produced. The company's marketing research department has recommended an introductory unit sales price of $49.00. Selling expenses are estimated to be $770,000 annually plus $3.20 for each unit sold. (ignore income taxes) PR 7.44 (Algo) Part 2: Determine the annual unit sales volume... 2. Determine the annual unit sales volume at which the firm wouid be indifferent between the two manufacturing methods. Note: Do not round intermediate calculations. Round your final answer to nearest whole number

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts