Question: Need help with Question #2? The final amounts were in for Nash Corp.'s fixed-MOH costs. The total fixed-MOH costs consisted of $2,600 of insurance (all

Need help with Question #2?

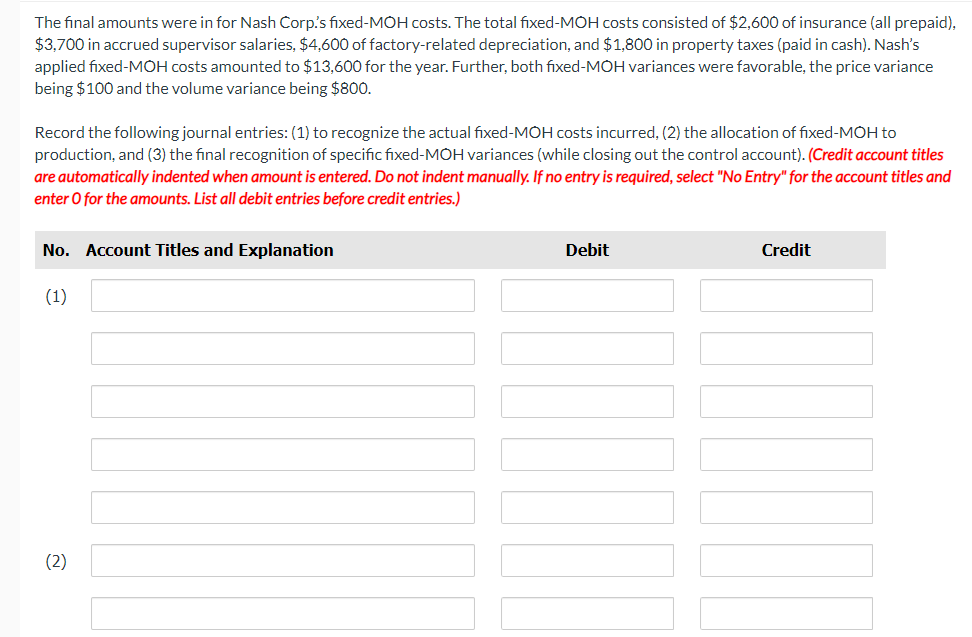

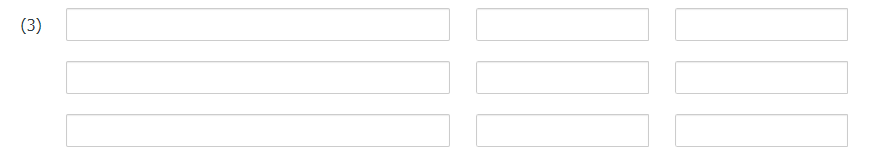

The final amounts were in for Nash Corp.'s fixed-MOH costs. The total fixed-MOH costs consisted of $2,600 of insurance (all prepaid), $3,700 in accrued supervisor salaries, $4,600 of factory-related depreciation, and $1,800 in property taxes (paid in cash). Nash's applied fixed-MOH costs amounted to $13,600 for the year. Further, both fixed-MOH variances were favorable, the price variance being $100 and the volume variance being $800. Record the following journal entries: (1) to recognize the actual fixed-MOH costs incurred, (2) the allocation of fixed-MOH to production, and (3) the final recognition of specific fixed-MOH variances (while closing out the control account). (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts. List all debit entries before credit entries.) (3)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts