Question: need help with part D d. Record the exchange for Keyes Inc. assuming the transaction lacks commercial substance. Clarkson Co. and Keyes Inc. exchange equipment.

need help with part D

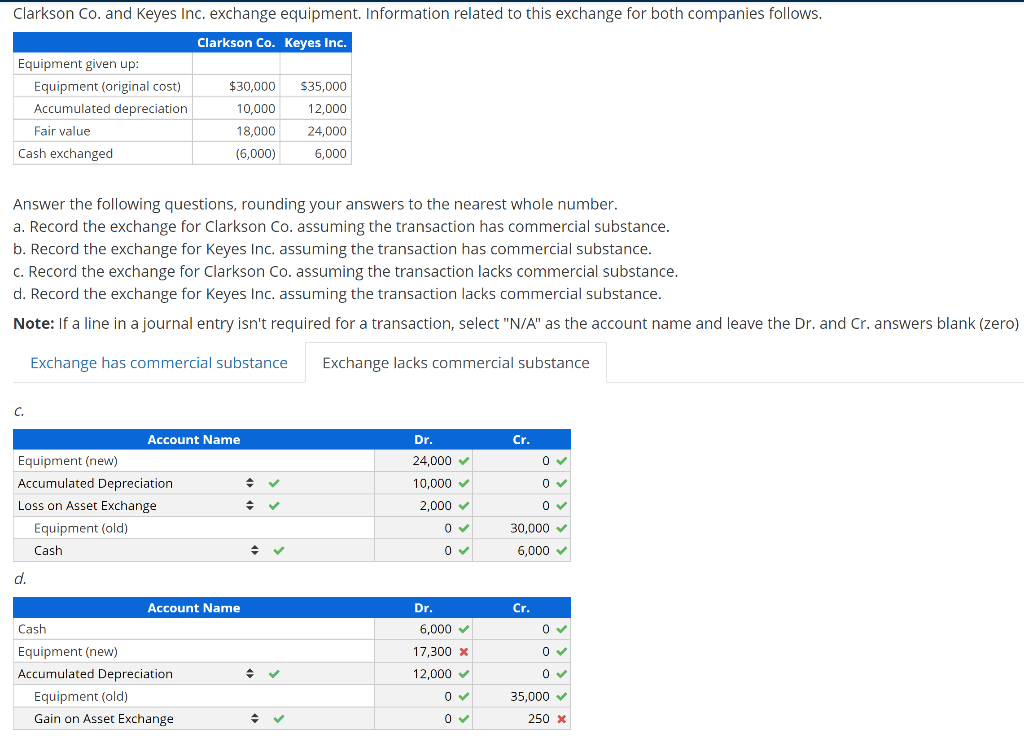

d. Record the exchange for Keyes Inc. assuming the transaction lacks commercial substance.

Clarkson Co. and Keyes Inc. exchange equipment. Information related to this exchange for both companies follows. Clarkson Co. Keyes Inc. Equipment given up: Equipment (original cost) $30,000 $35,000 12,000 Accumulated depreciation 10,000 Fair value 18,000 24,000 Cash exchanged (6,000) 6,000 Answer the following questions, rounding your answers to the nearest whole number. a. Record the exchange for Clarkson Co. assuming the transaction has commercial substance. b. Record the exchange for Keyes Inc. assuming the transaction has commercial substance. c. Record the exchange for Clarkson Co. assuming the transaction lacks commercial substance. d. Record the exchange for Keyes Inc. assuming the transaction lacks commercial substance Note: If a line in a journal entry isn't required for a transaction, select "N/A" as the account name and leave the Dr. and Cr. answers blank (zero) Exchange has commercial substance Exchange lacks commercial substance C. Account Name Dr. Cr. 24,000 Equipment (new) 0 Accumulated Depreciation 0 10,000 Loss on Asset Exchange 0 2,000 Equipment (old) 0 30,000 Cash 0 6,000 d. Account Name Dr. Cr. Cash 6,000 0 17,300 0 Equipment (new) Accumulated Depreciation 0 12,000 Equipment (old) 35,000 0 Gain on Asset Exchange 0 250

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts