Question: need help with q. 5-8 the others are for reference Q1 The following transactions occurred during Your 1, the first year of business, for Nancy

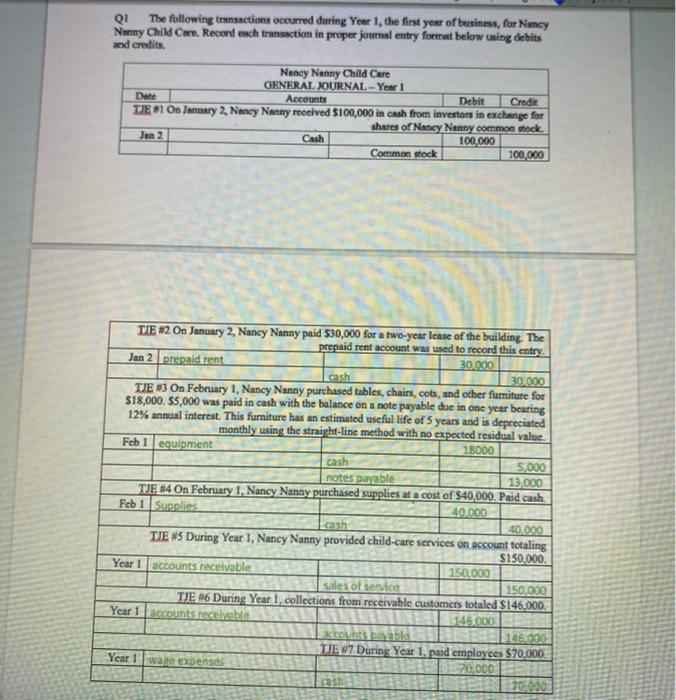

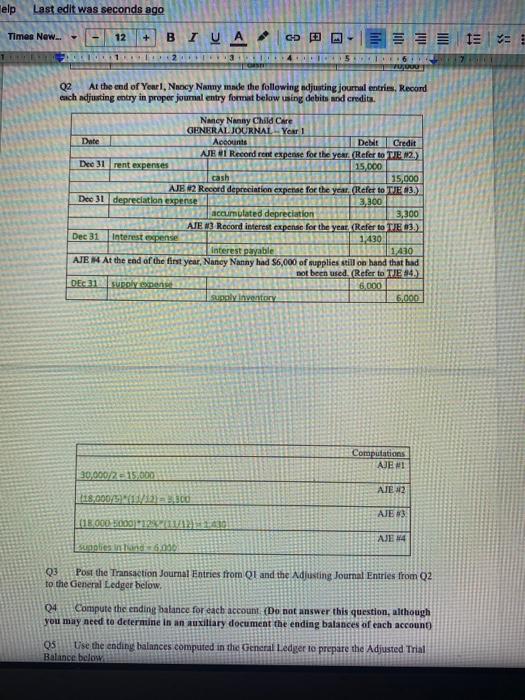

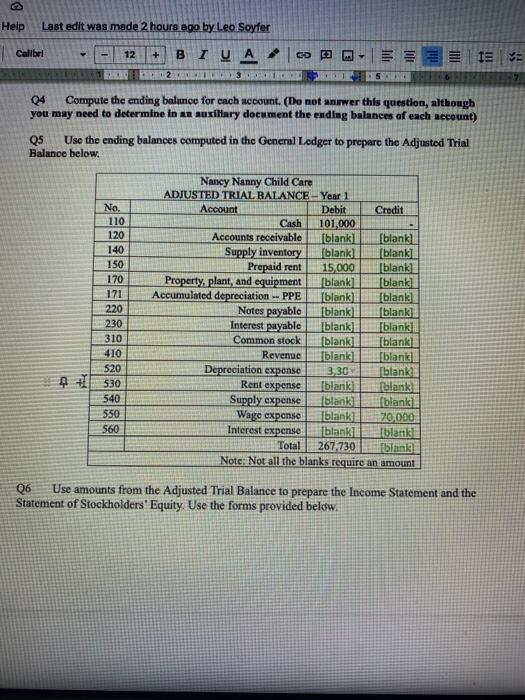

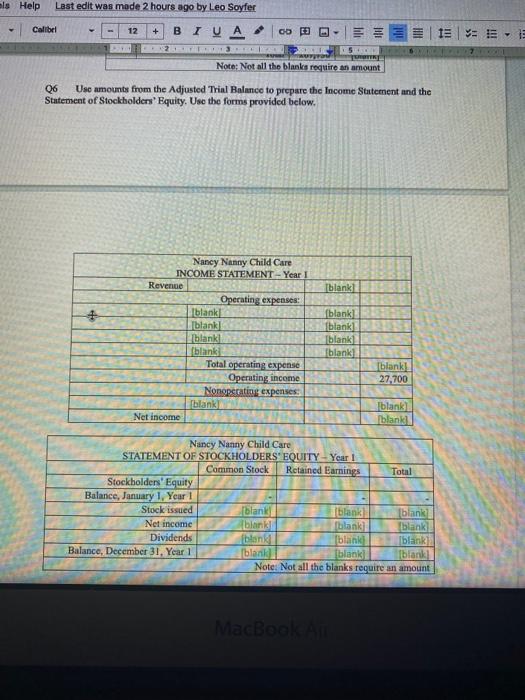

Q1 The following transactions occurred during Your 1, the first year of business, for Nancy Nanny Child Care Record ench transaction in proper journal entry form below using debits od credits Nancy Nanny Child Care GENERAL JOURNAL-Year 1 Date Accounts Debit Credit TJE 1 On Juary 2, Nancy Nanny received $100,000 in cash from investors in exchange for shares of Nancy Nanny common stock Jan 2 Cath 100,000 Common stock 100,000 TIE #2 On January 2, Nancy Nanny paid $30,000 for a two-year lease of the building. The prepaid rent account was used to record this entry Jan 2 prepaid rent 30.000 cash 30,000 TJE #3 On February 1, Nancy Nanny purchased tables, chairs, cots, and other furniture for $18,000 $5,000 was paid in cash with the balance on a note payable due in one year bearing 12% annual interest. This furniture has an estimated useful life of 5 years and is depreciated monthly using the straight-line method with no expected residual value Feb 1 equipment 18000 cash 5.000 notes payable 13.000 TJE 14 On February 1, Nancy Nanny purchased supplies at a cost of $40,000. Paid cash Feb 1 Supplies 40.000 40.000 TJE #5 During Year 1, Nancy Nanny provided child-care services on account totaling $150,000. Year 1 accounts receivable 150,000 sales of service 150,000 TJE 46 During Year 1, collections from receivable customers totaled $146,000. Year 1 accounts receivable 145.000 counts payable 146000 TJE 47 During Year 1. paid employees $70,000 Year 1 ware expenses 20,000 20,000 help Last edit was seconds ago Times New.. 12 + BI U Ac B - 19 = : TR121345.6 VUDOT 02 At the end of Yearl, Nancy Nanny made the following adjusting journal entries, Record each adjusting entry in proper journal entry format below using debits nod credite Nancy Nanny Child Care GENERAL JOURNAL Yer 1 Date Accounts Debit Credit AJE 21 Record rent expense for the year. Refer to TJEN2) Dec 31 rent expenses 15.000 cash 15,000 AJE 62 Record depreciation expense for the year (Refer to TJE03.) Dec 31 depreciation expense 3,300 accumulated depreciation 3,300 AJE 3 Record interest expense for the year. (Refer to TJE03) Dec 31 Interest expense 1.430 Interest payable 1410 AJEM At the end of the first year, Nancy Nanny had $6,000 of supplies still on hand that had not been used. (Refer to TIE 84.) DEC 31 SUBO 6.000 sugalinventory 5,000 Computations AJE #1 30,000/ 215,000 AJEN2 18,000 EMBO AJE 83 L1E000028 aplies in 6.000 Q3 Post the Transaction Journal Entries from Q1 and the Adjusting Journal Entries from Q2 to the General Ledger below 04 Compute the ending balance for each account. (Do not answer this question, although you may need to determine in an auxiliary document the ending balances of each account OS Lise the ending balances computed in the General Ledger to prepare the Adjusted Trial Balance below Help Last edit was made 2 hours ago by Leo Soyfer Calibri 12 + BIU A OD 2 = * 23 1 5 9 04 Compute the ending balance for each account. (Do not answer this question, although you may need to determine in an auxiliary document the ending balances of each account) Q5 Use the ending balances computed in the General Ledger to prepare the Adjusted Trial Balance below. No. 110 120 140 150 170 171 220 230 310 410 520 1530 540 550 560 Nancy Nanny Child Care ADJUSTED TRIAL BALANCE Year 1 Account Debit Credit Cash 101.000 Accounts receivable [blank] blankl Supply inventory Iblank] Iblank] Prepaid rent 15,000 [blanks Property, plant, and equipment [blank] [blank) Accumulated depreciation - PPE [blank) (blank] Notes payable [blank] blank] Interest payable Iblank] blank] Common stock blank] blank] Revenue blank] blank] Depreciation expense 3.30 [blank] Rent expense blank) Tblank Supply expense blank fblanc) Wage expense Iblanki 70,000 Interest expense blank] blank Total 267.730 blanks Note: Not all the blanks require an amount 06 Use amounts from the Adjusted Trial Balance to prepare the Income Statement and the Statement of Stockholders' Equity. Use the forms provided below. als Help Last edit was made 2 hours ago by Leo Soyfer Calibet 12 1E - EE + BIVA ob 13 === -23 TULITIKT Note: Not all the blanks require an amount 06 Use amounts from the Adjusted Trial Balance to prepare the Income Statement and the Statement of Stockholders' Equity. Use the forms provided below. Tblank] Nancy Nanny Child Care INCOME STATEMENT - Year Revenge Operating expenses blankl Iblank Iblankl (blank Total operating expense Operating income Nonoperating expenses [blank Net income (blank] Iblank Iblank] Tblank] blank 27,700 Iblank) Iblank] Nancy Nanny Child Care STATEMENT OF STOCKHOLDERS' EQUITY-Year! Common Stock Retained Earnings Total Stockholders' Equity Balance, January 1, Year! Stock issued blank blank) (blank] Net income blank [blank] blank] Dividends blank Iblank blanki Balance, December 31, Year 1 blank) [blank] blank] Note: Not all the blanks require an amount MacBook mes Now 12 + B 1 U A Go 52 alil 1 256 b7 Use amounts froen the General Ledger, Adjusted Trial Balance, and the Statement of Stockholders' Equity to prepare the Balance Sheet and the Statement of Cash Flows. Use the forms provided below. Nancy Nanny Child Care BALANCE SHEET Year 1 ASSETS Cash 101 000 (blank fblank] Iblank) [blank] blank blank] Property, plant, and equipment Iblank] Accumulated depreciation - PPE Iblanki 14,700 Total assets 140.700 LIABILITIES blank] blank blank] blank Total liabilities blank STOCKHOLDERS' EQUITY fulani hlantil blanka Total stockholders equity Total liabilities and stockholders equity Nancy Nanny Child Care STATEMENT OF CASH FLOWS - Year 1 CASH FROM OPERATING ACTIVITIES Cash from customers 146.000 Rent paid blank Cash paid for supplies bland Wages paid Net cash from operating activities CASH FROM INVESTING ACTIVITIES Cash paid for property.plant and equipment Net cash from investing activities blank CASH FROM FINANCING ACTIVITIES Cash from issuing common stock Net cash from financing activities ba Netzhange in cash 6 Beginning cush balance Le Endingsbalancs 101.000 Q8 Use amounts from the Adjusted Trial Balance to prepare Closing Journal Entries and the Post-Closing Trial Balance. Use the forms provided below. Imes New.. - 12 + B 7 UA 62 15 1 234 5 08 Use amounts from the Adjusted Trial Balance to prepare Closing Journal Entries and the Post-Closing Trial Balance. Use the forms provided below. Nancy Nanny Child Care - GENERAL JOURNAL Year 1 Date Accounts Debit Credit CJENI Close all revenue and gain accounts to come summary Dec 31 blank Iblanks Income summary 150,000 CJE 2 Close all expense and loss accounts fo income summary Iblank] Income summary 123,730 Iblank) Iblankl blank [blank blank] Iblanks blank] Iblank Iblank blank CJE 3 Close the income summary account to retained camnings blanki blaniel hal hland blanka CJE 14 Close the dividends account to retained earnings Dec 31 Retained earnings Dividends No. 110 120 140 150 170 171 220 230 310 320 Nancy Nanny Child Care Post-Closing TRIAL BALANCE -Year Account Debit Credit Cash 101.000 Accounts receivable Blank Supply inventory Thank Pregud rent Property, plant and equipment Accumulated depreciation PPE Note payable Interet payable Common stock Retained coming Total 144.000 Note: Not all the blanks quite an amount

Step by Step Solution

There are 3 Steps involved in it

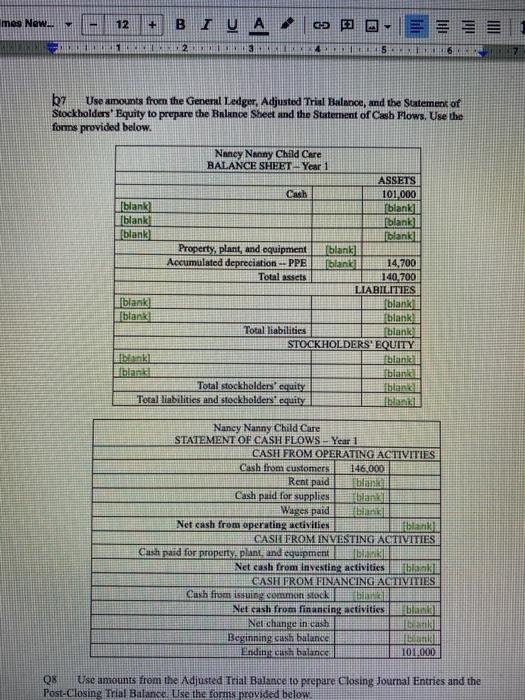

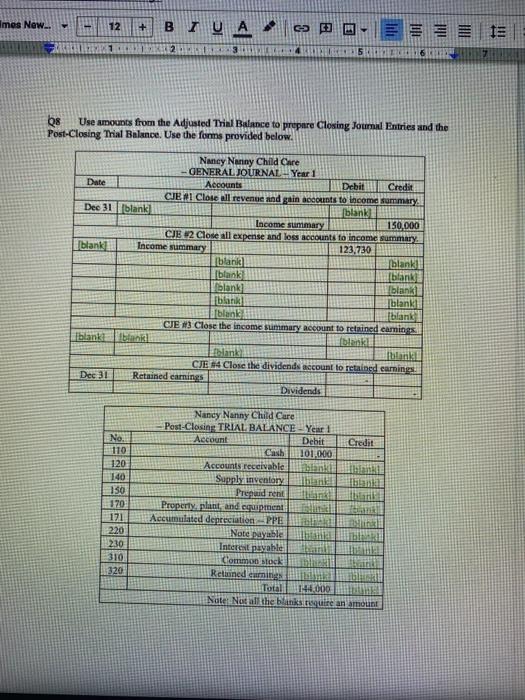

Get step-by-step solutions from verified subject matter experts