Question: need help with questions 31 and 32 Question 31 (1 point) From the information below. Select the optimal capital structure for Minnow Entertainment Company A)

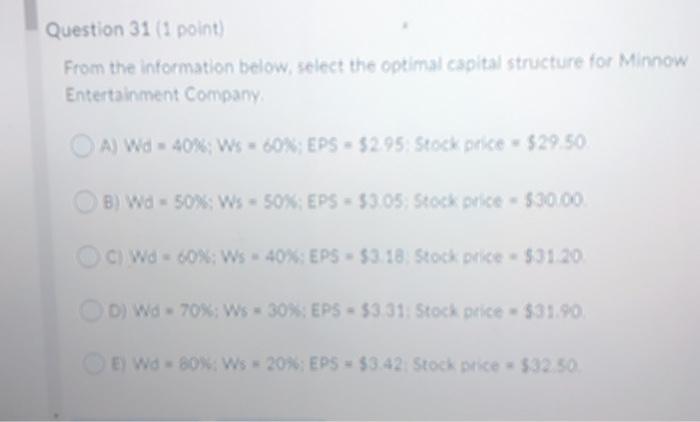

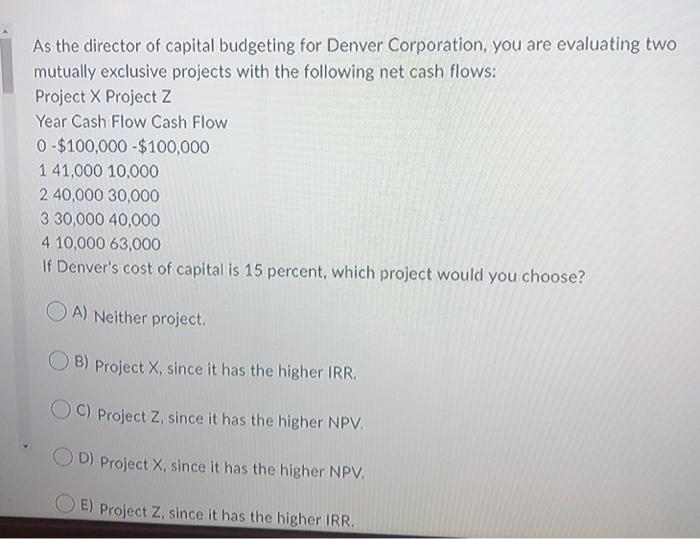

Question 31 (1 point) From the information below. Select the optimal capital structure for Minnow Entertainment Company A) Wd = 40%; Ws - 60%; EPS = $2.95 Stock price = $29.50 B) Wd -50% Ws - 50X: EPS = $3:05 Stock price $30,00 C) W = 60%: Ws -40% EPS = $3.18 Stock pike - $31.20 D) W - 70%; Ws - 30%, EPS = 53 31 Stock price $31.90 E) W = 80Ws - 20%: EPS = $3.42 Stock price $52.50 As the director of capital budgeting for Denver Corporation, you are evaluating two mutually exclusive projects with the following net cash flows: Project X Project z Year Cash Flow Cash Flow 0-$100,000 - $100,000 1 41,000 10,000 240,000 30,000 3 30,000 40,000 4 10,000 63,000 If Denver's cost of capital is 15 percent, which project would you choose? A) Neither project B) Project X, since it has the higher IRR. OC) Project Z, since it has the higher NPV. D) Project X, since it has the higher NPV. E) Project Z, since it has the higher IRR

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts