Question: Need help with question 17 & 18! c. Direct materials and direct manufacturing labor are included in total manufacturing costs. d. Manufacturing overhead costs incurred

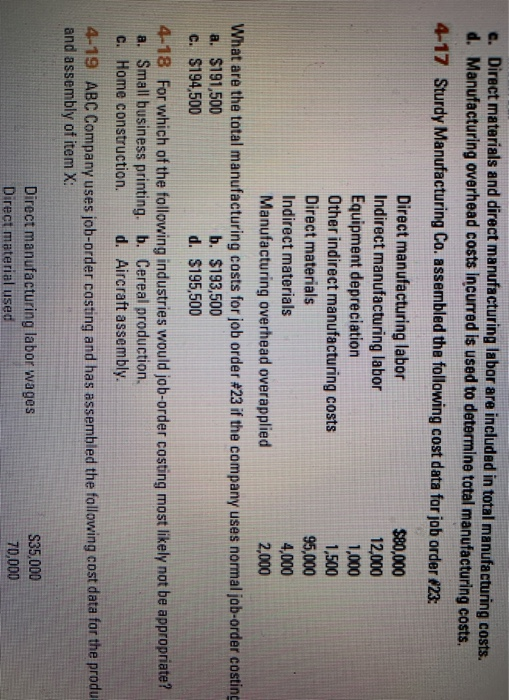

c. Direct materials and direct manufacturing labor are included in total manufacturing costs. d. Manufacturing overhead costs incurred is used to determine total manufacturing costs. 4-17 Sturdy Manufacturing Co. assembled the following cost data for job order 823: Direct manufacturing labor $80,000 Indirect manufacturing labor 12,000 Equipment depreciation 1,000 Other indirect manufacturing costs 1,500 Direct materials 95,000 Indirect materials 4,000 Manufacturing overhead overapplied 2,000 What are the total manufacturing costs for job order #23 if the company uses normal job-order costing a. $191,500 b. $193,500 c. $194,500 d. $195,500 4-18 For which of the following industries would job-order costing most likely not be appropriate? a. Small business printing. b. Cereal production c. Home construction. d. Aircraft assembly. 4-19 ABC Company uses job-order casting and has assembled the following cost data for the produ and assembly of item X: Direct manufacturing labor wages Direct material used S35,000 70,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts