Question: Need help with questions 1-4 1. 2. 3. 4. Bonds Issued at a Discount (Effective Interest) Theodore Corporation decided to issue long-term debt in order

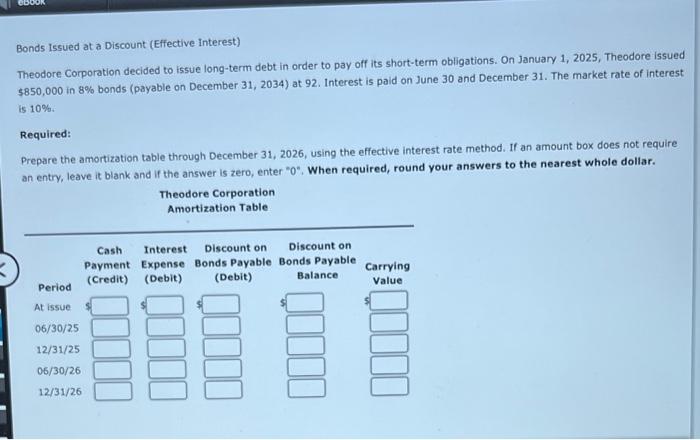

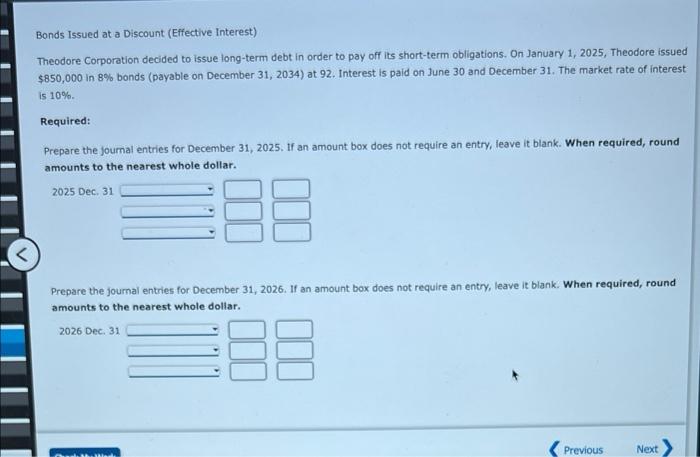

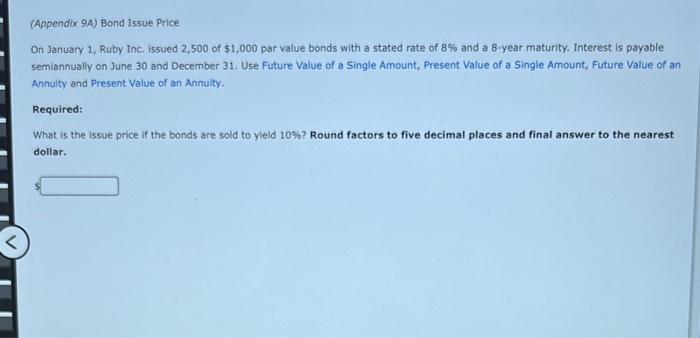

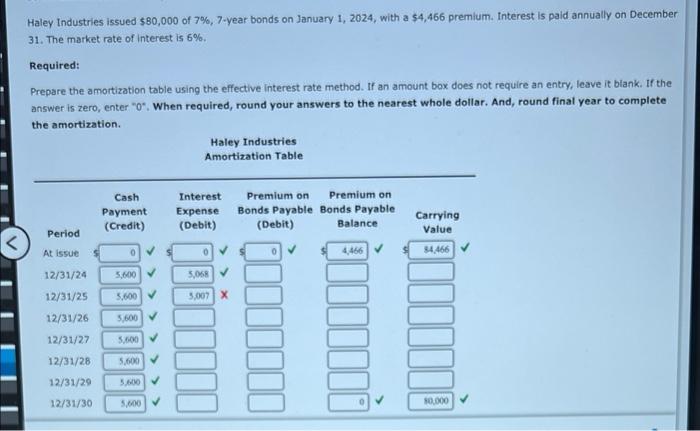

Bonds Issued at a Discount (Effective Interest) Theodore Corporation decided to issue long-term debt in order to pay off its short-term obligations. On January 1, 2025, Theodore issued $850,000 in 8% bonds (payable on December 31, 2034) at 92. Interest is paid on June 30 and December 31. The market rate of interest is 10%. Required: Prepare the amortization table through December 31, 2026, using the effective interest rate method. If an amount box does not require an entry, leave it blank and if the answer is zero, enter "0". When required, round your answers to the nearest whole dollar. Period At issue 06/30/25 12/31/25 06/30/26 12/31/26 Theodore Corporation Amortization Table Cash Discount on Interest Discount on Payment Expense Bonds Payable Bonds Payable. (Credit) (Debit) (Debit) Balance Carrying Value Bonds Issued at a Discount (Effective Interest) Theodore Corporation decided to issue long-term debt in order to pay off its short-term obligations. On January 1, 2025, Theodore issued $850,000 in 8% bonds (payable on December 31, 2034) at 92. Interest is paid on June 30 and December 31. The market rate of interest is 10%. Required: Prepare the journal entries for December 31, 2025. If an amount box does not require an entry, leave it blank. When required, round amounts to the nearest whole dollar. 2025 Dec. 31 38 Prepare the journal entries for December 31, 2026. If an amount box does not require an entry, leave it blank. When required, round amounts to the nearest whole dollar. 2026 Dec. 31 Previous Next (Appendix 9A) Bond Issue Price On January 1, Ruby Inc. issued 2,500 of $1,000 par value bonds with a stated rate of 8% and a 8-year maturity. Interest is payable semiannually on June 30 and December 31. Use Future Value of a Single Amount, Present Value of a Single Amount, Future Value of an Annuity and Present Value of an Annuity. Required: What is the issue price if the bonds are sold to yield 10% ? Round factors to five decimal places and final answer to the nearest dollar. Haley Industries issued $80,000 of 7%, 7-year bonds on January 1, 2024, with a $4,466 premium. Interest is paid annually on December 31. The market rate of interest is 6%. Required: Prepare the amortization table using the effective interest rate method. If an amount box does not require an entry, leave it blank. If the answer is zero, enter "0". When required, round your answers to the nearest whole dollar. And, round final year to complete the amortization. Period At issue 12/31/24 12/31/25 12/31/26 12/31/27 12/31/28 12/31/29 12/31/30 Cash Payment (Credit) 0 5,600 5,600 V 5,600 V 5,600 5,600 5,600 5,000 Haley Industries Amortization Table Interest Expense (Debit) 0 5,068 5,007 X Premium on Premium on Bonds Payable Bonds Payable (Debit) Balance 0 4,466 00000 Carrying Value 84,466 80,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts