Question: Need help with question C (rest are correct) Phoenix Corp. faltered in the recent recession but is recovering. Free cash flow has grown rapidly. Forecasts

Need help with question C (rest are correct)

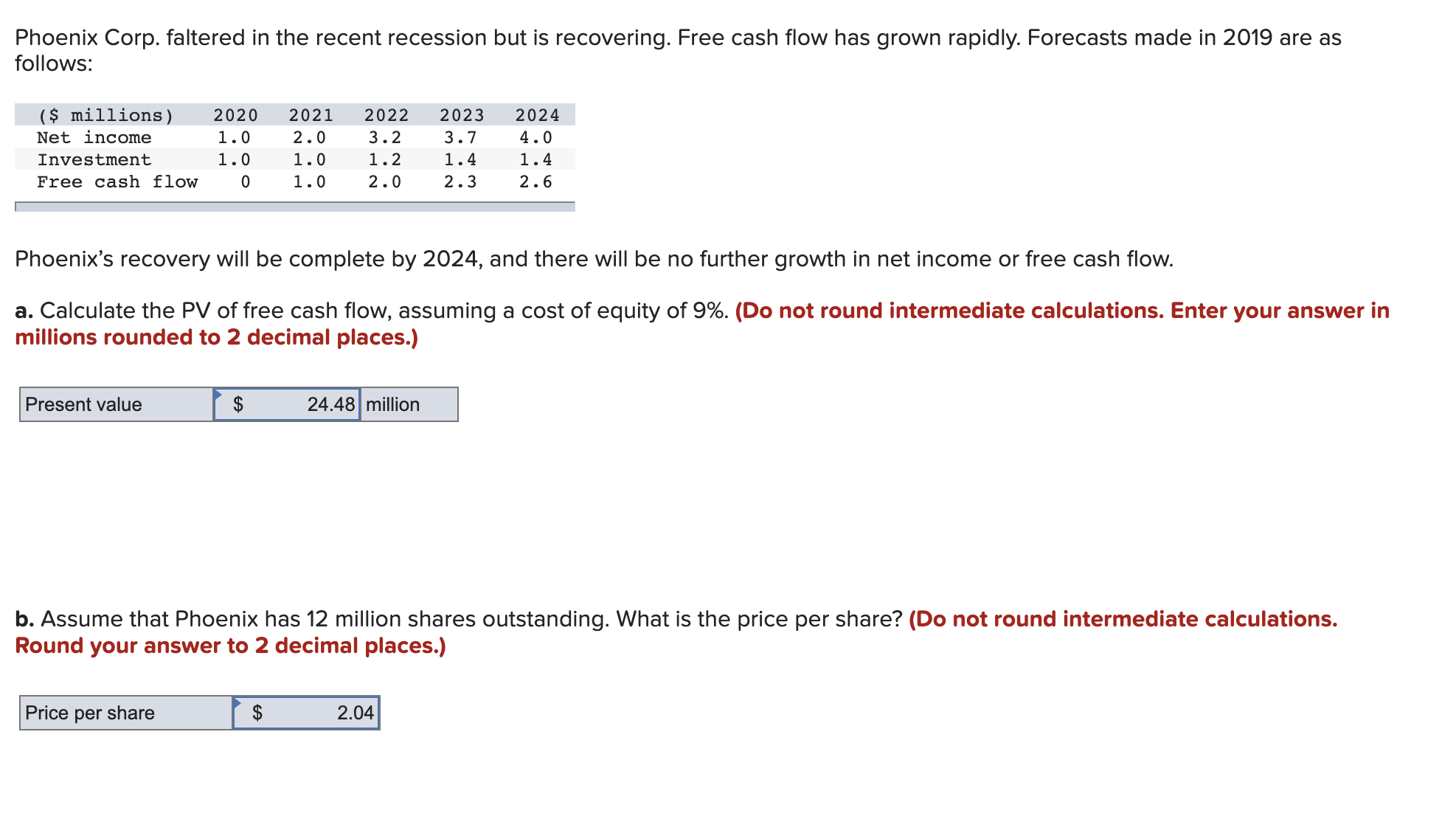

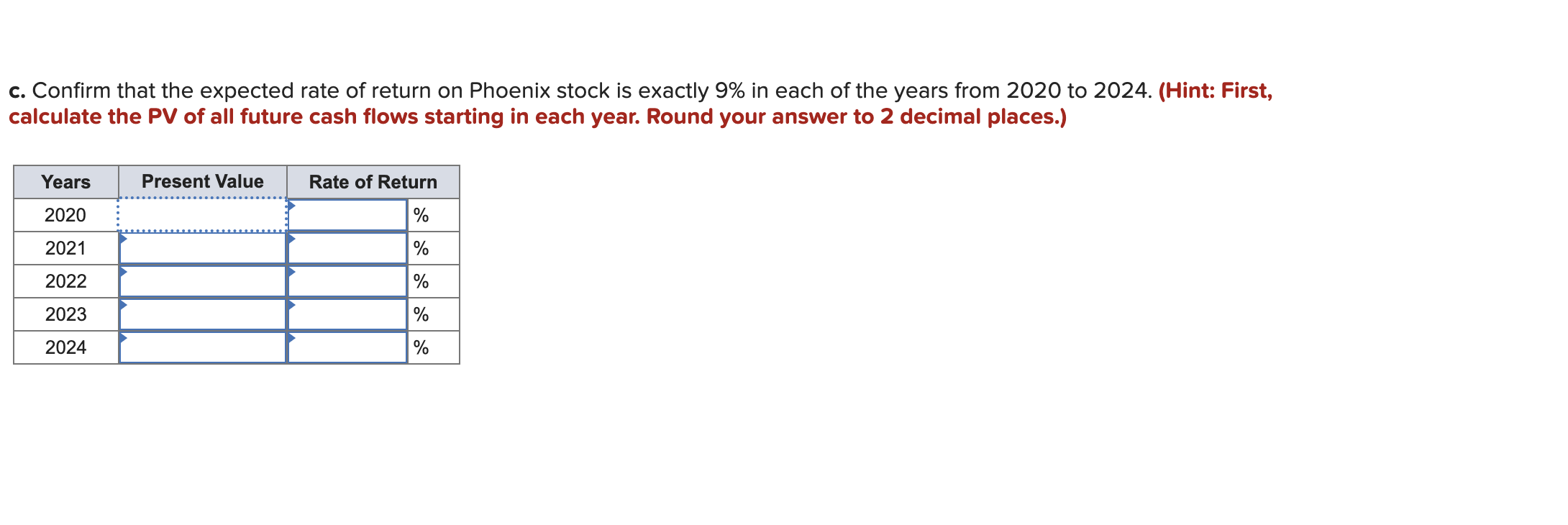

Phoenix Corp. faltered in the recent recession but is recovering. Free cash flow has grown rapidly. Forecasts made in 2019 are as follows: Phoenix's recovery will be complete by 2024 , and there will be no further growth in net income or free cash flow. a. Calculate the PV of free cash flow, assuming a cost of equity of 9%. (Do not round intermediate calculations. Enter your answer in millions rounded to 2 decimal places.) b. Assume that Phoenix has 12 million shares outstanding. What is the price per share? (Do not round intermediate calculations. Round your answer to 2 decimal places.) c. Confirm that the expected rate of return on Phoenix stock is exactly 9\% in each of the years from 2020 to 2024. (Hint: First, calculate the PV of all future cash flows starting in each year. Round your answer to 2 decimal places.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts