Question: Need help with questions C, D, & E Problem 9-21A (Algo) Comparing return on investment and residual income LO 9-2, 9-3 Rundle Corporation operates three

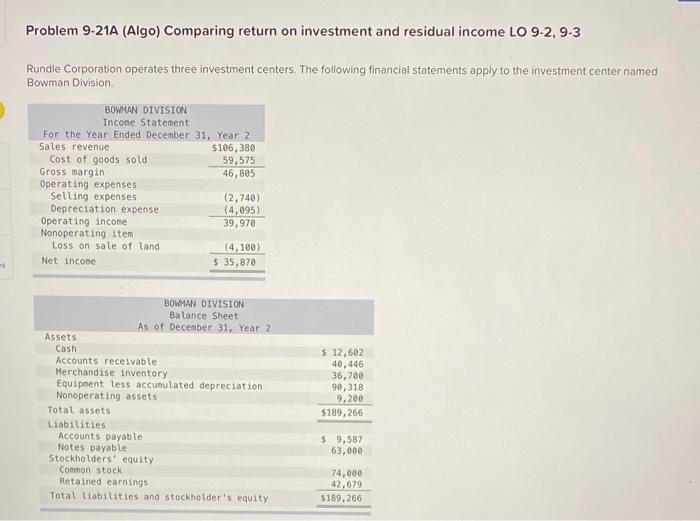

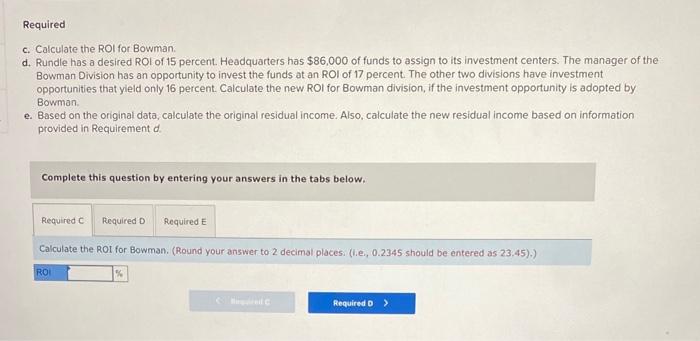

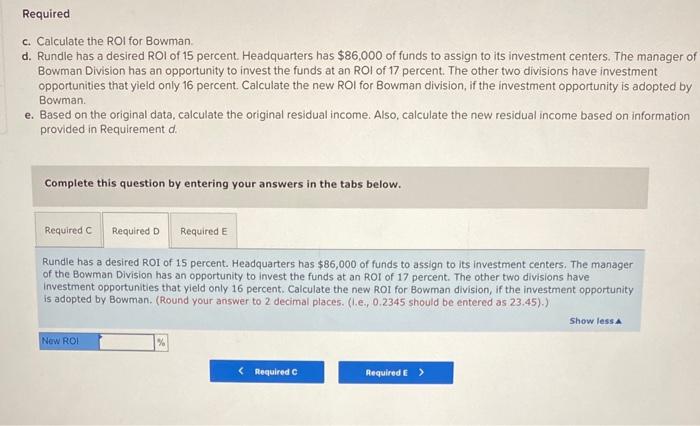

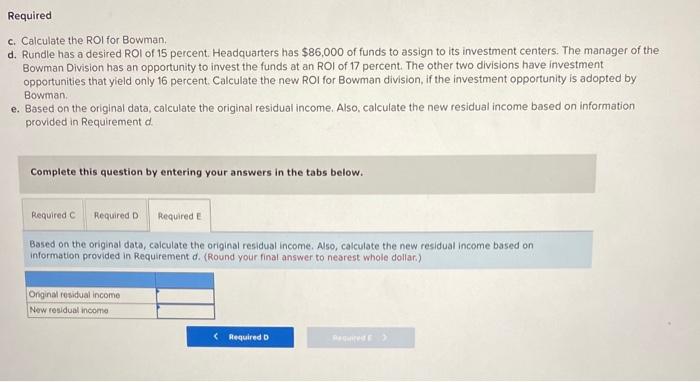

Problem 9-21A (Algo) Comparing return on investment and residual income LO 9-2, 9-3 Rundle Corporation operates three investment centers. The following financial statements apply to the investment center named Bowman Division. c. Calculate the ROl for Bowman. d. Rundle has a desired ROL of 15 percent. Headquarters has $86,000 of funds to assign to its investment centers. The manager of the Bowman Division has an opportunity to invest the funds at an ROI of 17 percent. The other two divisions have investment opportunities that yleld only 16 percent. Calculate the new ROI for Bowman division, if the investment opportunity is adopted by Bowman. e. Based on the original data, calculate the original residual income. Also, calculate the new residual income based on information provided in Requirement d. Complete this question by entering your answers in the tabs below. Calculate the ROI for Bowman. (Round your answer to 2 decimal places (i.e., 0.2345 should be entered as 23.45 ).) c. Calculate the ROI for Bowman. d. Rundle has a desired ROI of 15 percent. Headquarters has $86,000 of funds to assign to its investment centers. The manager o Bowman Division has an opportunity to invest the funds at an ROI of 17 percent. The other two divisions have investment opportunities that yield only 16 percent. Calculate the new ROI for Bowman division, if the investment opportunity is adopted by Bowman. e. Based on the original data, calculate the original residual income. Also, calculate the new residual income based on information provided in Requirement d Complete this question by entering your answers in the tabs below. Rundle has a desired ROI of 15 percent. Headquarters has $86,000 of funds to assign to its investment centers. The manager of the Bowman Division has an opportunity to invest the funds at an ROI of 17 percent. The other two divisions have Investment opportunities that yield only 16 percent. Calculate the new ROI for Bowman division, if the investment opportunity is adopted by Bowman. (Round your answer to 2 decimal places. (l.e., 0.2345 should be entered as 23.45).) c. Calculate the ROI for Bowman, d. Rundle has a desired ROI of 15 percent. Headquarters has $86,000 of funds to assign to its investment centers. The manager of the Bowman Division has an opportunity to invest the funds at an ROI of 17 percent. The other two divisions have investment opportunities that yield only 16 percent. Calculate the new ROI for Bowman division, if the investment opportunity is adopted by Bowman. e. Based on the original data, calculate the original residual income. Also, calculate the new residual income based on information provided in Requirement d. Complete this question by entering your answers in the tabs below. Based on the original dato, calculate the original residual income. Asso, calculate the new residual income based on information provided in Requirement d. (Round your finat answer to nearest whole dollar.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts