Question: Need help with questions 1 - 4 . Please show steps. Integrated Mini Case MEASURING LIQUIDITY RISK A DI has the following balance sheet (

Need help with questions Please show steps.

Integrated Mini Case

MEASURING LIQUIDITY RISK

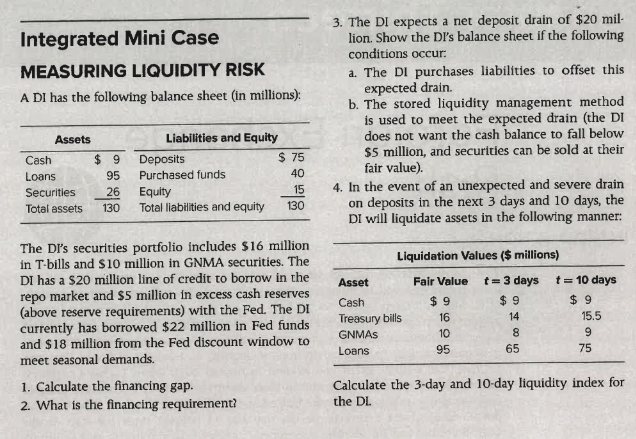

A DI has the following balance sheet in millions:

The DI's securities portfolio includes $ million

in Tbills and $ million in GNMA securities The

DI has a $ million line of credit to borrow in the

repo market and $ million in excess cash reserves

above reserve requirements with the Fed. The DI

currently has borrowed $ million in Fed funds

and $ million from the Fed discount window to

meet seasonal demands.

Calculate the financing gap.

What is the financing requirement?

The DI expects a net deposit drain of $ mil

lion. Show the DI's balance sheet if the following

conditions occur:

a The DI purchases liabilities to offset this

expected drain.

b The stored liquidity management method

is used to meet the expected drain the DI

does not want the cash balance to fall below

$ million, and securities can be sold at their

fair value

In the event of an unexpected and severe drain

on deposits in the next days and days, the

DI will liquidate assets in the following manner:

Calculate the day and day liquidity index for

the DL

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock