Question: Need help with part 2 following the same format of part 1 Part B: Internal and sustainable growth rates - Tabs IGR, SGR and write-up

Need help with part 2 following the same format of part 1

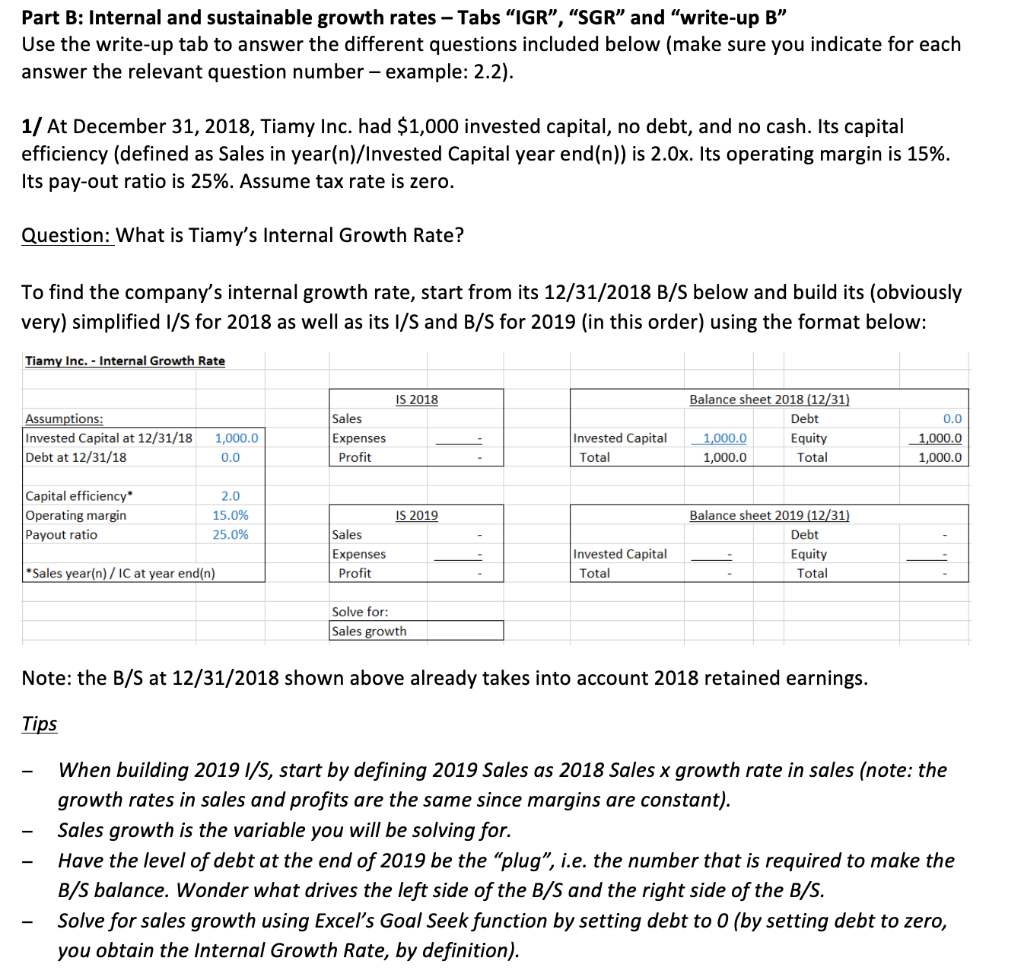

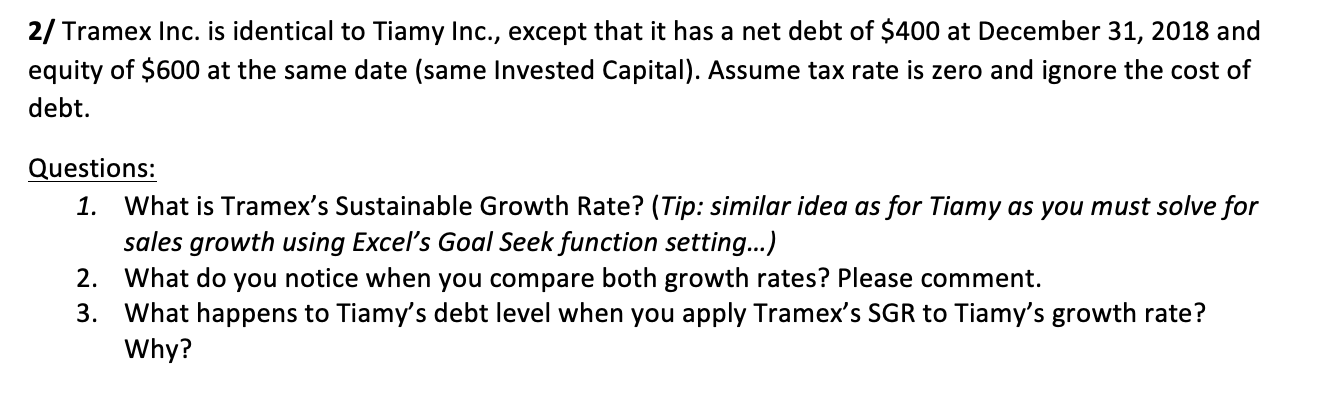

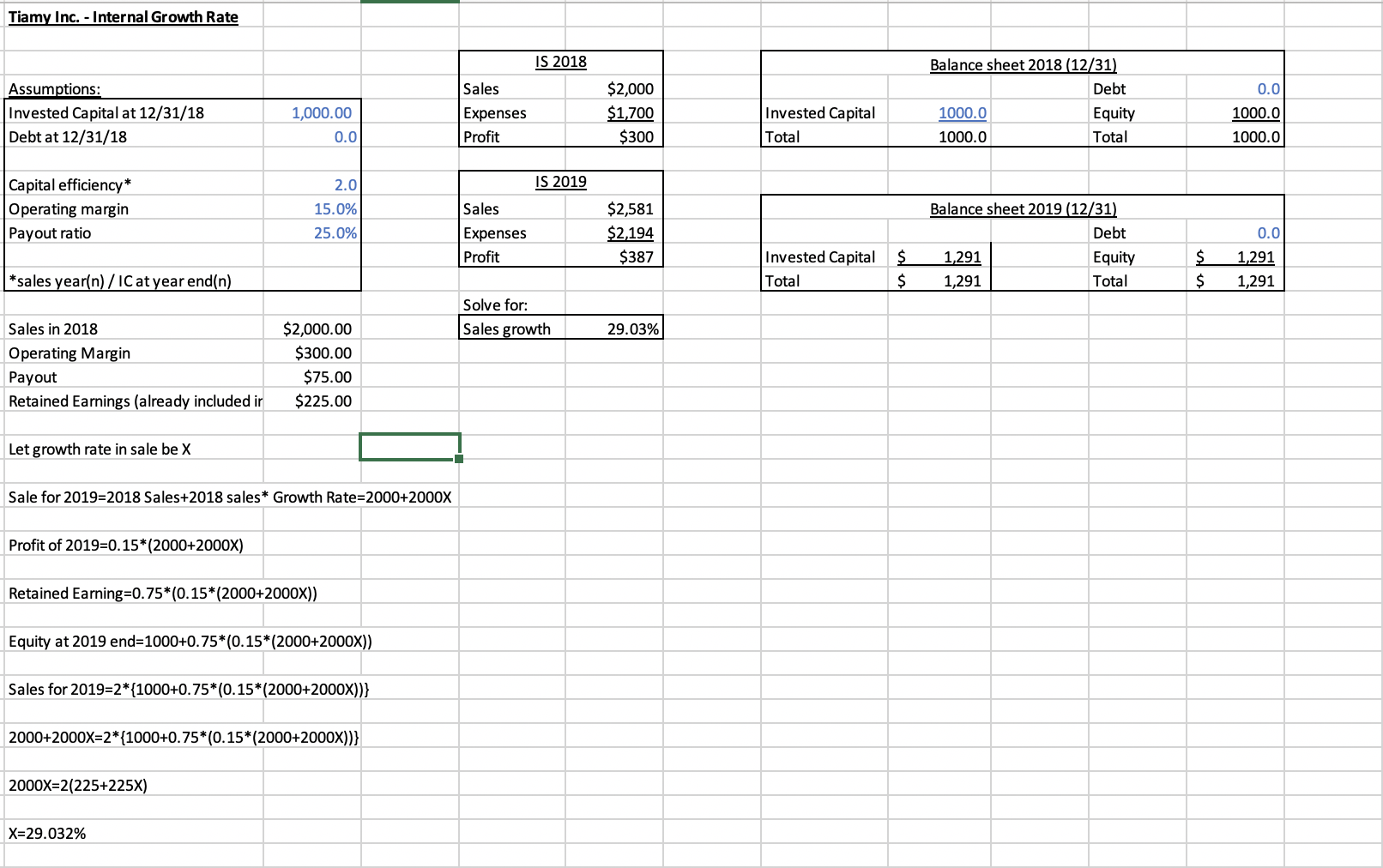

Part B: Internal and sustainable growth rates - Tabs IGR, SGR" and "write-up B" Use the write-up tab to answer the different questions included below (make sure you indicate for each answer the relevant question number - example: 2.2). 1/ At December 31, 2018, Tiamy Inc. had $1,000 invested capital, no debt, and no cash. Its capital efficiency (defined as Sales in year(n)/Invested Capital year end(n)) is 2.0x. Its operating margin is 15%. Its pay-out ratio is 25%. Assume tax rate is zero. Question: What is Tiamy's Internal Growth Rate? To find the company's internal growth rate, start from its 12/31/2018 B/S below and build its (obviously very) simplified I/S for 2018 as well as its 1/S and B/S for 2019 (in this order) using the format below: Tiamy Inc. - Internal Growth Rate IS 2018 Assumptions: Invested Capital at 12/31/18 Debt at 12/31/18 Balance sheet 2018 (12/31) Debt 1,000.0 Equity 1,000.0 Total Sales Expenses Profit 1,000.0 0.0 Invested Capital Total 0.0 1,000.0 1,000.0 Capital efficiency* Operating margin Payout ratio 2.0 15.0% 25.0% IS 2019 Sales Expenses Profit Balance sheet 2019 (12/31) Debt Equity Total *Sales year(n)/ IC at year end(n) Invested Capital Total Solve for: Sales growth Note: the B/S at 12/31/2018 shown above already takes into account 2018 retained earnings. Tips When building 2019 I/S, start by defining 2019 Sales as 2018 Sales x growth rate in sales (note: the growth rates in sales and profits are the same since margins are constant). Sales growth is the variable you will be solving for. Have the level of debt at the end of 2019 be the plug", i.e. the number that is required to make the B/S balance. Wonder what drives the left side of the B/S and the right side of the B/S. Solve for sales growth using Excel's Goal Seek function by setting debt to 0 (by setting debt to zero, you obtain the Internal Growth Rate, by definition). 2/ Tramex Inc. is identical to Tiamy Inc., except that it has a net debt of $400 at December 31, 2018 and equity of $600 at the same date (same Invested Capital). Assume tax rate is zero and ignore the cost of debt. Questions: 1. What is Tramex's Sustainable Growth Rate? (Tip: similar idea as for Tiamy as you must solve for sales growth using Excel's Goal Seek function setting...) 2. What do you notice when you compare both growth rates? Please comment. What happens to Tiamy's debt level when you apply Tramex's SGR to Tiamy's growth rate? Why? Tiamy Inc. - Internal Growth Rate 0.0 Assumptions: Invested Capital at 12/31/18 Debt at 12/31/18 IS 2018 Sales Expenses Profit Balance sheet 2018 (12/31) Debt 1000.0 Equity 1000.0 Total $2,000 $1,700 $300 1,000.00 0.0 1000.0 Invested Capital Total 1000.0 IS 2019 Capital efficiency* Operating margin Payout ratio 2.0 15.0% 25.0% Sales Expenses Profit $2,581 $2,194 $387 Balance sheet 2019 (12/31) Debt 1,291 Equity 1,291 Total Invested Capital Total $ $ $ 0.0 1,291 1,291 *sales year(n) / IC at year end(n) Solve for: Sales growth 29.03% Sales in 2018 Operating Margin $2,000.00 $300.00 $75.00 $225.00 Payout Retained Earnings (already included ir Let growth rate in sale be X Sale for 2019=2018 Sales+2018 sales* Growth Rate=2000+2000X Profit of 2019=0.15*(2000+2000x) Retained Earning=0.75*(0.15* (2000+2000x)) Equity at 2019 end=1000+0.75*(0.15* (2000+2000x)) Sales for 2019=2*{1000+0.75*(0.15*(2000+2000X))} 2000+2000X=2* {1000+0.75*(0.15*(2000+2000x))} 2000X=2(225+225x) X=29.032% Part B: Internal and sustainable growth rates - Tabs IGR, SGR" and "write-up B" Use the write-up tab to answer the different questions included below (make sure you indicate for each answer the relevant question number - example: 2.2). 1/ At December 31, 2018, Tiamy Inc. had $1,000 invested capital, no debt, and no cash. Its capital efficiency (defined as Sales in year(n)/Invested Capital year end(n)) is 2.0x. Its operating margin is 15%. Its pay-out ratio is 25%. Assume tax rate is zero. Question: What is Tiamy's Internal Growth Rate? To find the company's internal growth rate, start from its 12/31/2018 B/S below and build its (obviously very) simplified I/S for 2018 as well as its 1/S and B/S for 2019 (in this order) using the format below: Tiamy Inc. - Internal Growth Rate IS 2018 Assumptions: Invested Capital at 12/31/18 Debt at 12/31/18 Balance sheet 2018 (12/31) Debt 1,000.0 Equity 1,000.0 Total Sales Expenses Profit 1,000.0 0.0 Invested Capital Total 0.0 1,000.0 1,000.0 Capital efficiency* Operating margin Payout ratio 2.0 15.0% 25.0% IS 2019 Sales Expenses Profit Balance sheet 2019 (12/31) Debt Equity Total *Sales year(n)/ IC at year end(n) Invested Capital Total Solve for: Sales growth Note: the B/S at 12/31/2018 shown above already takes into account 2018 retained earnings. Tips When building 2019 I/S, start by defining 2019 Sales as 2018 Sales x growth rate in sales (note: the growth rates in sales and profits are the same since margins are constant). Sales growth is the variable you will be solving for. Have the level of debt at the end of 2019 be the plug", i.e. the number that is required to make the B/S balance. Wonder what drives the left side of the B/S and the right side of the B/S. Solve for sales growth using Excel's Goal Seek function by setting debt to 0 (by setting debt to zero, you obtain the Internal Growth Rate, by definition). 2/ Tramex Inc. is identical to Tiamy Inc., except that it has a net debt of $400 at December 31, 2018 and equity of $600 at the same date (same Invested Capital). Assume tax rate is zero and ignore the cost of debt. Questions: 1. What is Tramex's Sustainable Growth Rate? (Tip: similar idea as for Tiamy as you must solve for sales growth using Excel's Goal Seek function setting...) 2. What do you notice when you compare both growth rates? Please comment. What happens to Tiamy's debt level when you apply Tramex's SGR to Tiamy's growth rate? Why? Tiamy Inc. - Internal Growth Rate 0.0 Assumptions: Invested Capital at 12/31/18 Debt at 12/31/18 IS 2018 Sales Expenses Profit Balance sheet 2018 (12/31) Debt 1000.0 Equity 1000.0 Total $2,000 $1,700 $300 1,000.00 0.0 1000.0 Invested Capital Total 1000.0 IS 2019 Capital efficiency* Operating margin Payout ratio 2.0 15.0% 25.0% Sales Expenses Profit $2,581 $2,194 $387 Balance sheet 2019 (12/31) Debt 1,291 Equity 1,291 Total Invested Capital Total $ $ $ 0.0 1,291 1,291 *sales year(n) / IC at year end(n) Solve for: Sales growth 29.03% Sales in 2018 Operating Margin $2,000.00 $300.00 $75.00 $225.00 Payout Retained Earnings (already included ir Let growth rate in sale be X Sale for 2019=2018 Sales+2018 sales* Growth Rate=2000+2000X Profit of 2019=0.15*(2000+2000x) Retained Earning=0.75*(0.15* (2000+2000x)) Equity at 2019 end=1000+0.75*(0.15* (2000+2000x)) Sales for 2019=2*{1000+0.75*(0.15*(2000+2000X))} 2000+2000X=2* {1000+0.75*(0.15*(2000+2000x))} 2000X=2(225+225x) X=29.032%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts