Question: Need help with second journal entry. Record to recognize bad debt expense for 2021. Pincus Associates uses the allowance method to account for bad debts.

Need help with second journal entry. Record to recognize bad debt expense for 2021.

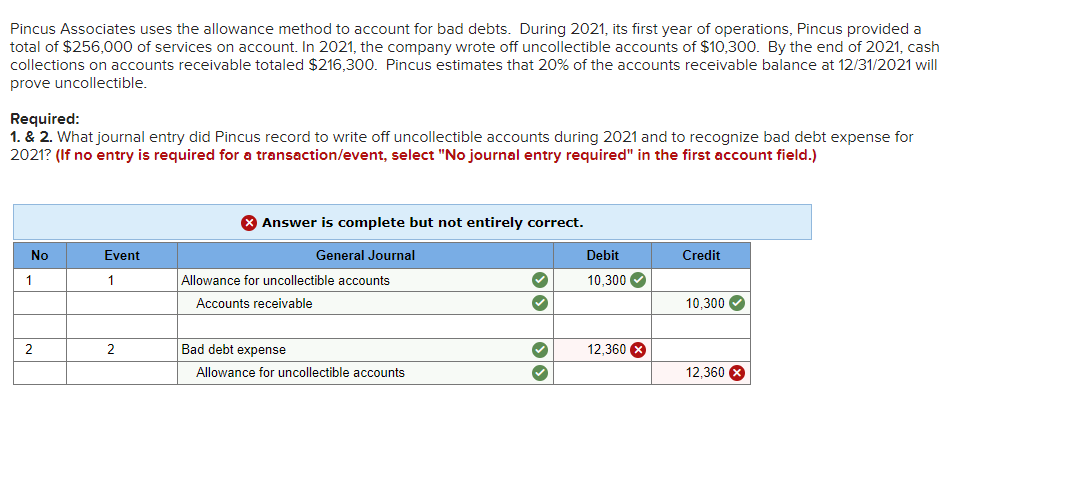

Pincus Associates uses the allowance method to account for bad debts. During 2021, its first year of operations, Pincus provided a total of $256,000 of services on account. In 2021, the company wrote off uncollectible accounts of $10,300. By the end of 2021, cash collections on accounts receivable totaled $216,300. Pincus estimates that 20% of the accounts receivable balance at 12/31/2021 will prove uncollectible. Required: 1. & 2. What journal entry did Pincus record to write off uncollectible accounts during 2021 and to recognize bad debt expense for 2021? (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) Answer is complete but not entirely correct. No Event Debit Credit 1 1 General Journal Allowance for uncollectible accounts Accounts receivable 10,300 oo 10,300 2 2 12,360 X Bad debt expense Allowance for uncollectible accounts 12,360 X

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts