Question: Need help with section d, section f and section h please. Thanks. Liz and John formed the equal LJ Partnership on January 1 of the

Need help with section d, section f and section h please.

Thanks.

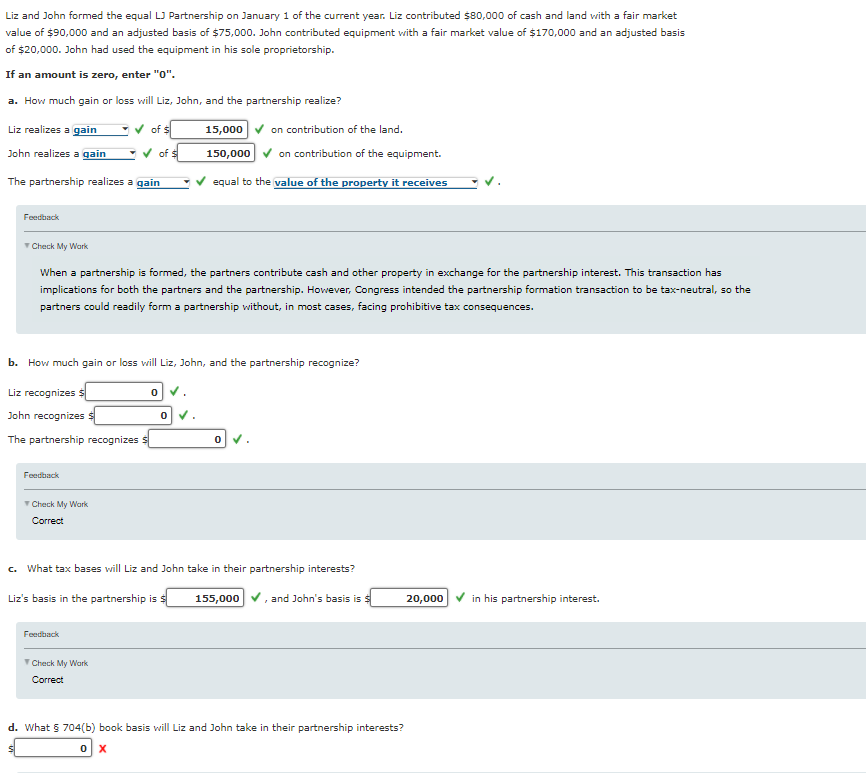

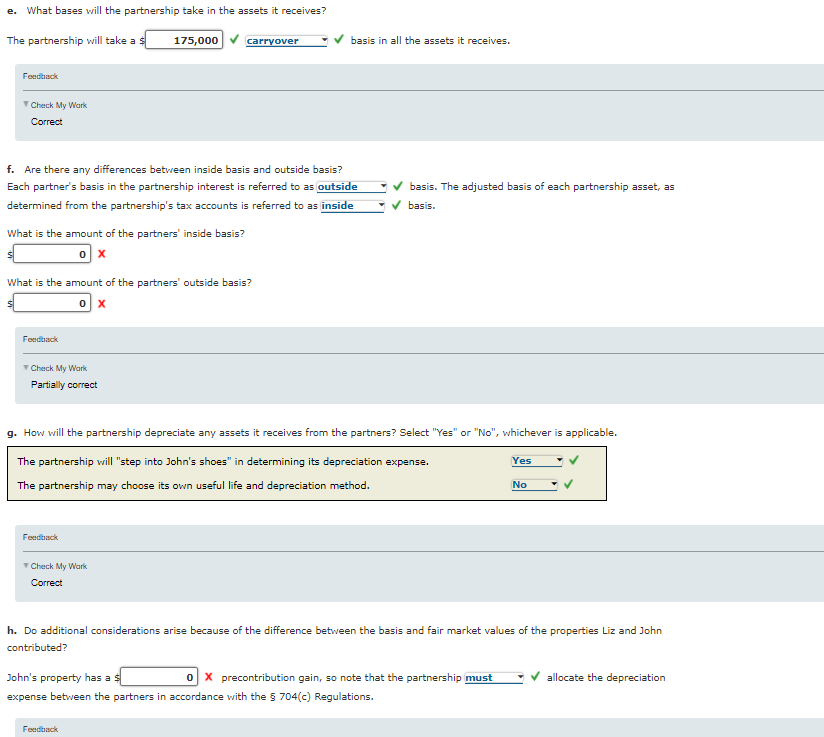

Liz and John formed the equal LJ Partnership on January 1 of the current year. Liz contributed $80,000 of cash and land with a fair market value of $90,000 and an adjusted basis of $75,000. John contributed equipment with a fair market value of $170,000 and an adjusted basis of $20,000. John had used the equipment in his sole proprietorship. If an amount is zero, enter "o". a. How much gain or loss will Liz, John, and the partnership realize? Liz realizes a gain of $ 15,000 on contribution of the land. John realizes a gain of 150,000 on contribution of the equipment. The partnership realizes a gain equal to the value of the property it receives Feedback Check My Work When a partnership is formed, the partners contribute cash and other property in exchange for the partnership interest. This transaction has implications for both the partners and the partnership. However, Congress intended the partnership formation transaction to be tax-neutral, so the partners could readily form a partnership without, in most cases, facing prohibitive tax consequences. b. How much gain or loss will Liz, John, and the partnership recognize? Liz recognizes $1 0 John recognizes s o The partnership recognizes 0 Feedback Check My Work Correct c. What tax bases will Liz and John take in their partnership interests? Liz's basis in the partnership is s 155,000, and John's basis is 20,000 in his partnership interest. Feedback Check My Work Correct d. What $ 704(b) book basis will Liz and John take in their partnership interests? OX e. What bases will the partnership take in the assets it receives? The partnership will take a 175,000 carryover basis in all the assets it receives. Feedback Check My Work Correct basis. The adjusted basis of each partnership asset, as basis. f. Are there any differences between inside basis and outside basis? Each partner's basis in the partnership interest is referred to as outside determined from the partnership's tax accounts is referred to as inside What is the amount of the partners' inside basis? ox What is the amount of the partners' outside basis? ox Feedback Check My Work Partially correct g. How will the partnership depreciate any assets it receives from the partners? Select "Yes" or "No", whichever is applicable. The partnership will "step into John's shoes" in determining its depreciation expense. Yes The partnership may choose its own useful life and depreciation method. No Feedback Check My Work Correct h. Do additional considerations arise because of the difference between the basis and fair market values of the properties Liz and John contributed? allocate the depreciation John's property has a $ o precontribution gain, so note that the partnership must expense between the partners in accordance with the $ 704(c) Regulations. Feedback

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts