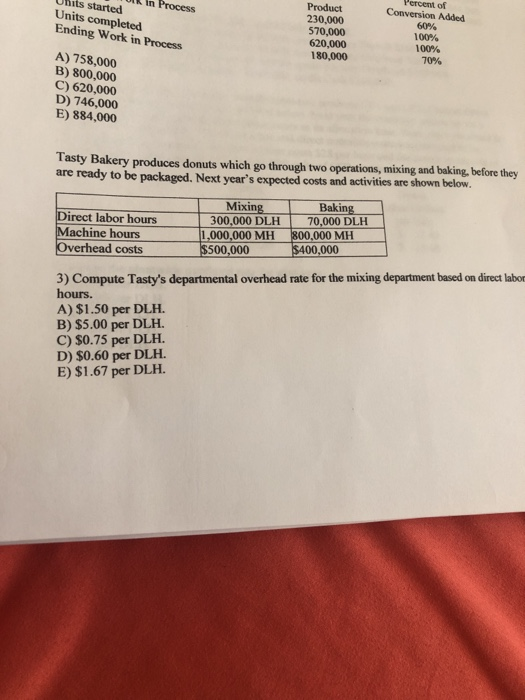

Question: need help with question #4 OIL In Process Units started Units completed Ending Work in Process Product 230,000 570,000 620.000 180.000 Percent of Conversion Added

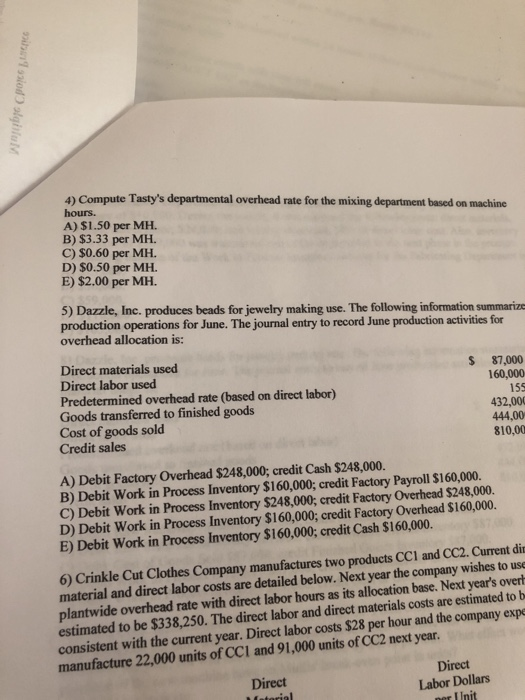

OIL In Process Units started Units completed Ending Work in Process Product 230,000 570,000 620.000 180.000 Percent of Conversion Added 60% 100% 100% 70% A) 758,000 B) 800,000 C) 620,000 D) 746,000 E) 884,000 Tasty Bakery produces donuts which go through two operations, mixing and baking, before they are ready to be packaged. Next year's expected costs and activities are shown below. Direct labor hours Machine hours Overhead costs Mixing 300.000 DLH 1,000,000 MH $500,000 Baking 70,000 DLH 800.000 MH $400,000 3) Compute Tasty's departmental overhead rate for the mixing department based on direct labor hours. A) $1.50 per DLH. B) $5.00 per DLH. C) $0.75 per DLH. D) $0.60 per DLH. E) $1.67 per DLH. w od slgium 4) Compute Tasty's departmental overhead rate for the mixing department based on machine hours. A) $1.50 per MH. B) $3.33 per MH. C) $0.60 per MH. D) $0.50 per MH. E) $2.00 per MH. 5) Dazzle, Inc. produces beads for jewelry making use. The following information summarize production operations for June. The journal entry to record June production activities for overhead allocation is: $ 87,000 160,000 155 432,000 Direct materials used Direct labor used Predetermined overhead rate (based on direct labor) Goods transferred to finished goods Cost of goods sold Credit sales 444,00 810,00 A) Debit Factory Overhead $248,000; credit Cash $248,000. B) Debit Work in Process Inventory $160,000; credit Factory Payroll $160,000. C) Debit Work in Process Inventory $248,000; credit Factory Overhead $248,000. D) Debit Work in Process Inventory $160,000; credit Factory Overhead $160,000. E) Debit Work in Process Inventory $160,000; credit Cash $160,000. 6) Crinkle Cut Clothes Company manufactures two products CCI and CC2. Current dir material and direct labor costs are detailed below. Next year the company wishes to use plantwide overhead rate with direct labor hours as its allocation base. Next year's overt estimated to be $338,250. The direct labor and direct materials costs are estimated to be consistent with the current year. Direct labor costs $28 per hour and the company expe manufacture 22,000 units of CCI and 91,000 units of CC2 next year. Direct Labor Dollars per Init Direct fatorial

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts