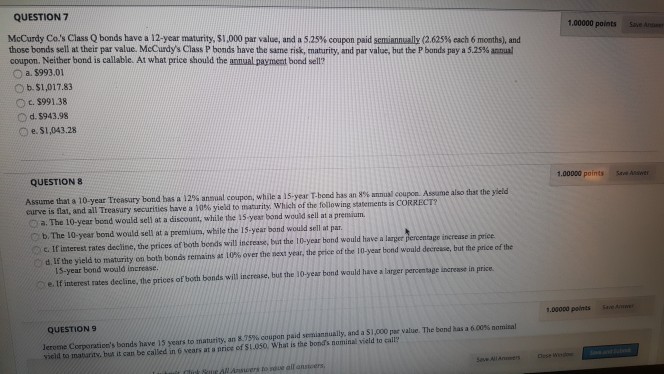

Question: need help with question 7 and 8. thanks! QUESTION 7 McCurdy Co.'s Class Q bonds have a 12-year maturity, S 1,000 par value, and a

need help with question 7 and 8. thanks!

QUESTION 7 McCurdy Co.'s Class Q bonds have a 12-year maturity, S 1,000 par value, and a 5.25% coupon paid s 1.00000 points Save Anee those bonds sell at their par value. McCurdy s Class p bonds have the same nsk, maturity, and par val e but the p bands pay a 525% annual coupon. Neither bond is callable. At what price should the armual payment bond sell? 0 a. S993.01 b. $1,017.83 O c. S991.38 O d. S943.98 e.S1,04328 a a y (2.625% each 6 months) and QUESTION8 1.00000 points Seve A Assume that a 10-year Treasury bond has a 12% annual coupon, while a 15-year T-bond has an 8% n n al cup . Treasury securities have a e owing staten en sao o A en 0% yield to maturity. Which of the a. The 10-year bond would setl at a discount, while the 15 yesr bond would sell at a prenmiunm. bThe 10-year bond would sell at a premium, while the 15-year bond would sell at par C. If interest ates decine, the prices of both beeds willincresase, bout the 10-year band would have a larger percentage increase in price d. lf the yield to maturity on both bonds remains at 10% over the next year, the price of the 10-year bond would decrease, but the price of the 13-year bond would inerease. o e. If interest rates decline, the prices of both bonds will increase, but the 10-year bond wauld have a larger percentage increase in price .00000 paints Save A QUESTION 9 lerome Corporati n's bands have i years to maturity, an 875% o upon paid se in nually, and a SI,000 par value. The bond has a 6 dos nominal vicid to inaturity, but it can be called in 6 years at a price of $1.050. What is the bond's nominal vield to call? Answers to sdue all anstoers

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts