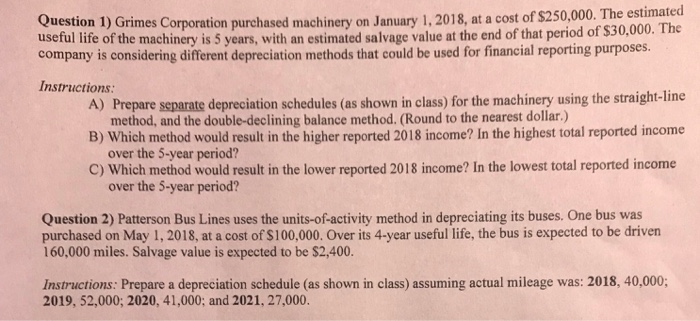

Question: Need help with question #1 and #2 Question 1) Grimes Corporation purchased machinery on January 1,2018, at a cost of S250,000. The estimated useful life

Question 1) Grimes Corporation purchased machinery on January 1,2018, at a cost of S250,000. The estimated useful life of the machinery is 5 years, with an estimated salvage value at the end of that period of $30,000. company is considering different depreciation methods that could be used for financial reporting purposes. Instructions The A) Prepare separate depreciation schedules (as shown in class) for the machinery using the straight-line B) Which method would result in the higher reported 2018 income? In the highest total reported income C) Which method would result in the lower reported 2018 income? In the lowest total reported income method, and the double-declining balance method. (Round to the nearest dollar.) over the 5-year period? over the 5-year period? Question 2) Patterson Bus Lines uses the units-of-activity method in depreciating its buses. One bus was purchased on May 1, 2018, at a cost of $100,000. Over its 4-year useful life, the bus is expected to be driven 160,000 miles. Salvage value is expected to be $2,400. Instructions: Prepare a depreciation schedule (as shown in class) assuming actual mileage was: 2018, 40,000; 2019, 52,000; 2020, 41,000; and 2021, 27,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts