Question: NEED HELP WITH QUESTION 5,7, AND 8 PLEASE WITH EXPLANATION bonds payable. What is the effect of the failure to record premium amortization on interest

NEED HELP WITH QUESTION 5,7, AND 8 PLEASE WITH EXPLANATION

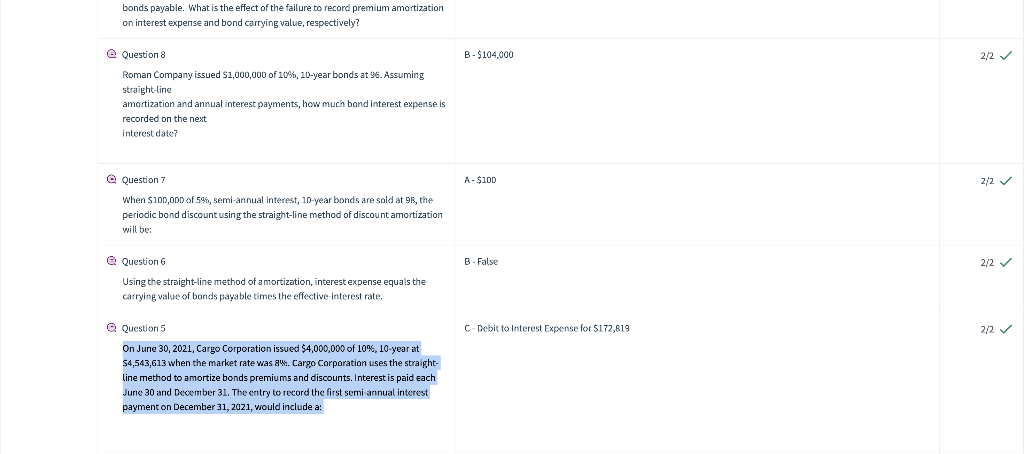

bonds payable. What is the effect of the failure to record premium amortization on interest expense and bond carrying value, respectively? Q Question 8 B$104,000 Roman Company issued $1,000,000 of 10%, 10-year bonds at 96 . Assuming straight-line amortization and annual interest payments, how much bond interest expense is recorded on the next interest date? Q Question 7 A $100 When $100,000 of 5%, semi-annual interest, 10-year bonds are sold at 98 , the periodic bond discount using the straight-line method of discount amortization will be: Q. Question 6 B - False Using the straight-line method of amortization, interest expense equals the carrying value of bonds payable times the effective-interest rate. Q Question 5 C- Debit to Interest Expense for $172,819 On June 30, 2021, Cargo Corporation issued $4,000,000 of 10%, 10-year at $4,543,613 when the market rate was a 4 . Cargo Corporation uses the straightline method to amortize bonds premiums and discounts. Interest is paid each June 30 and December 31 . The entry to record the first semi-annual interest payment on December 31, 2021, would include a

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts