Question: Need help with schedule C ? The bookkeeper provided the following additional information: - Donations expense is a ( $ 6 0 0

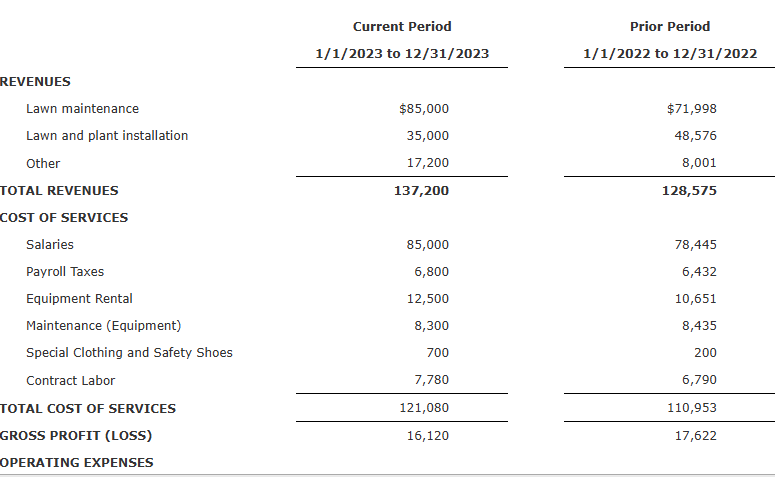

Need help with schedule C

The bookkeeper provided the following additional information:

Donations expense is a $ donation to the Campaign to ReElect Senator Ami Dahla.

Training includes $ for an educational seminar on bug control. It also includes the cost for Russell to attend an online certificate program in landscaping in order to improve his skills and advertise his designation as a certified landscaper. The tuition, fees, and books cost $

No business gift exceeded $ in value.

The subscription is for a trade magazine titled Plants Unlimited.

Meals and entertainment expense is $ of business meals and $ for season tickets to Boise State University that Russell uses to Russell drove his pickup truck purchased business miles in He also drove the truck commuting miles and other miles. The Longs have another car available for personal use. Truck business mileage is not reflected in the income statement.

The business uses the cash method of accounting and has no accounts receivable or inventory held for resale.

In addition to the above expenses, the Longs have set aside one room of their house as a home office. The room is square feet and their house nas a total of square feet. They pay $ per year rental on their house, and the utilities amount to $ for the year.

The Longs inherited a large number of acres of farm land from Linda's father in and sold it immediately for its market value of $ They invested the proceeds in the Potato Dividend High Yield Fund and received Form DIV see separate tab

inda lost her job in late and collected unemployment in as shown on Form G see separate tab

Russell was divorced on April and pays his exspouse, Lois Long SSN alimony of $ per month in

Russell's Social Security number is and Linda's is They made an estimated tax payment to the IRS of $ on December

Required:

Complete the Longs' federal tax return for on Form Schedule Schedule B Schedule C Form and the Qualified Dividends and Capital Gain Tax Worksheet.

Do not complete Form depreciation or Form additional child tax credit You may ignore any related selfemployment taxes. Make realistic assumptions about any missing data.

If required, enter a "loss" as a negative number on the tax form. Do not enter deductions or other amounts as negative numbers.

If an amount box does not require an entry or the answer is zero, enter

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock