Question: Need Help with question e. and f. please Look at the illustrative new-issue prospectus. a. Is this issue a primary offering, a secondary offering, or

Need Help with question e. and f. please

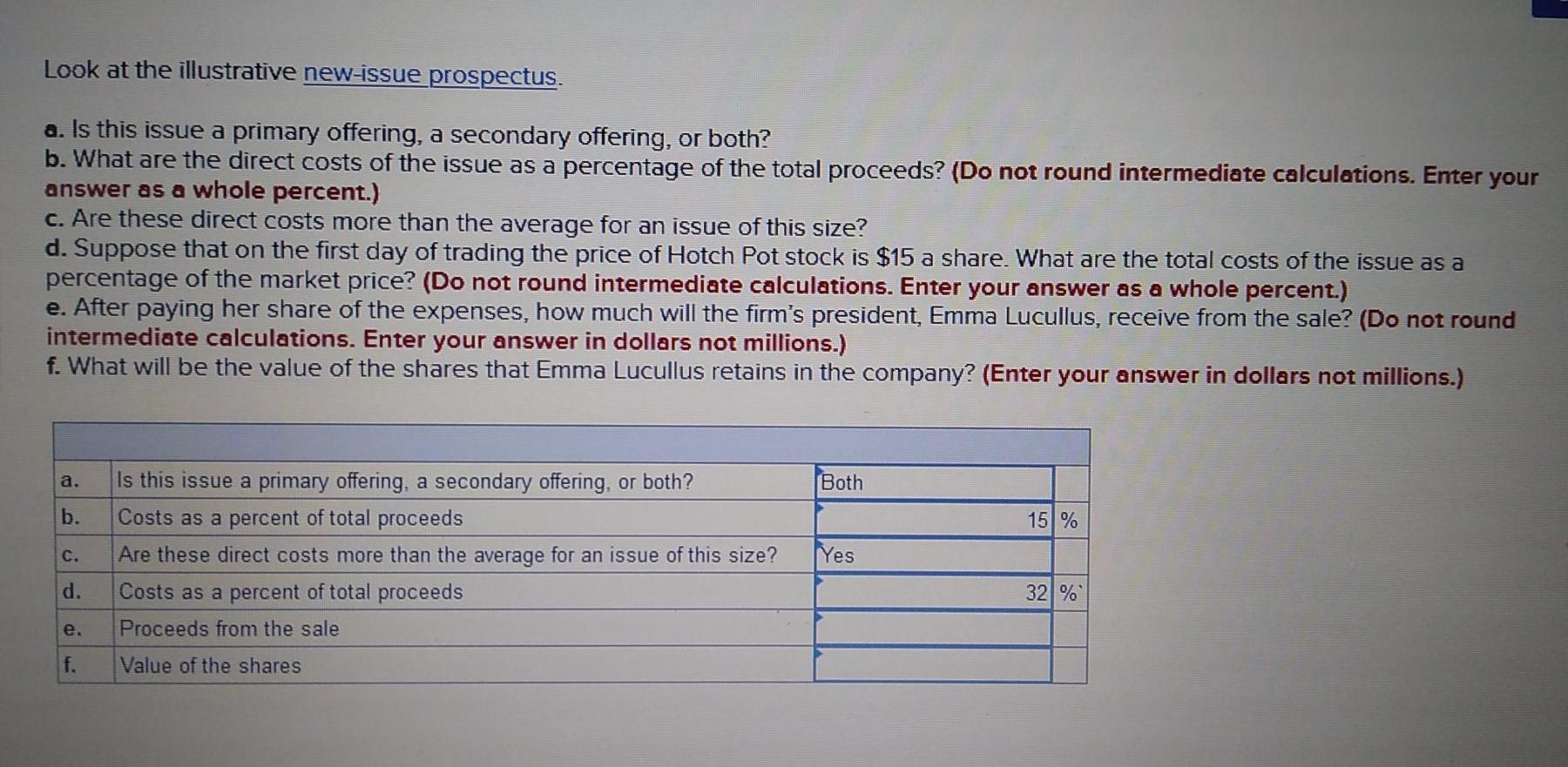

Look at the illustrative new-issue prospectus. a. Is this issue a primary offering, a secondary offering, or both? b. What are the direct costs of the issue as a percentage of the total proceeds? (Do not round intermediate calculations. Enter your answer as a whole percent.) c. Are these direct costs more than the average for an issue of this size? d. Suppose that on the first day of trading the price of Hotch Pot stock is $15 a share. What are the total costs of the issue as a percentage of the market price? (Do not round intermediate calculations. Enter your answer as a whole percent.) e. After paying her share of the expenses, how much will the firm's president, Emma Lucullus, receive from the sale? (Do not round intermediate calculations. Enter your answer in dollars not millions.) f. What will be the value of the shares that Emma Lucullus retains in the company? (Enter your answer in dollars not millions.) a. Both b. 15% C. Is this issue a primary offering, a secondary offering, or both? Costs as a percent of total proceeds Are these direct costs more than the average for an issue of this size? Costs as a percent of total proceeds Proceeds from the sale Yes d. 32% e. f. Value of the shares Look at the illustrative new-issue prospectus. a. Is this issue a primary offering, a secondary offering, or both? b. What are the direct costs of the issue as a percentage of the total proceeds? (Do not round intermediate calculations. Enter your answer as a whole percent.) c. Are these direct costs more than the average for an issue of this size? d. Suppose that on the first day of trading the price of Hotch Pot stock is $15 a share. What are the total costs of the issue as a percentage of the market price? (Do not round intermediate calculations. Enter your answer as a whole percent.) e. After paying her share of the expenses, how much will the firm's president, Emma Lucullus, receive from the sale? (Do not round intermediate calculations. Enter your answer in dollars not millions.) f. What will be the value of the shares that Emma Lucullus retains in the company? (Enter your answer in dollars not millions.) a. Both b. 15% C. Is this issue a primary offering, a secondary offering, or both? Costs as a percent of total proceeds Are these direct costs more than the average for an issue of this size? Costs as a percent of total proceeds Proceeds from the sale Yes d. 32% e. f. Value of the shares

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts