Question: Need help with requirement 1. I attached the transaction list. Thank you in advance 3 The Polaris Company uses a job-order costing system. The following

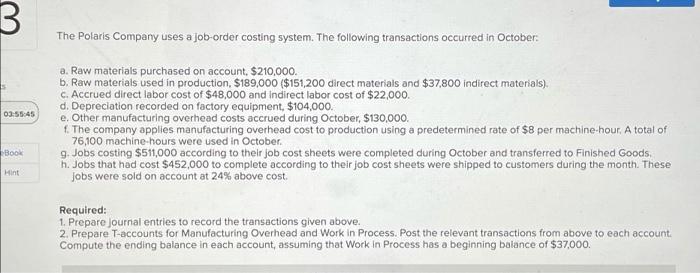

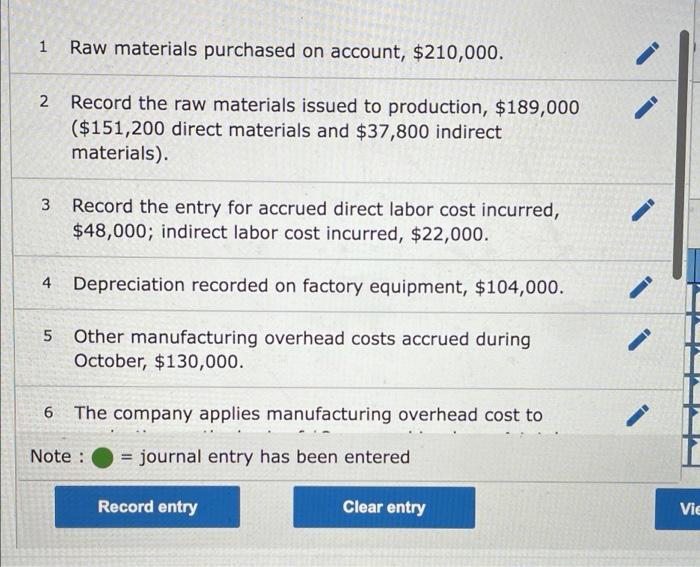

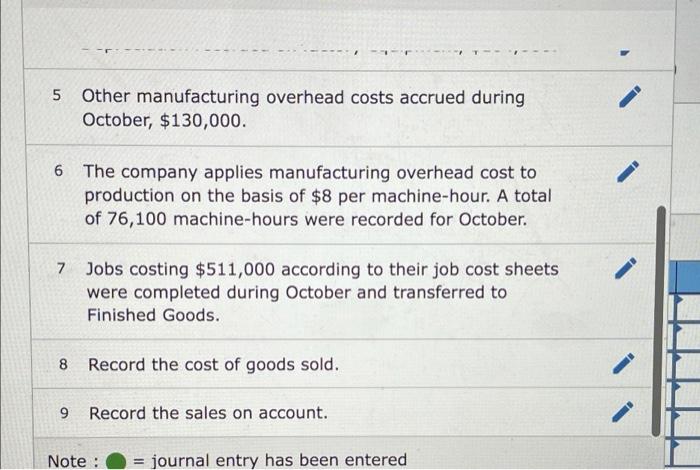

3 The Polaris Company uses a job-order costing system. The following transactions occurred in October: a. Raw materials purchased on account, $210,000. b. Raw materials used in production, $189,000 ($151,200 direct materials and $37,800 indirect materials). c. Accrued direct labor cost of $48,000 and indirect labor cost of $22,000. d. Depreciation recorded on factory equipment, $104,000. 03:55:45 e. Other manufacturing overhead costs accrued during October, $130,000. f. The company applies manufacturing overhead cost to production using a predetermined rate of $8 per machine-hour. A total of 76,100 machine-hours were used in October. Book g. Jobs costing $511,000 according to their job cost sheets were completed during October and transferred to Finished Goods. Hint h. Jobs that had cost $452,000 to complete according to their job cost sheets were shipped to customers during the month. These jobs were sold on account at 24% above cost. Required: 1. Prepare journal entries to record the transactions given above. 2. Prepare T-accounts for Manufacturing Overhead and Work in Process. Post the relevant transactions from above to each account. Compute the ending balance in each account, assuming that Work in Process has a beginning balance of $37,000. Raw materials purchased on account, $210,000. 2 Record the raw materials issued to production, $189,000 ($151,200 direct materials and $37,800 indirect materials). 3 Record the entry for accrued direct labor cost incurred, $48,000; indirect labor cost incurred, $22,000. 4 Depreciation recorded on factory equipment, $104,000. 5 Other manufacturing overhead costs accrued during October, $130,000. 6 The company applies manufacturing overhead cost to Note : = journal entry has been entered Record entry Clear entry H Vie 5 Other manufacturing overhead costs accrued during October, $130,000. 6 The company applies manufacturing overhead cost to production on the basis of $8 per machine-hour. A total of 76,100 machine-hours were recorded for October. 7 Jobs costing $511,000 according to their job cost sheets were completed during October and transferred to Finished Goods. 8 Record the cost of goods sold. 9 Record the sales on account. Note : = journal entry has been entered

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts