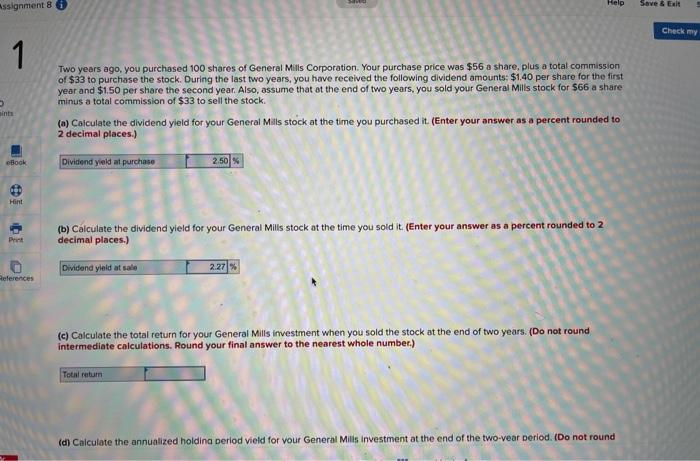

Question: need help with part C and D Help Assignment 8 Save & Exit Check my 1 Two years ago, you purchased 100 shares of General

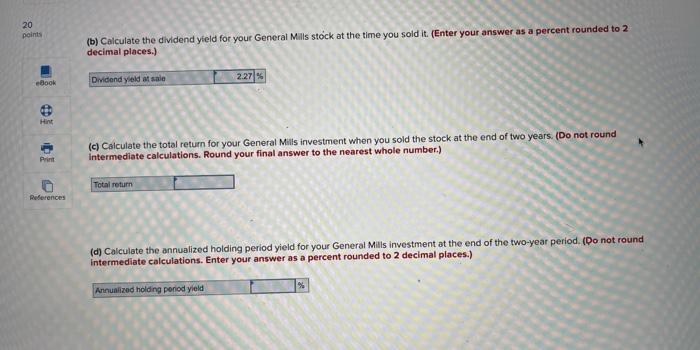

Help Assignment 8 Save & Exit Check my 1 Two years ago, you purchased 100 shares of General Mills Corporation. Your purchase price was $56 a share, plus a total commission of $33 to purchase the stock. During the last two years, you have received the following dividend amounts: $1,40 per share for the first year and $1.50 per share the second year. Also, assume that at the end of two years, you sold your General Mills stock for $66 a share minus a total commission of $33 to sell the stock. (a) Calculate the dividend yield for your General Mills stock at the time you purchased it (Enter your answer as a percent rounded to 2 decimal places.) int Book Dividend yield at purchase 2,50 % Hint (b) Calculate the dividend yield for your General Mills stock at the time you sold it (Enter your answer as a percent rounded to 2 decimal places.) Print Dividend yield at sale References (c) Calculate the total return for your General Mills investment when you sold the stock at the end of two years. (Do not round intermediate calculations. Round your final answer to the nearest whole number.) Total return (d) Calculate the annualized holding period vield for your General Mills Investment at the end of the two vear period. (Do not round 20 points (b) Calculate the dividend yield for your General Mills stock at the time you sold it. (Enter your answer as a percent rounded to 2 decimal places.) eBook 2.27 Dividend yield at sale Hint (c) Calculate the total return for your General Mills investment when you sold the stock at the end of two years. (Do not round intermediate calculations. Round your final answer to the nearest whole number.) Print Total return References (d) Calculate the annualized holding period yield for your General Mills investment at the end of the two-year period. (Do not round intermediate calculations. Enter your answer as a percent rounded to 2 decimal places.) % Annualized holding period yield

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts