Question: Need help with part b please. Thanks :) Question 2 On July 1, 2017, Crane Corp. issued $4,260,000 of 10-year, 5% bonds at $4,608,286. This

Need help with part b please. Thanks :)

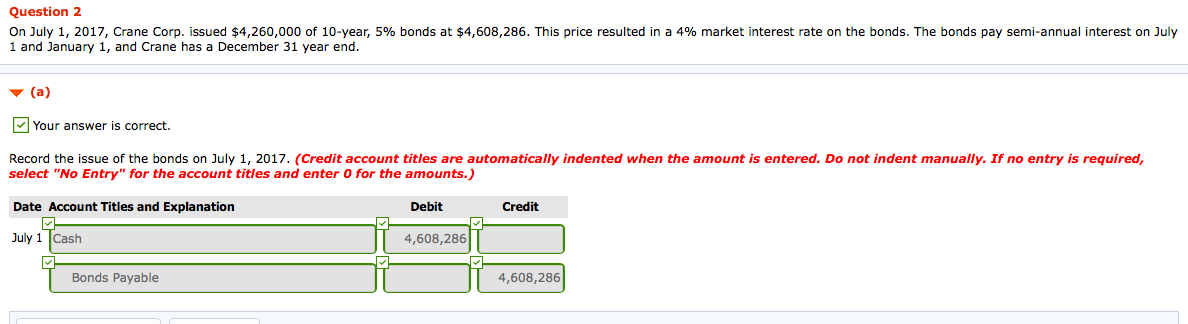

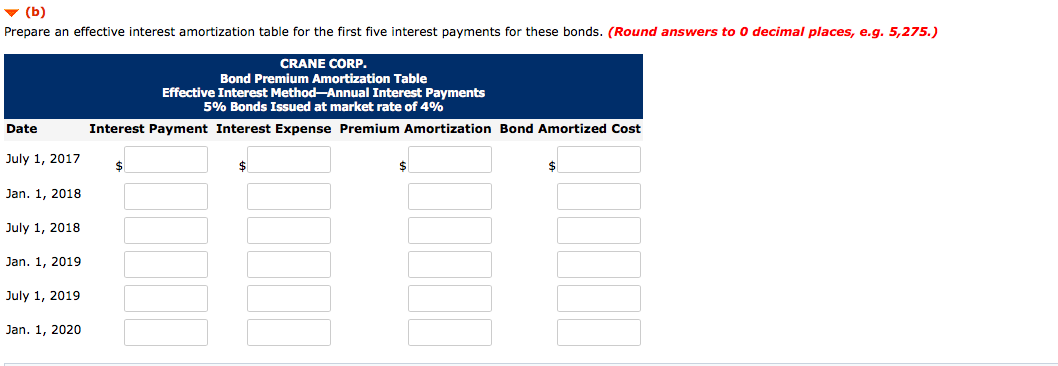

Question 2 On July 1, 2017, Crane Corp. issued $4,260,000 of 10-year, 5% bonds at $4,608,286. This price resulted in a 4% market interest rate on the bonds. The bonds pay semi-annual interest on July 1 and January 1, and Crane has a December 31 year end. v (a) Your answer is correct. Record the issue of the bonds on July 1, 2017. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter o for the amounts.) Date Account Titles and Explanation Debit Credit July 1 Cash 4,608,286 Bonds Payable 4,608,286 v (b) Prepare an effective interest amortization table for the first five interest payments for these bonds. (Round answers to 0 decimal places, e.g. 5,275.) CRANE CORP. Bond Premium Amortization Table Effective Interest Method-Annual Interest Payments 5% Bonds Issued at market rate of 4% Interest Payment Interest Expense Premium Amortization Bond Amortized Cost Date July 1, 2017 $ Jan. 1, 2018 July 1, 2018 Jan. 1, 2019 July 1, 2019 Jan. 1, 2020

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts