Question: need help with part C need help with part C ( number of sessions ) Jason is a computer-savy millennial. He started his own business

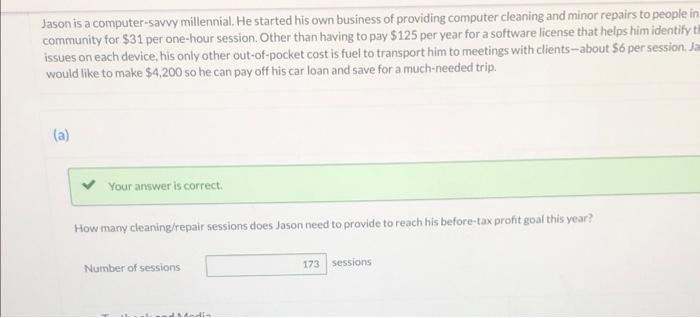

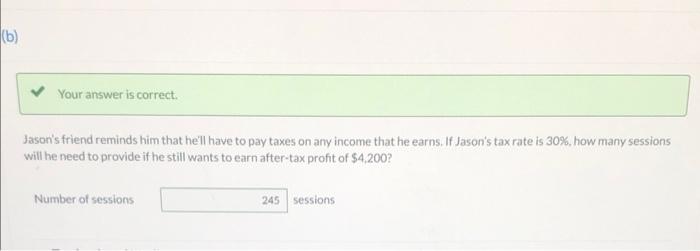

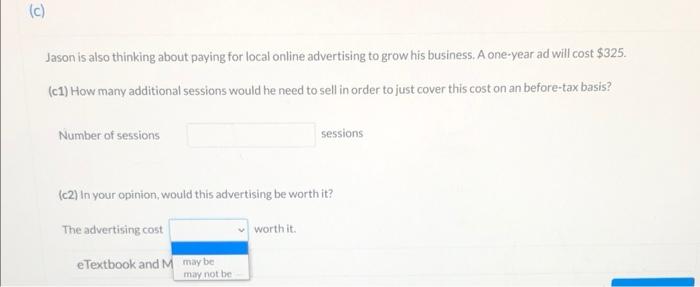

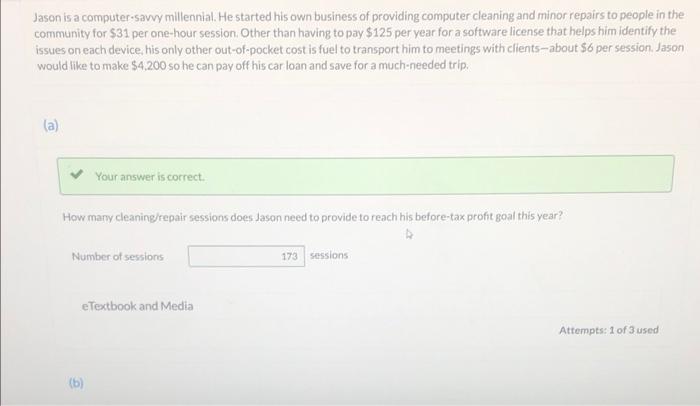

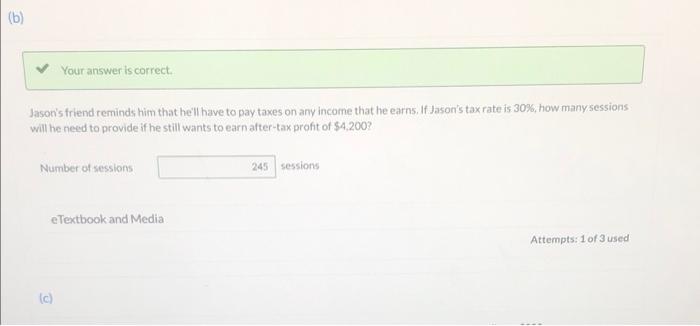

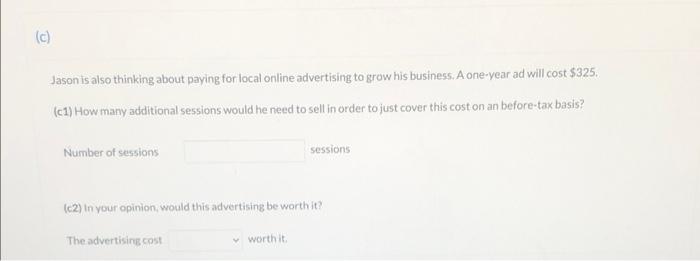

Jason is a computer-savy millennial. He started his own business of providing computer cleaning and minor repairs to people in community for $31 per one-hour session. Other than having to pay $125 per year for a software license that helps him identify issues on each device, his only other out-of-pocket cost is fuel to transport him to meetings with clients-about $6 per session. would like to make $4,200 so he can pay off his car loan and save for a much-needed trip. (a) Your answer is correct. How many cleaning/repair sessions does Jason need to provide to reach his before-tax profit goal this year? Number of sessions sessions Jason's friend reminds him that he'll have to pay taxes on any income that he earns. If Jason's tax rate is 30%, how many sessions will he need to provide if he still wants to earn after-tax profit of $4,200 ? Number of sessions sessions Jason is also thinking about paying for local online advertising to grow his business. A one-year ad will cost $325. (c1) How many additional sessions would he need to sell in order to just cover this cost on an before-tax basis? Number of sessions sessions (c2) In your opinion, would this advertising be worth it? The advertising cost worth it. eTextbook and M Jason is a computer-savy millennial. He started his own business of providing computer cleaning and minor repairs to people in the community for $31 per one-hour session. Other than having to pay $125 per year for a software license that helps him identify the issues on each device, his only other out-of-pocket cost is fuel to transport him to meetings with clients-about $6 per session. Jason would like to make $4,200 so he can pay off his car loan and save for a much-needed trip. (a) Your answer is correct. How many cleaningrepair sessions does Jason need to provide to reach his before-tax profit goal this year? Number of sessions sessions eTextbook and Media Attempts: 1 of 3 used Jasor's friend reminds him that hell have to pay taxes on any income that he earns. If. Jason's tax rate is 30%, how manysessions will he need to provide if he still wants to earn after-tax profit of $4,200 ? Number of sessions sessions Jason is also thinking about paying for local online advertising to grow his business. A one-year ad will cost $325. (c1) How many additional sessions would he need to sell in order to just cover this cost on an before-tax basis? Number of sessions sessions (c2) In your opinion, would this advertising be worthit? The advertising cost worthit

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts