Question: NEED HELP WITH PRACTICE TEST ANSWER ACCORDINGLY PLEASE AND THANK YOU! a. Determine the NPV of the following two investments. Use a discount rate of

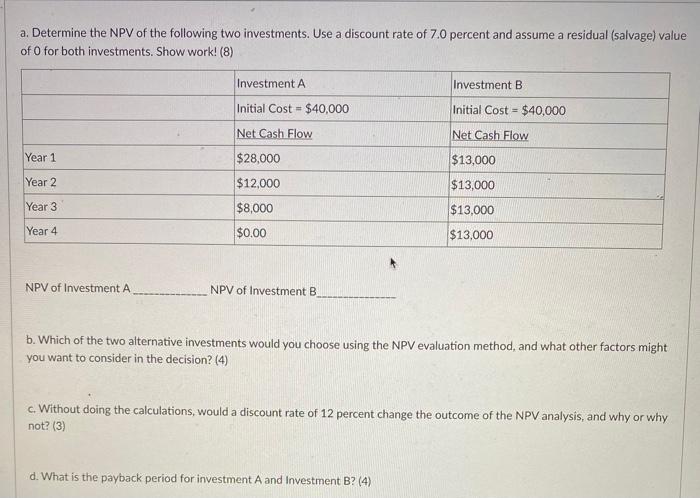

a. Determine the NPV of the following two investments. Use a discount rate of 70 percent and assume a residual (salvage) value of O for both investments. Show work! (8) Investment A Investment B Initial Cost = $40,000 Initial Cost = $40,000 Net Cash Flow $28,000 Net Cash Flow Year 1 $13,000 Year 2 $12,000 $13,000 Year 3 $8,000 $13,000 Year 4 $0.00 $13,000 NPV of Investment A NPV of Investment B b. Which of the two alternative investments would you choose using the NPV evaluation method, and what other factors might you want to consider in the decision? (4) c. Without doing the calculations, would a discount rate of 12 percent change the outcome of the NPV analysis, and why or why not? (3) d. What is the payback period for investment A and Investment B? (4)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts