Question: need help with question 1 and 2 Question 1 (1 point) Suppose the interest rate on a 3-year Treasury Note is 3.25%, and 6-year Notes

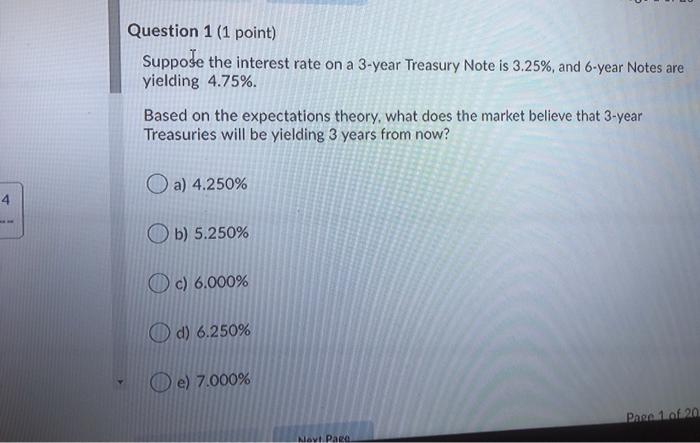

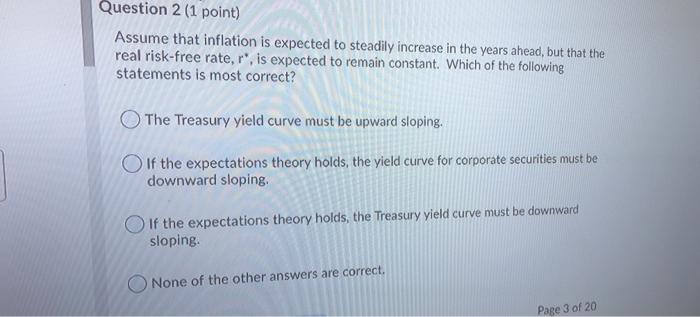

Question 1 (1 point) Suppose the interest rate on a 3-year Treasury Note is 3.25%, and 6-year Notes are yielding 4.75%. Based on the expectations theory, what does the market believe that 3-year Treasuries will be yielding 3 years from now? a) 4.250% 4 Ob) 5.250% Oc) 6.000% O d) 6.250% e) 7.000% Parafi20 Navi. Para Question 2 (1 point) Assume that inflation is expected to steadily increase in the years ahead, but that the real risk-free rate, r', is expected to remain constant. Which of the following statements is most correct? The Treasury yield curve must be upward sloping. If the expectations theory holds, the yield curve for corporate securities must be downward sloping If the expectations theory holds, the Treasury yield curve must be downward sloping None of the other answers are correct. Page 3 of 20

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts