Question: need help with part 1. S B Question One 1 Decorative Doors, Inc., produces two types of doors, interior and exterior. The company's simple costing

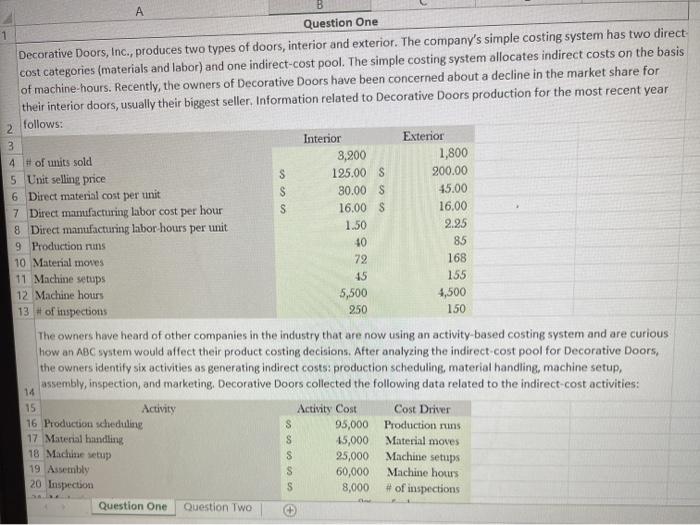

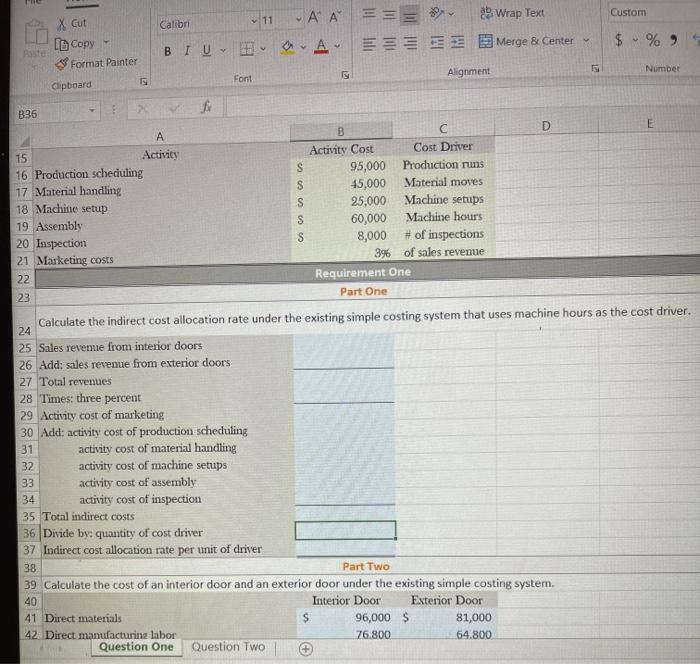

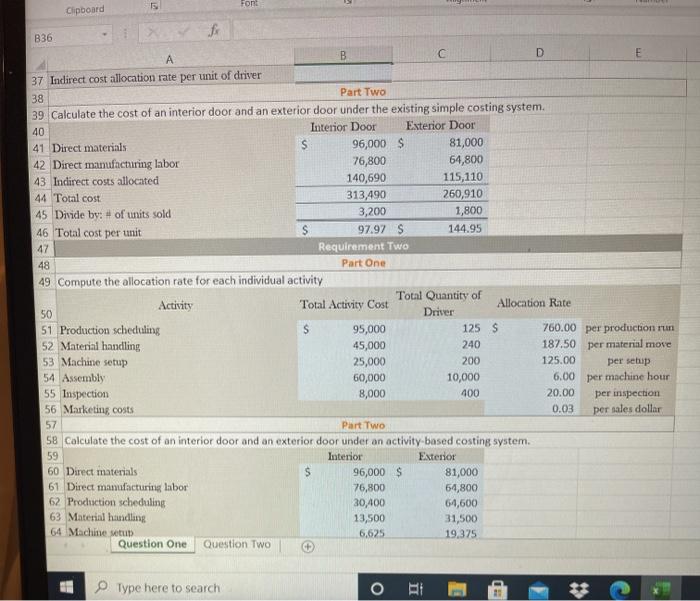

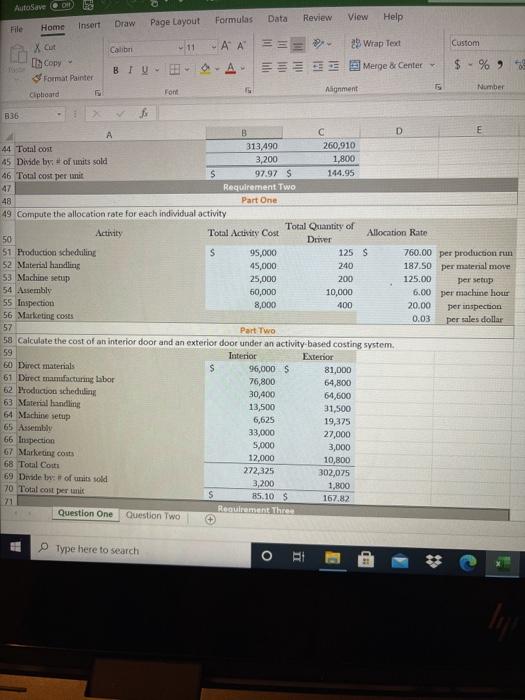

S B Question One 1 Decorative Doors, Inc., produces two types of doors, interior and exterior. The company's simple costing system has two direct cost categories (materials and labor) and one indirect-cost pool. The simple costing system allocates indirect costs on the basis of machine-hours. Recently, the owners of Decorative Doors have been concerned about a decline in the market share for their interior doors, usually their biggest seller. Information related to Decorative Doors production for the most recent year 2 follows: Interior Exterior 3 4 # of units sold 8,200 1,800 5 Unit selling price 125.00 S 200.00 6 Direct material cost per unit 80.00 S 45.00 7 Direct mamfacturing labor cost per hour 16.00 S 16.00 8 Direct manufacturing labor hours per unit 1.50 2.25 9 Production runs 10 85 10 Material moves 72 168 11 Machine setups 15 155 12 Machine hours 5,500 4,500 13 of inspections 250 150 The owners have heard of other companies in the industry that are now using an activity based costing system and are curious how an ABC system would affect their product costing decisions. After analyzing the indirect cost pool for Decorative Doors, the owners identify six activities as generating indirect costs: production scheduling material handling, machine setup, assembly, inspection, and marketing, Decorative Doors collected the following data related to the indirect cost activities: 14 15 Activity Activity Cost Cost Driver 16 Production scheduling S 95,000 Production runs 17 Material handling S 45,000 Material moves 18 Machine setup S 25,000 19 Assembly S 60,000 Machine hours 20 Inspection S 8,000 # of inspections Question One Question Two Machine setups Custom Xcut 11 Calibri A A === Wrap Text BIU - OAE Merge & Center [D Copy Format Painter $ %) Font Alignment Number Clipboard B36 C E D B A 15 Activity Activity Cost Cost Driver 16 Production scheduling S 95,000 Production runs 17 Material handling S 45,000 Material moves 18 Machine setup S 25,000 Machine setups 19 Assembly S 60,000 Machine hours 20 Inspection 8,000 # of inspections 21 Marketing costs 3% of sales revenue 22 Requirement One 23 Part One Calculate the indirect cost allocation rate under the existing simple costing system that uses machine hours as the cost driver. 24 25 Sales revenue from interior doors 26 Add: sales revenue from exterior doors 27 Total revenues 28 Times: three percent 29 Activity cost of marketing 30 Add: activity cost of production scheduling 31 activity cost of material handling 32 activity cost of machine setups 33 activity cost of assembly 34 activity cost of inspection 35 Total indirect costs 36 Divide by: quantity of cost driver 37 Indirect cost allocation rate per unit of driver 38 Part Two 39 Calculate the cost of an interior door and an exterior door under the existing simple costing system. 40 Interior Door Exterior Door 41 Direct materials 96,000 $ 81,000 42 Direct manufacturing labor 76.800 64.800 Question One Question Two 15 Font Clipboard B36 A B C D E 37 Indirect cost allocation rate per unit of driver 38 Part Two 39 Calculate the cost of an interior door and an exterior door under the existing simple costing system. 40 Interior Door Exterior Door 41 Direct materials s 96,000 $ 81,000 42 Direct manufacturing labor 76,800 64,800 43 Indirect costs allocated 140,690 115,110 44 Total cost 313,490 260,910 45 Divide by: # of units sold 3,200 1,800 46 Total cost per unit 97.97 S 144.95 47 Requirement Two 48 Part One 49 Compute the allocation rate for each individual activity Total Quantity of Activity Total Activity Cost Allocation Rate 50 Driver 51 Production scheduling 95,000 125 S 760.00 per production run 52 Material handling 45,000 240 187.50 per material move 53 Machine setup 25,000 200 125.00 per setup 54 Assembly 60,000 10,000 6.00 per machine hour 55 Inspection 8,000 400 20.00 per inspection 56 Marketing costs 0.03 per sales dollar 57 Part Two 58 Calculate the cost of an interior door and an exterior door under an activity based costing system. 59 Interior Exterior 60 Direct materials 96,000 $ 81,000 61 Direct manufacturing labor 76,800 64,800 62 Production scheduling 30,400 64,600 63 Material handling 13,500 31,500 64 Machine setu 6,625 19.375 Question One Question Two Type here to search o AutoSave Formulas Data Review View Help File Home Insert Page Layout Draw 23 Wrap Ted Custom Calib Xcut Its Copy & Format Painter Ciptioard 11 CAA A BIU - Merge & Center $ - % Font Agnment Number 3.36 B A D E 44 Total cost 313,490 260,910 45 Divide by: # of its sold 3,200 1,800 46 Total cost per init $ 97.97 $ 144.95 Requirement Two 48 Part One 49 Compute the allocation rate for each individual activity Activity Total Activity Cost Total Quantity of Allocation Rate 50 Denver 51 Production scheduling S 95,000 125 S 760.00 per production run 52 Material handling 45,000 240 187.50 per material move 53 Machine setup 25,000 200 125.00 per setup 54 Assembly 60,000 10,000 6.00 per machine hour 55 Inspection 8,000 400 20.00 per inspection 56 Marketing costs 0.03 per sales dollar 57 Part Two 58 Calculate the cost of an interior door and an exterior door under an activity based costing system. 59 Interior Exterior 60 Direct materials $ 96,000 S 81,000 61 Direct manifacturing Labor 76,800 64,800 62 Production scheduling 30,400 64,600 63 Material handling 13,500 31,500 64 Machine setup 6,625 19,375 65 Assembly 33,000 27,000 66 Inspection 5,000 67 Marketing costs 3,000 12,000 68 Total Costs 10,800 272,325 302,075 69 Dividew: # of units sold 3,200 1,800 70 Total cost per unit S 85.10 $ 167.82 71 Requirement Three Question One Question Two Type here to search O ou **

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts