Question: need help with questions 35 and 36 Question 35 (1 point) ABC Corp has an outstanding bond with effective maturity of 25 years, a 5%

need help with questions 35 and 36

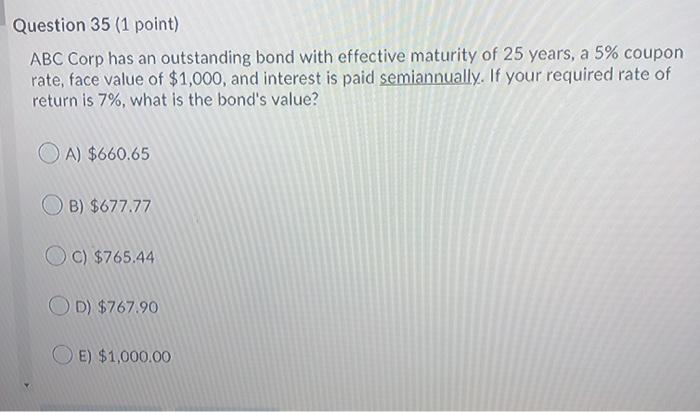

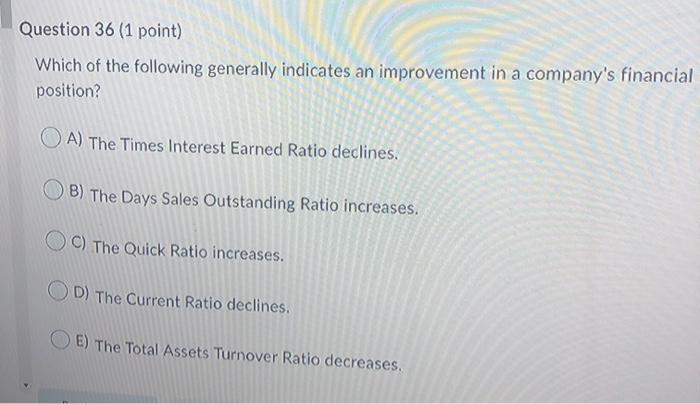

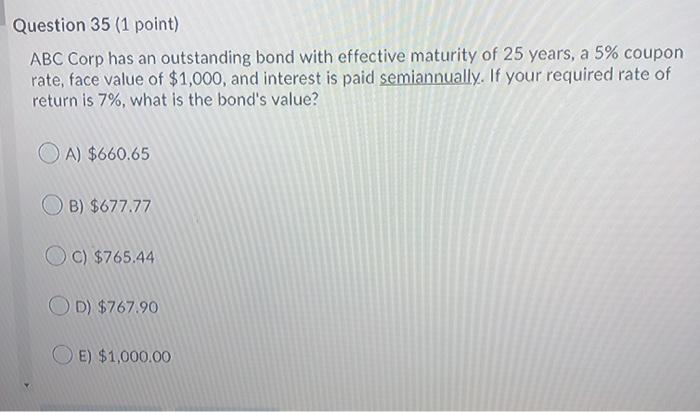

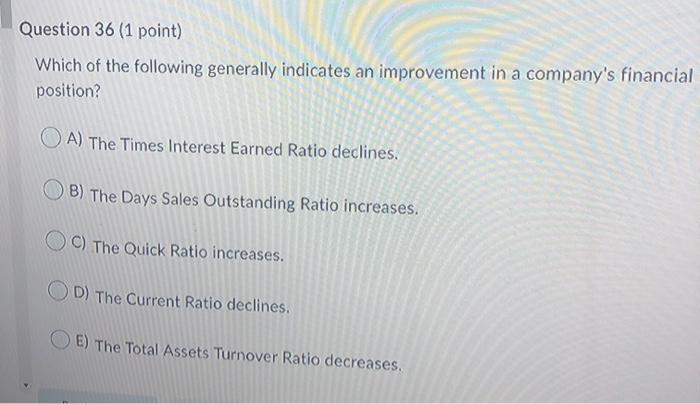

Question 35 (1 point) ABC Corp has an outstanding bond with effective maturity of 25 years, a 5% coupon rate, face value of $1,000, and interest is paid semiannually. If your required rate of return is 7%, what is the bond's value? OA) $660.65 B) $677.77 OC) $765.44 OD) $767.90 E) $1,000.00 Question 36 (1 point) Which of the following generally indicates an improvement in a company's financial position? OA) The Times Interest Earned Ratio declines. B) The Days Sales Outstanding Ratio increases. C) The Quick Ratio increases. OD) The Current Ratio declines. E) The Total Assets Turnover Ratio decreases

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock