Question: need help with question 25 and 26 Question 25 (1 point) Which of the following items should Bev's Beverage Inc. take into account when evaluating

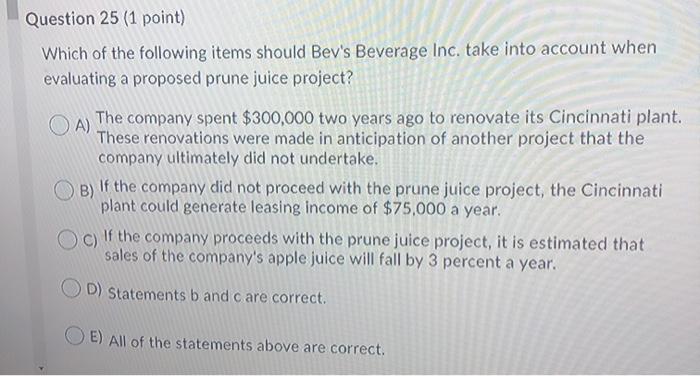

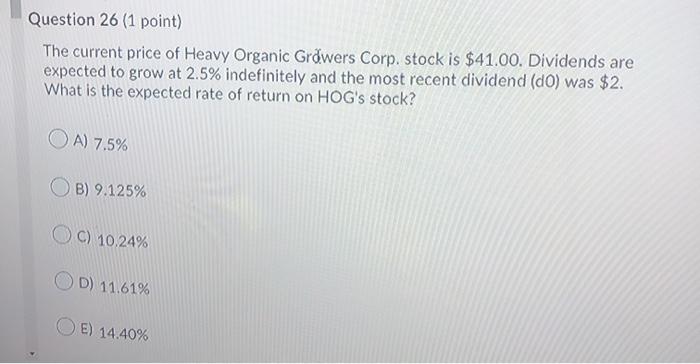

Question 25 (1 point) Which of the following items should Bev's Beverage Inc. take into account when evaluating a proposed prune juice project? A) The company spent $300,000 two years ago to renovate its Cincinnati plant. These renovations were made in anticipation of another project that the company ultimately did not undertake. B) If the company did not proceed with the prune juice project, the Cincinnati plant could generate leasing income of $75,000 a year. c) If the company proceeds with the prune juice project, it is estimated that sales of the company's apple juice will fall by 3 percent a year. D) Statements b and care correct. E) All of the statements above are correct. Question 26 (1 point) The current price of Heavy Organic Growers Corp, stock is $41.00. Dividends are expected to grow at 2.5% indefinitely and the most recent dividend (d) was $2. What is the expected rate of return on HOG's stock? O A) 7.5% OB) 9.125% OC) 10.24% D) 11.61% E) 14.40%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts