Question: NEED HELP WITH PT. 2 ASAP!! needs to be put into a journal and ledgers Designs. PART 1: TRANSACTIONS AND LEDGERS Record the following transactions

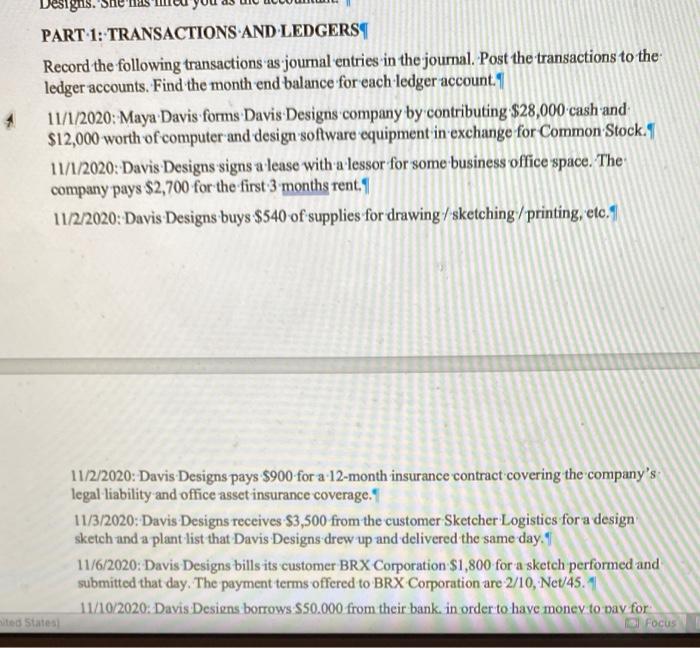

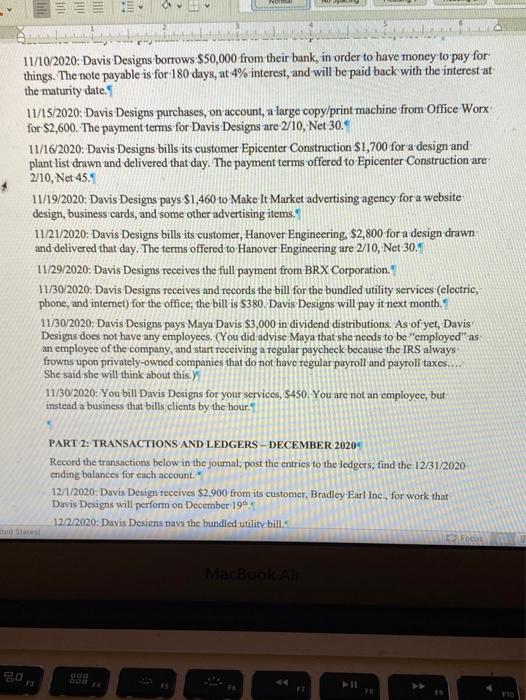

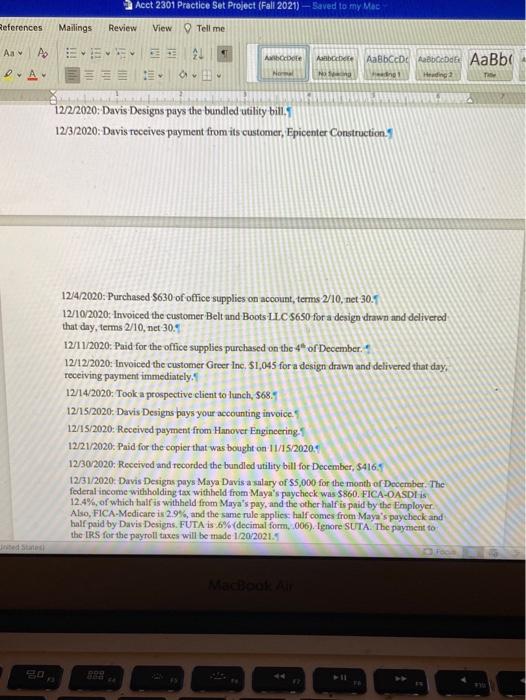

Designs. PART 1: TRANSACTIONS AND LEDGERS Record the following transactions as journal entries in the journal. Post the transactions to the ledger accounts. Find the month end balance for each ledger account 11/1/2020: Maya Davis forms Davis Designs company by contributing $28,000 cash and $12,000 worth of computer and design software equipment in exchange for Common Stock. 11/1/2020: Davis Designs signs a lease with a lessor for some business office space. The company pays $2,700 for the first 3 months rent. 11/2/2020: Davis Designs buys $540 of supplies for drawing/sketching/printing, etc. 11/2/2020: Davis Designs pays $900 for a 12-month insurance contract covering the company's ral legalliability and office asset insurance coverage. 11/3/2020: Davis Designs receives $3,500 from the customer Sketcher Logistics for a design sketch and a plant list that Davis Designs drew up and delivered the same day. I 11/6/2020: Davis Designs bills its customer BRX Corporation $1,800 for a sketch performed and submitted that day. The payment terms offered to BRX Corporation are 2/10, Net/45. 11/10/2020: Davis Designs borrows $50.000 from their bank in order to have money to pay for Lol Focus ed States HIE 5 ... 11/10/2020: Davis Designs borrows $50,000 from their bank, in order to have money to pay for things. The note payable is for 180 days, at 4% interest, and will be paid back with the interest at the maturity date. 11/15/2020: Davis Designs purchases, on account, a large copy/print machine from Office Worx for $2,600. The payment terms for Davis Designs are 2/10, Net 30.9 11/16/2020: Davis Designs bills its customer Epicenter Construction $1,700 for a design and plant list drawn and delivered that day. The payment terms offered to-Epicenter Construction are 2/10, Net 45.5 11/19/2020. Davis Designs pays $1,460 to Make It Market advertising agency for a website design, business cards, and some other advertising items. 11/21/2020: Davis Designs bills its customer, Hanover Engineering, $2,800 for a design drawn and delivered that day. The terms offered to Hanover Engineering are 2/10, Net 30. 11/29/2020: Davis Designs receives the full payment from BRX Corporation." 11/30/2020: Davis Designs receives and records the bill for the bundled utility services (electric, phone, and internet) for the office; the bill is $380. Davis Designs will pay it next month. 11/30/2020: Davis Designs pays Maya Davis $3,000 in dividend distributions. As of yet, Davis Designs does not have any employees. (You did advise Maya that she needs to be "employed" as an employee of the company, and start receiving a regular paycheck because the IRS always frowns upon privately-owned companies that do not have regular payroll and payroll taxes.... She said she will think about this. 11/30/2020: You bill Davis Designs for your services, $450. You are not an employee, but instead a business that bills clients by the hour. PART 2: TRANSACTIONS AND LEDGERS - DECEMBER 2020 Record the transactions below in the joumal; post the entries to the ledgers, find the 12/31/2020 ending balances for each account." 12/1/2020: Davis Design Teccives $2,900 from its customer, Bradley Earl Inc, for work that Davis Designs will perform on December 19 1272/2020: Davis Desiens pays the bundled utility bills tel Focul MacBook BO ro Acet 2301 Practice Set Project (Fall 2021) - Saved to my Mac References Mailings Review View Tell me Aav A Abacoste Abde EEL = gy AaBbceDe AaBbcDdEt AaBbo Heading? D-A- No Nag hen! 1272/2020: Davis Designs pays the bundled utility bills 12/3/2020: Davis receives payment from its customer, Epicenter Construction 12/4/2020: Purchased $630 of office supplies on account, terms 2/10, net 30.1 12/10/2020 Invoiced the customer Belt and Boots LLC 5650 for a design drawn and delivered that day, terms 2/10, net 30.4 12/11/2020: Paid for the office supplies purchased on the 4* of December. 12/12/2020: Invoiced the customer Greer Inc. $1,045 for a design drawn and delivered that day, receiving payment immediately. 12/14/2020: Took a prospective client to lunch, 568.5 12/15/2020. Davis Designs pays your accounting invoice. 12/15/2020: Roceived payment from Hanover Engineering 12/21/2020: Paid for the copier that was bought on 11/15/2020.4 12/30/2020: Received and recorded the bundled utility bill for December, 54165 12/31/2020. Davis Designs pays Maya Davis a salary of $5,000 for the month of December. The federal income withholding tax withheld from Maya's paycheck was $860. FICA-OASDI 12.4%, of which half is withheld from Maya's pay, and the other half is paid by the Employer Also, FICA-Medicare is 2.9%, and the same rule applies half comes from Maya's paycheck and half paid by Davis Designs. FUTA is 6% (decimal form, 006). Ignore SUTA. The payment to the IRS for the payroll taxes will be made 1/20/2021.5 ed Stat Macbook An 20

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts