Question: Need help with Questions 5 please help please 4. (Following Q3) Now suppose that the price of IBM is $150/share at the close on Dec

Need help with Questions 5 please help please

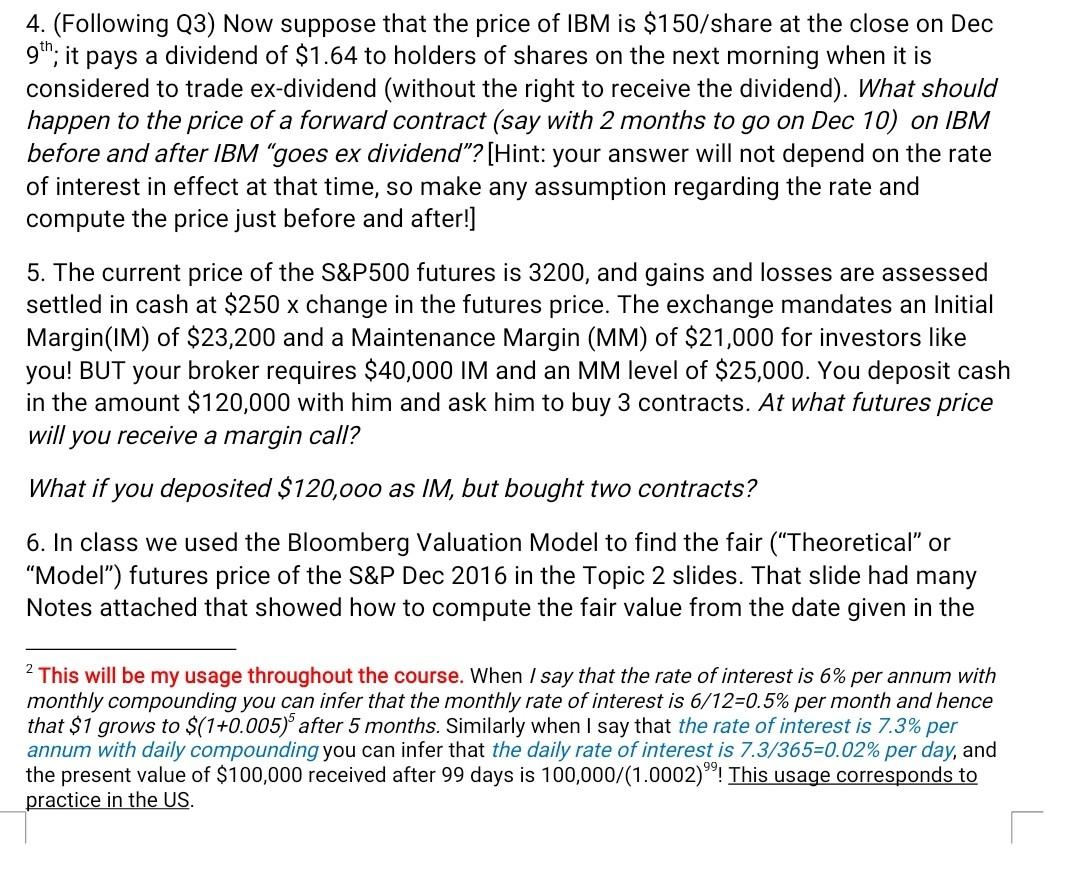

4. (Following Q3) Now suppose that the price of IBM is $150/share at the close on Dec 9th; it pays a dividend of $1.64 to holders of shares on the next morning when it is considered to trade ex-dividend (without the right to receive the dividend). What should happen to the price of a forward contract (say with 2 months to go on Dec 10) on IBM before and after IBM goes ex dividend"? [Hint: your answer will not depend on the rate of interest in effect at that time, so make any assumption regarding the rate and compute the price just before and after!] 5. The current price of the S&P500 futures is 3200, and gains and losses are assessed settled in cash at $250 x change in the futures price. The exchange mandates an Initial Margin(IM) of $23,200 and a Maintenance Margin (MM) of $21,000 for investors like you! BUT your broker requires $40,000 IM and an MM level of $25,000. You deposit cash in the amount $120,000 with him and ask him to buy 3 contracts. At what futures price will you receive a margin call? What if you deposited $120,000 as IM, but bought two contracts? 6. In class we used the Bloomberg Valuation Model to find the fair (Theoretical or "Model") futures price of the S&P Dec 2016 in the Topic 2 slides. That slide had many Notes attached that showed how to compute the fair value from the date given in the 2 This will be my usage throughout the course. When I say that the rate of interest is 6% per annum with monthly compounding you can infer that the monthly rate of interest is 6/12=0.5% per month and hence that $1 grows to $(1+0.005) after 5 months. Similarly when I say that the rate of interest is 7.3% per annum with daily compounding you can infer that the daily rate of interest is 7.3/365=0.02% per day, and the present value of $100,000 received after 99 days is 100,000/(1.0002)99! This usage corresponds to practice in the US. 4. (Following Q3) Now suppose that the price of IBM is $150/share at the close on Dec 9th; it pays a dividend of $1.64 to holders of shares on the next morning when it is considered to trade ex-dividend (without the right to receive the dividend). What should happen to the price of a forward contract (say with 2 months to go on Dec 10) on IBM before and after IBM goes ex dividend"? [Hint: your answer will not depend on the rate of interest in effect at that time, so make any assumption regarding the rate and compute the price just before and after!] 5. The current price of the S&P500 futures is 3200, and gains and losses are assessed settled in cash at $250 x change in the futures price. The exchange mandates an Initial Margin(IM) of $23,200 and a Maintenance Margin (MM) of $21,000 for investors like you! BUT your broker requires $40,000 IM and an MM level of $25,000. You deposit cash in the amount $120,000 with him and ask him to buy 3 contracts. At what futures price will you receive a margin call? What if you deposited $120,000 as IM, but bought two contracts? 6. In class we used the Bloomberg Valuation Model to find the fair (Theoretical or "Model") futures price of the S&P Dec 2016 in the Topic 2 slides. That slide had many Notes attached that showed how to compute the fair value from the date given in the 2 This will be my usage throughout the course. When I say that the rate of interest is 6% per annum with monthly compounding you can infer that the monthly rate of interest is 6/12=0.5% per month and hence that $1 grows to $(1+0.005) after 5 months. Similarly when I say that the rate of interest is 7.3% per annum with daily compounding you can infer that the daily rate of interest is 7.3/365=0.02% per day, and the present value of $100,000 received after 99 days is 100,000/(1.0002)99! This usage corresponds to practice in the US

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts