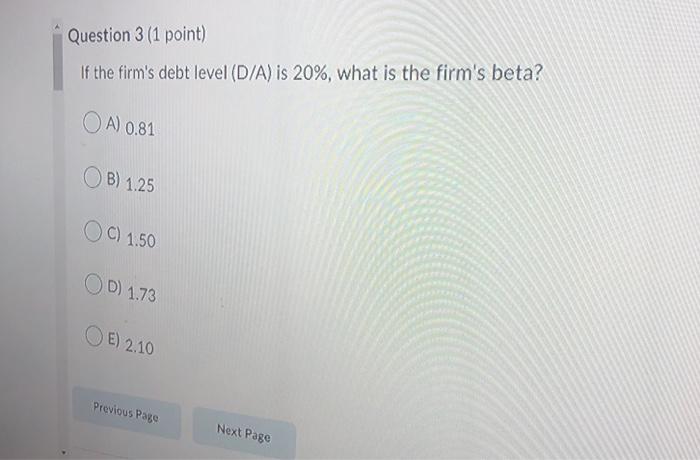

Question: need help with questions 3 and 4 Question 3 (1 point) If the firm's debt level (D/A) is 20%, what is the firm's beta? OA)

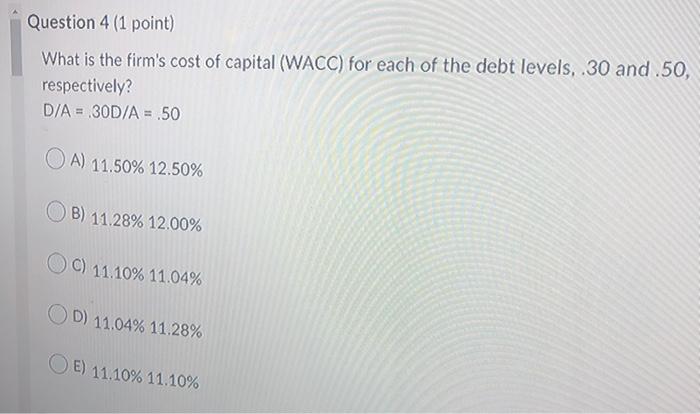

Question 3 (1 point) If the firm's debt level (D/A) is 20%, what is the firm's beta? OA) 0.81 OB) 1.25 OC) 1.50 OD) 1.73 O E) 2.10 Previous Page Next Page Question 4 (1 point) What is the firm's cost of capital (WACC) for each of the debt levels, 30 and .50, respectively? D/A = 30D/A = .50 OA) 11.50% 12.50% B) 11.28% 12.00% C) 11.10% 11.04% OD 11.04% 11.28% E) 11.10% 11.10% Question 3 (1 point) If the firm's debt level (D/A) is 20%, what is the firm's beta? OA) 0.81 OB) 1.25 OC) 1.50 OD) 1.73 O E) 2.10 Previous Page Next Page Question 4 (1 point) What is the firm's cost of capital (WACC) for each of the debt levels, 30 and .50, respectively? D/A = 30D/A = .50 OA) 11.50% 12.50% B) 11.28% 12.00% C) 11.10% 11.04% OD 11.04% 11.28% E) 11.10% 11.10%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts