Question: Need help with problem 12.3a first page and continues to the top next page, please disregard problem 12.4a 392 CHAPTER 12 Aturah, Delemoh, and the

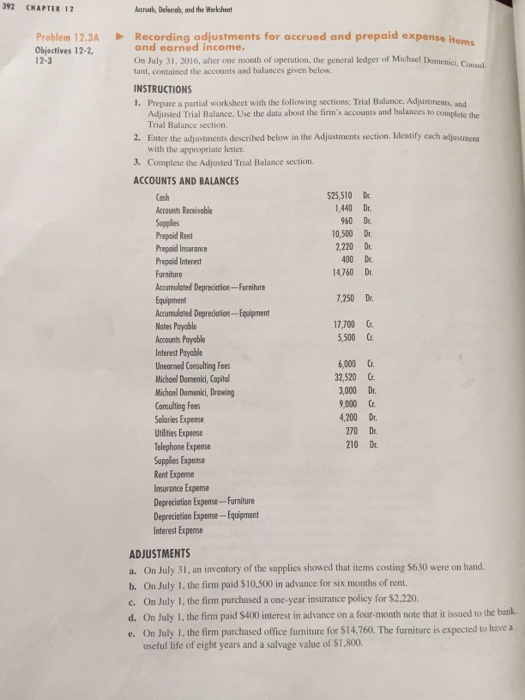

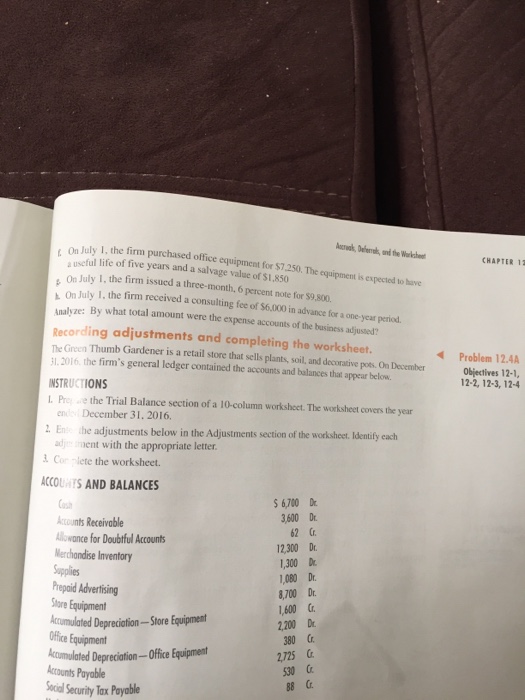

392 CHAPTER 12 Aturah, Delemoh, and the Worleheet Problem 12.3A Recording adjustments for accrued and prepaid expense item, and earned income. objectives 12-2, On July 3 2016, after one month of operation. the general ledger of Michael Domeniei.conust. 2-3 tant, contained the accounts and balances given below. INSTRUCTIONS i. Prepare a partial worksheet with the following sections: Trial Balance. Adjustments, and Adjusted Trial Balance. Use the data about the firm's accounts and balances to completethe Trial Balance section. 2. Enter the adjustments described below in the Adjustments section. Identify cach adjustment with the appropriate letter. 3. Complete the Adjusted Trial Balance section ACCOUNTS AND BALANCES S25,510 Dr. 1,440 Dr. Accounts Receiveble 10,500 2220 Dr. 400 Dr. Prepaid Interest Accumulated Depreciation-Furniture 7250 Dr. Equipment Accumulated Depreciaion-Equipment 17700 Notes Payable 5.500 6000 Unearned Consulting Fees 32,520 Michoel Domenici, Copilol 3000 Dr. Michoel Domenici, Drawing 9,000 Cr. 4,200 Dr. Selories Expense 210 Utilities Expense 210 Dt. Telephone Expense Supplies Expense Insurance Expense Depreciation Expense-Furniture Depreciction Expense-Equipment Interest Expense ADJUSTMENTS a. On July 31. an inventory of the supplies showed that items costing $630 were on hand. b. On July the firm paid S10500 in advance for six months of rent. On July 1, the firm purchased a one-year insurance policy for $2,220. d. on July the firm paid S400 interest in advance on a four-month note that it issued to the bank e. On July 1. the firm purchased office furniture for Sl4,760. The furniture is expected to have a useful life of eight years and a salvage value of $1,800

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts