Question: Need help with part B and C please. Thank you Assume a Modigliani-Miller (MM) world. AntiVaxer, PaleoBro, and Boop are three similar com- panies in

Need help with part B and C please. Thank you

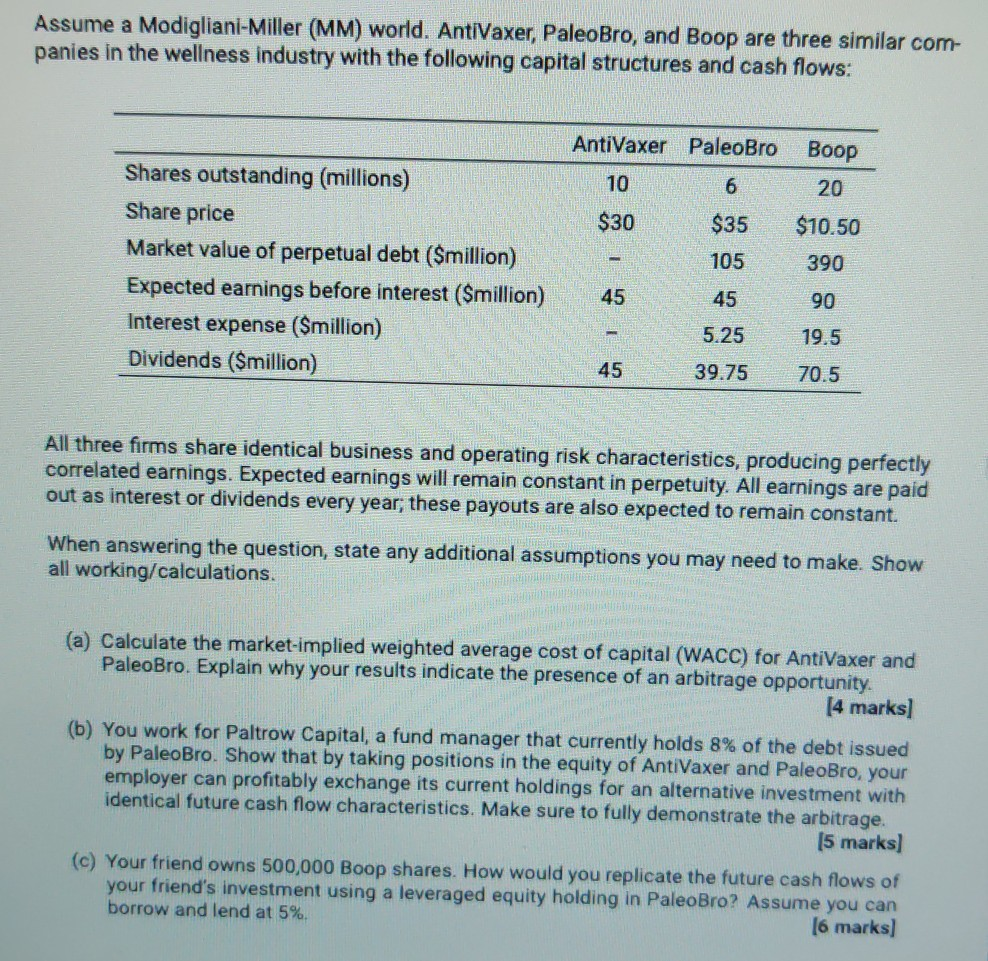

Assume a Modigliani-Miller (MM) world. AntiVaxer, PaleoBro, and Boop are three similar com- panies in the wellness industry with the following capital structures and cash flows: AntiVaxer PaleoBro Boop 10 6 20 $30 $35 $10.50 Shares outstanding (millions) Share price Market value of perpetual debt ($million) Expected earnings before interest ($million) Interest expense (Smillion) Dividends ($million) 105 390 45 45 90 - 5.25 19.5 45 39.75 70.5 All three firms share identical business and operating risk characteristics, producing perfectly correlated earnings. Expected earnings will remain constant in perpetuity. All earnings are paid out as interest or dividends every year, these payouts are also expected to remain constant. When answering the question, state any additional assumptions you may need to make. Show all working/calculations. (a) Calculate the market-implied weighted average cost of capital (WACC) for AntiVaxer and PaleoBro. Explain why your results indicate the presence of an arbitrage opportunity. (4 marks) (b) You work for Paltrow Capital, a fund manager that currently holds 8% of the debt issued by Paleo Bro. Show that by taking positions in the equity of AntiVaxer and PaleoBro, your employer can profitably exchange its current holdings for an alternative investment with identical future cash flow characteristics. Make sure to fully demonstrate the arbitrage. (5 marks) (c) Your friend owns 500,000 Boop shares. How would you replicate the future cash flows of your friend's investment using a leveraged equity holding in PaleoBro? Assume you can borrow and lend at 5%. [6 marks) Assume a Modigliani-Miller (MM) world. AntiVaxer, PaleoBro, and Boop are three similar com- panies in the wellness industry with the following capital structures and cash flows: AntiVaxer PaleoBro Boop 10 6 20 $30 $35 $10.50 Shares outstanding (millions) Share price Market value of perpetual debt ($million) Expected earnings before interest ($million) Interest expense (Smillion) Dividends ($million) 105 390 45 45 90 - 5.25 19.5 45 39.75 70.5 All three firms share identical business and operating risk characteristics, producing perfectly correlated earnings. Expected earnings will remain constant in perpetuity. All earnings are paid out as interest or dividends every year, these payouts are also expected to remain constant. When answering the question, state any additional assumptions you may need to make. Show all working/calculations. (a) Calculate the market-implied weighted average cost of capital (WACC) for AntiVaxer and PaleoBro. Explain why your results indicate the presence of an arbitrage opportunity. (4 marks) (b) You work for Paltrow Capital, a fund manager that currently holds 8% of the debt issued by Paleo Bro. Show that by taking positions in the equity of AntiVaxer and PaleoBro, your employer can profitably exchange its current holdings for an alternative investment with identical future cash flow characteristics. Make sure to fully demonstrate the arbitrage. (5 marks) (c) Your friend owns 500,000 Boop shares. How would you replicate the future cash flows of your friend's investment using a leveraged equity holding in PaleoBro? Assume you can borrow and lend at 5%. [6 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts