Question: need help with part b On August 1, Sheffield, Inc, exchanged productive assets with Tamarisk, Inc. Sheffield's asset is referred to below as Asset A

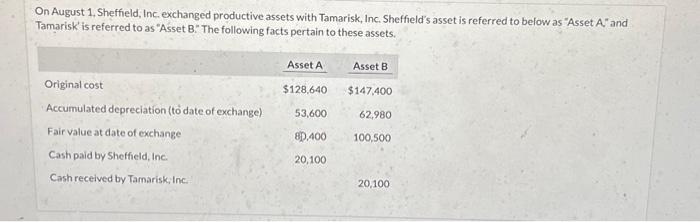

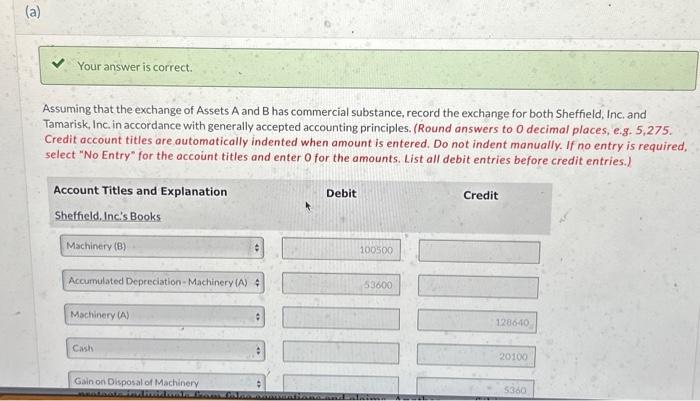

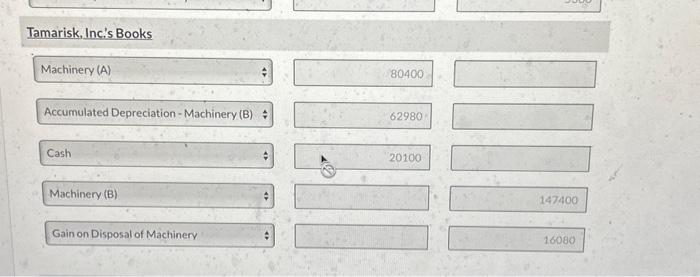

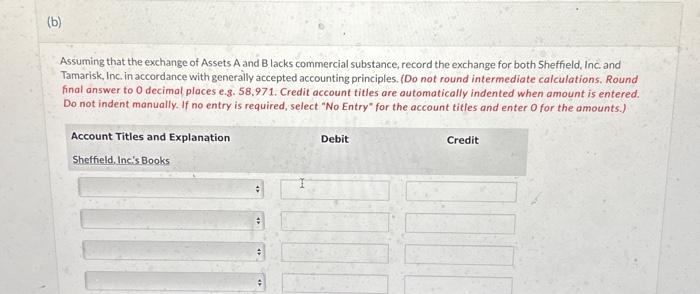

On August 1, Sheffield, Inc, exchanged productive assets with Tamarisk, Inc. Sheffield's asset is referred to below as "Asset A" and Tamarisk' is referred to as "Asset B." The following facts pertain to these assets. Assuming that the exchange of Assets A and B has commercial substance, record the exchange for both Sheffield, Inc. and Tamarisk, Inc. in accordance with generally accepted accounting principles. (Round answers to 0 decimal places, e.g. 5,275. Credit account titles are outomatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter o for the amounts. List all debit entries before credit entries.) Tamarisk, Inc.'s Books Machinery (A) 80400 Accumulated Depreciation - Machinery (B) 62980 Cash 20100 Machinery (B) \begin{tabular}{r} 20100 \\ \hline \end{tabular} Machinery (B) * 147400 Gain on Disposal of Machinery 16080 Assuming that the exchange of Assets A and B lacks commercial substance, record the exchange for both Sheffield, Inc. and Tamarisk, Inc, in accordance with generally accepted accounting principles. (Do not round intermediate calculations. Round final answer to 0 decimal places e.s. 58,971. Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter o for the amounts.) Tamarisk. Inc's Books

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts