Question: need help with questions a,b,c Hack Wellington Co. is considering a three-year project that will require an initial investment of $45,000. It has estimated that

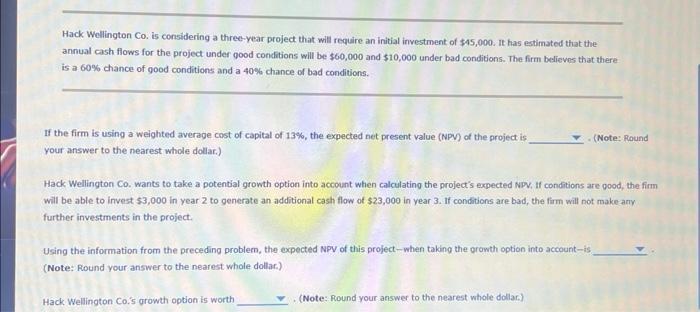

Hack Wellington Co. is considering a three-year project that will require an initial investment of $45,000. It has estimated that the annual cash flows for the project under good conditions will be $60,000 and $10,000 under bad conditions. The firm believos that there is a 60% chance of good conditions and a 40% chance of bad conditions. If the firm is using a weighted average cost of capital of 13%, the expected net present value (NPV) of the groject is your answer to the nearest whole dollar.) Hack Wellington Co. Wants to take a potential growth option into account when calculating the project's expected NpV, If conditions are good, the firm Will be able to invest $3,000 in year 2 to generate an additional cash flow of $23,000 in year 3 . If conditions are bad, the firm will not make arry further investments in the project. Using the information from the preceding problem, the expected Npy of this project-when taking the orowth option into account-is (Note: Round your answer to the nearest whole dollar.) Hack Wellington Co.5 growth option is worth . (Note: Round your answer to the nearest whole dollar.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts