Question: need help with steps on hoe to find this! need steps on how to find this Record journal entries for these transactions assuming Garcia follows

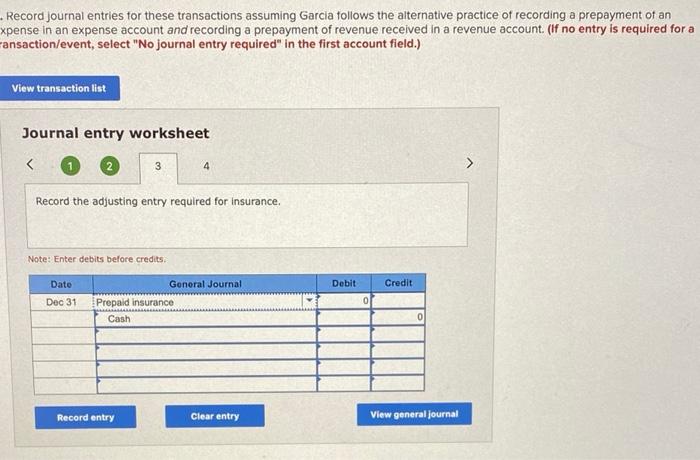

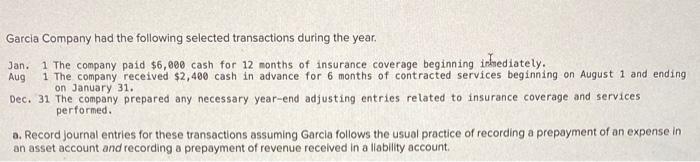

Record journal entries for these transactions assuming Garcia follows the alternative practice of recording a prepayment of an kense in an expense account and recording a prepayment of revenue received in a revenue account. (If no entry is required for a ansaction/event, select "No journal entry required" in the first account field.) Journal entry worksheet Record the adjusting entry required for insurance. Note: Enter debits before credits. Garcia Company had the following selected transactions during the year. Jan. 1 The company paid $6,000 cash for 12 months of insurance coverage beginning intinediately. Aug 1 The company received $2,400 cash in advance for 6 months of contracted services beginning on August 1 and ending on January 31. Dec. 31 The company prepared any necessary year-end adjusting entries related to insurance coverage and services performed. a. Record Journal entries for these transactions assuming Garcla follows the usual practice of recording a prepayment of an expense in an asset account and recording a prepayment of revenue recelved in a llability account

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts