Question: need help with perpetual fifo, lifo, weighted average, and specific identification 9 value: 36.00 points Problem 6-3A Perpetual: Alternative cost flows LO P1 Montoure Company

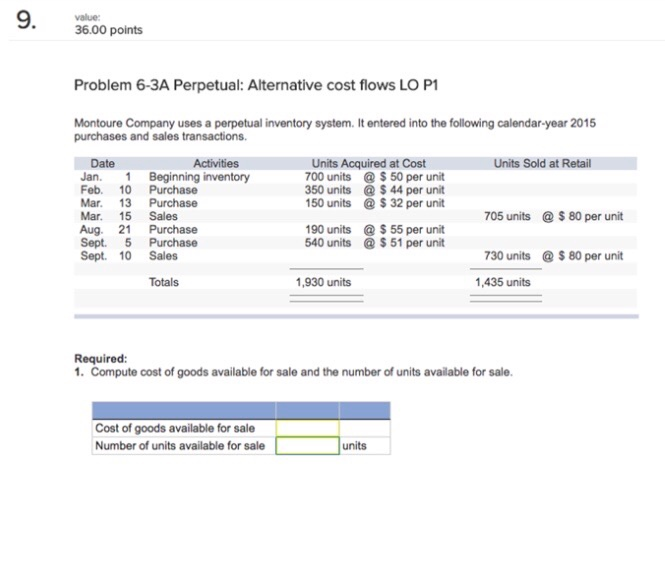

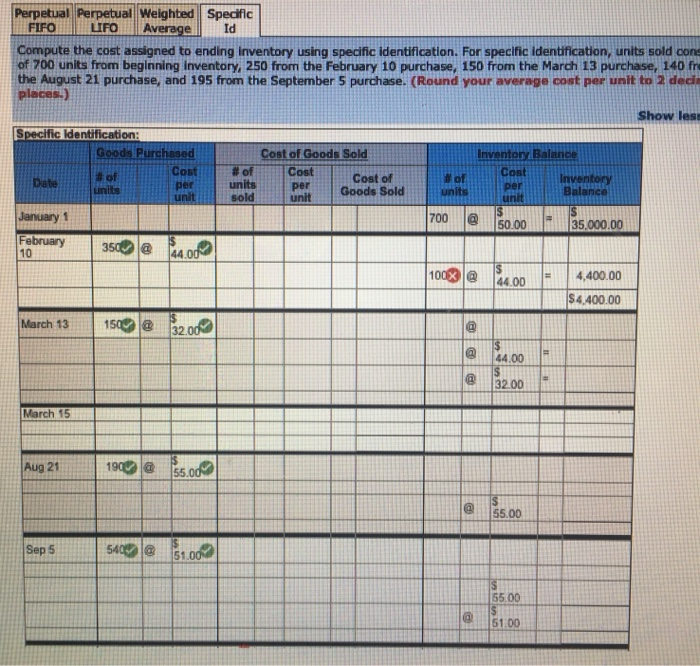

9 value: 36.00 points Problem 6-3A Perpetual: Alternative cost flows LO P1 Montoure Company uses a perpetual inventory system. It entered into the following calendar-year 2015 purchases and sales transactions. Activities 1 Beginning inventory Units Acquired at Cost 700 units@$ 50 per unit 350 units $ 44 per unit 150 units @$32 per unit Units Sold at Retail Date Jan Feb. Mar. 10 Purchase 13 Purchase 15 Sales Purchase Sept. 5 Purchase Sept. 10 Sales 705 units@$ 80 per unit Mar. $ 55 per unit @$ 51 per unit Aug. 21 190 units 540 units 730 units @$ 80 per unit Totals 1,930 units 1,435 units Required: 1. Compute cost of goods available for sale and the number of units available for sale. Cost of goods available for sale units Number of units available for sale Perpetual Perpetbual Weighted Specific FIFO LIFO Average Id Compute the cost assigned to ending inventory using specific identification. For specific identification, units sold cons of 700 units from beginning inventory, 250 from the February 10 purchase, 150 from the March 13 purchase, 140 fre the August 21 purchase, and 195 from the September 5 purchase. (Round your average cost per unit to 2 decia places.) Show less Specific Identification: Goods Purchased Cost of Goods Sold # of units sold Inventory Balance Cost Cost Cost per unit # of Linits # of units Cost of Goods Sold Inventory Balance Date per unit per unit S 50.00 S January 1 700 35.000.00 February 10 IS 44.00 350 S 100X 4,400.00 44.00 $4.400.00 150 @32.00 March 13 S 44.00 S 32.00 March 15 190 @55.000 Aug 21 S 55.00 540 Sep 5 51.00 S 55.00 S 51.00

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts