Question: Need help with question 1 (a) Today is year 0 . You are told that the evolution of future discount functions can be described by

Need help with question 1 (a)

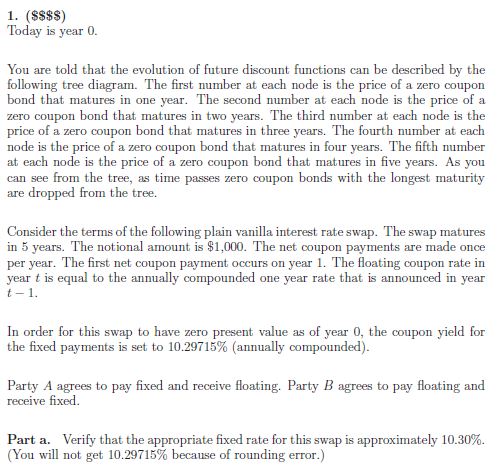

Today is year 0 . You are told that the evolution of future discount functions can be described by the following tree diagram. The first number at each node is the price of a zero coupon bond that matures in one year. The second number at each node is the price of a zero coupon bond that matures in two years. The third number at each node is the price of a zero coupon bond that matures in three years. The fourth number at each node is the price of a zero coupon bond that matures in four years. The fifth number at each node is the price of a zero coupon bond that matures in five years. As you can see from the tree, as time passes zero coupon bonds with the longest maturity are dropped from the tree. Consider the terms of the following plain vanilla interest rate swap. The swap matures in 5 years. The notional amount is $1,000. The net coupon payments are made once per year. The first net coupon payment occurs on year 1 . The floating coupon rate in year t is equal to the annually compounded one year rate that is announced in year t1. In order for this swap to have zero present value as of year 0 , the coupon yield for the fixed payments is set to 10.29715% (annually compounded). Party A agrees to pay fixed and receive floating. Party B agrees to pay floating and receive fixed. Part a. Verify that the appropriate fixed rate for this swap is approximately 10.30%. (You will not get 10.29715% because of rounding error.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts