Question: Need help with question C!, thanks! Compute ROE and RNOA with Disaggregation Selected balance sheet and income statement information for Home Depot follows $ millions

Need help with question C!, thanks!

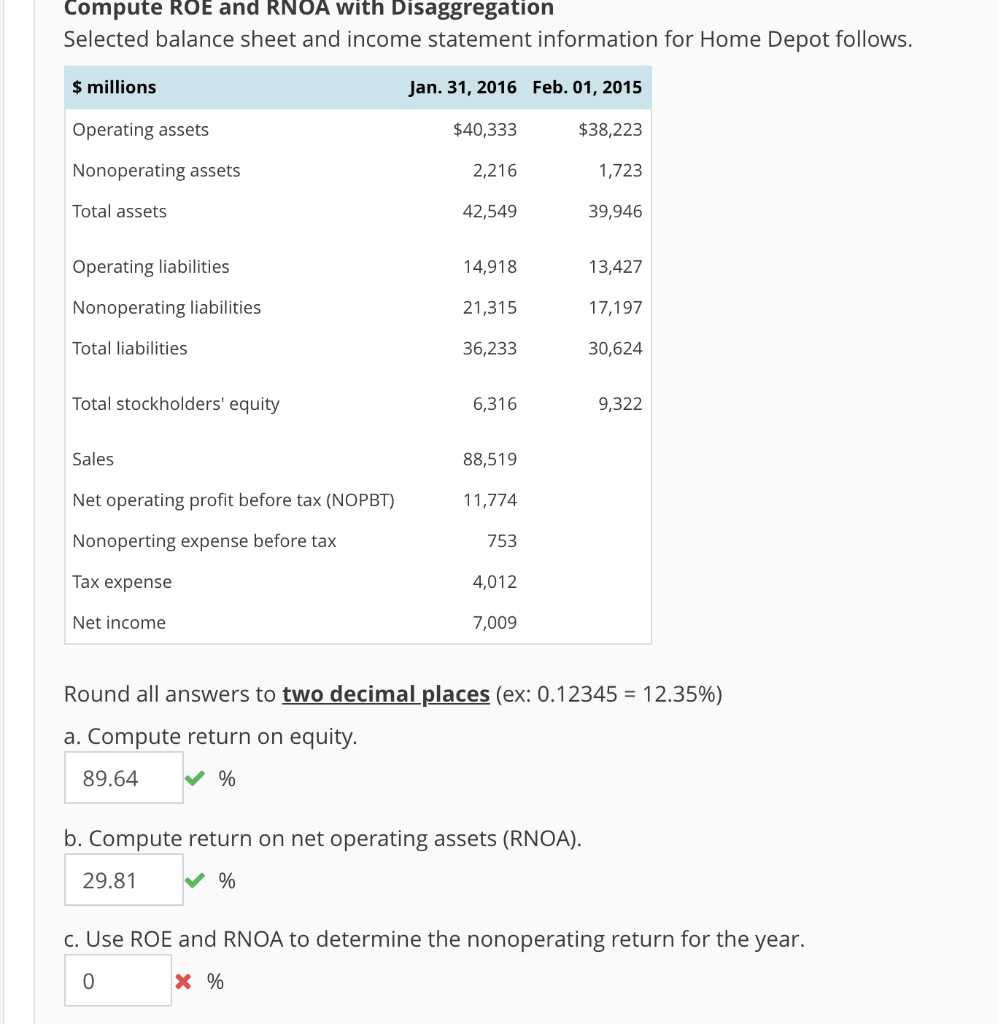

Compute ROE and RNOA with Disaggregation Selected balance sheet and income statement information for Home Depot follows $ millions Operating assets Nonoperating assets Total assets Jan. 31, 2016 Feb. 01, 2015 $38,223 1,723 39,946 $40,333 2,216 42,549 14,918 21,315 36,233 13,427 17,197 30,624 9,322 Operating liabilities Nonoperating liabilities Total liabilities Total stockholders' equity Sales Net operating profit before tax (NOPBT) Nonoperting expense before tax Tax expense Net income 6,316 88,519 11,774 753 4,012 7,009 Round all answers to two decimal places (ex: 012345-12.35%) a. Compute return on equity 89.64 % b. Compute return on net operating assets (RNOA). 29.81 % C. Use ROE and RNOA to determine the nonoperating return for the year. Compute ROE and RNOA with Disaggregation Selected balance sheet and income statement information for Home Depot follows $ millions Operating assets Nonoperating assets Total assets Jan. 31, 2016 Feb. 01, 2015 $38,223 1,723 39,946 $40,333 2,216 42,549 14,918 21,315 36,233 13,427 17,197 30,624 9,322 Operating liabilities Nonoperating liabilities Total liabilities Total stockholders' equity Sales Net operating profit before tax (NOPBT) Nonoperting expense before tax Tax expense Net income 6,316 88,519 11,774 753 4,012 7,009 Round all answers to two decimal places (ex: 012345-12.35%) a. Compute return on equity 89.64 % b. Compute return on net operating assets (RNOA). 29.81 % C. Use ROE and RNOA to determine the nonoperating return for the year

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts