Question: Need help with questions 1-3 Options for Q2 & 3 Comparing Three Depreciation Methods residual value of $31,000. The equipment was used for 3,200 hours

Need help with questions 1-3

Options for Q2 & 3

Options for Q2 & 3

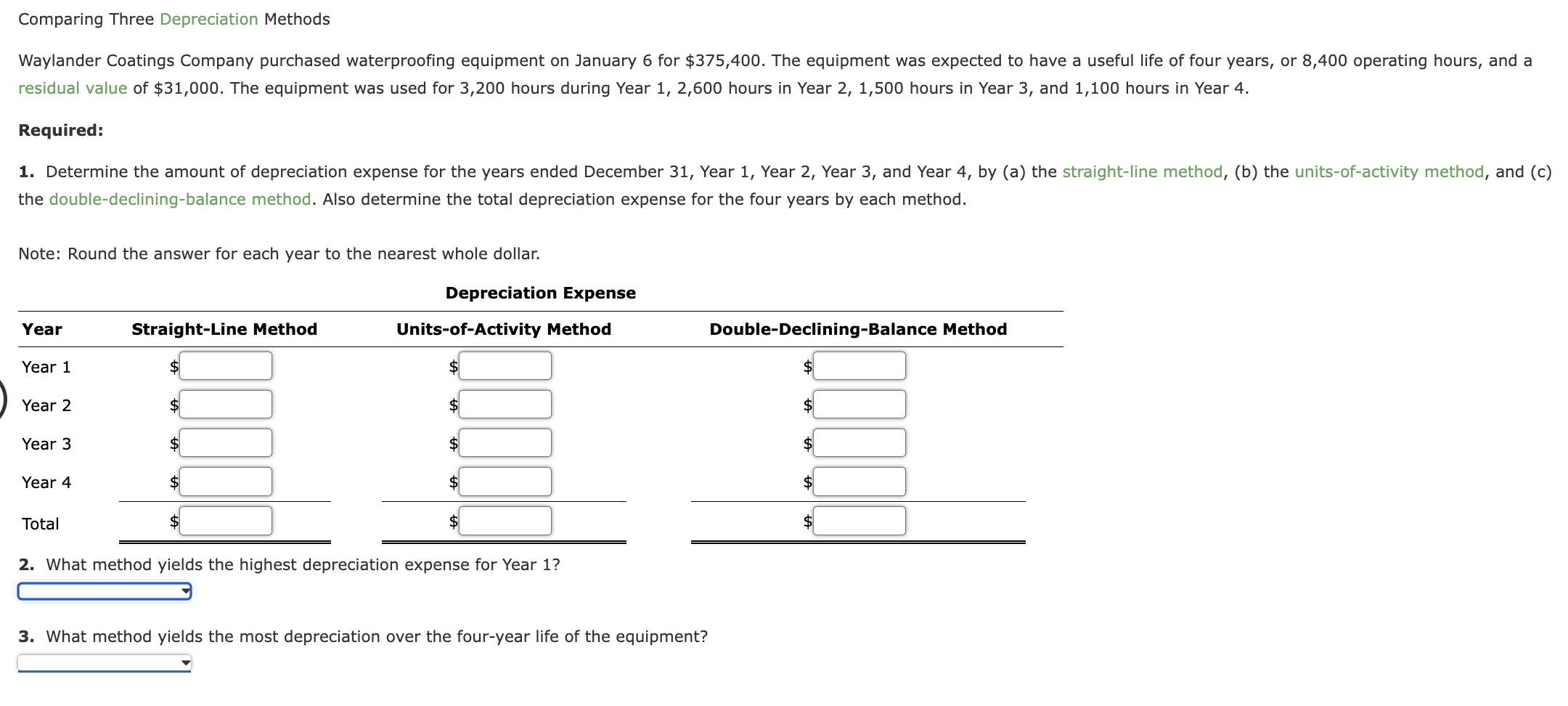

Comparing Three Depreciation Methods residual value of $31,000. The equipment was used for 3,200 hours during Year 1,2,600 hours in Year 2, 1,500 hours in Year 3 , and 1,100 hours in Year 4. Required: the double-declining-balance method. Also determine the total depreciation expense for the four years by each method. Note: Round the answer for each year to the nearest whole dollar. 2. What method yields the highest depreciation expense for Year 1 ? 3. What method yields the most depreciation over the four-year life of the equipment? Straight-line method Units-of-output method Double-declining-balance method All three depreciation methods

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts