Question: need help with question 6 and 7 please Question 6 (1 point) Determine the internal rate of return for a project that costs $228,000 and

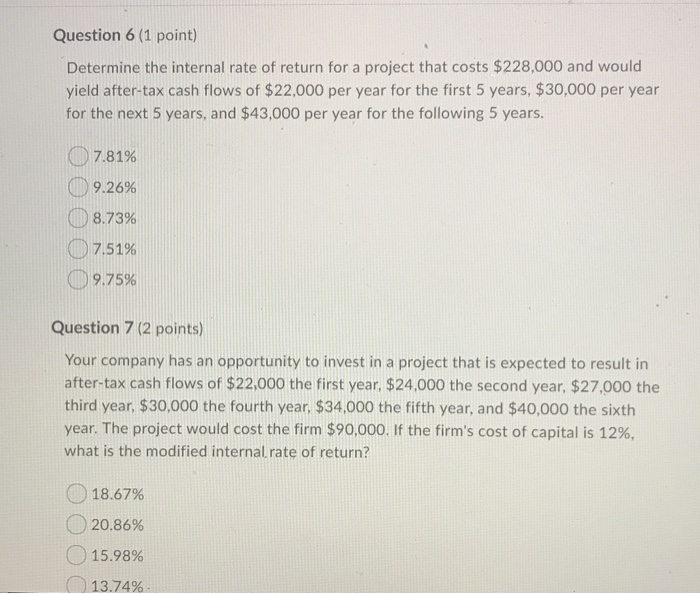

Question 6 (1 point) Determine the internal rate of return for a project that costs $228,000 and would yield after-tax cash flows of $22,000 per year for the first 5 years, $30,000 per year for the next 5 years, and $43,000 per year for the following 5 years. 7.81% 9.26% 8.73% 7.51% ID 9.75% Question 7 (2 points) Your company has an opportunity to invest in a project that is expected to result in after-tax cash flows of $22,000 the first year, $24,000 the second year, $27,000 the third year, $30,000 the fourth year, $34,000 the fifth year, and $40,000 the sixth year. The project would cost the firm $90,000. If the firm's cost of capital is 12%, what is the modified internal rate of return? 18.67% 20.86% 15.98% 13.74%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts