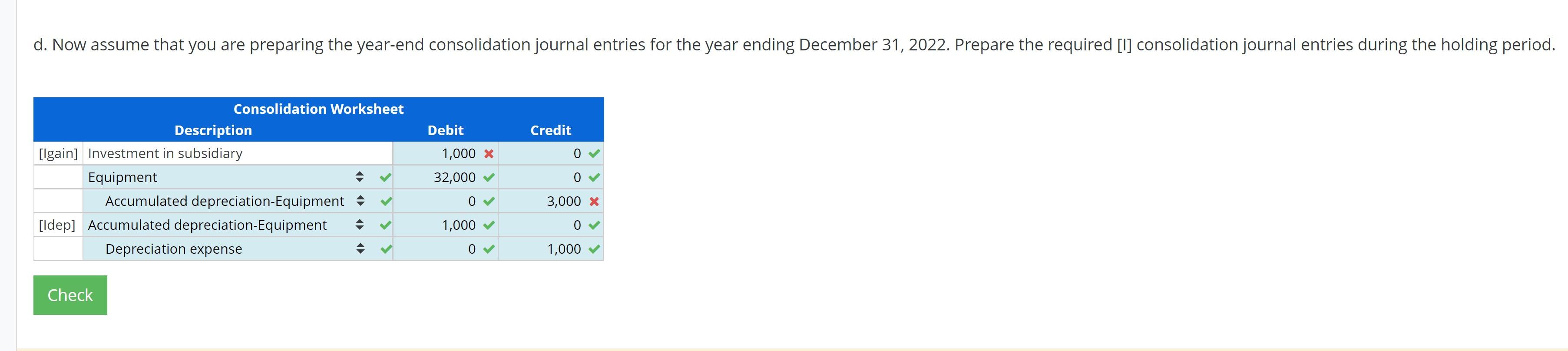

Question: Need help with part D Preparing the [I] consolidation journal entries for sale of depreciable assets - Equity method remaining useful life of 8 years.

![Need help with part D Preparing the [I] consolidation journal entries](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/09/66f7a32c7d230_19666f7a32c1bd3f.jpg)

Need help with part D

Preparing the [I] consolidation journal entries for sale of depreciable assets - Equity method remaining useful life of 8 years. The parent uses the equity method to account for its Equity Investment. a. Compute the annual pre-consolidation depreciation expense for the subsidiary (pre-intercompany sale) and the parent (post-intercompany sale), b. Compute the pre-consolidation Gain on Sale recognized by the subsidiary during 2020. c. Prepare the required [l] consolidation journal encry in 2020 (assume a full year of depreciation). Check Preparing the [I] consolidation journal entries for sale of depreciable assets - Equity method remaining useful life of 8 years. The parent uses the equity method to account for its Equity Investment. a. Compute the annual pre-consolidation depreciation expense for the subsidiary (pre-intercompany sale) and the parent (post-intercompany sale), b. Compute the pre-consolidation Gain on Sale recognized by the subsidiary during 2020. c. Prepare the required [l] consolidation journal encry in 2020 (assume a full year of depreciation). Check

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts