Question: Need help with Tax problems. Understanding taxes In general, is the U.S. federal tax system progressive or regressive? O Progressive Regressive You bought 1,000 shares

Need help with Tax problems.

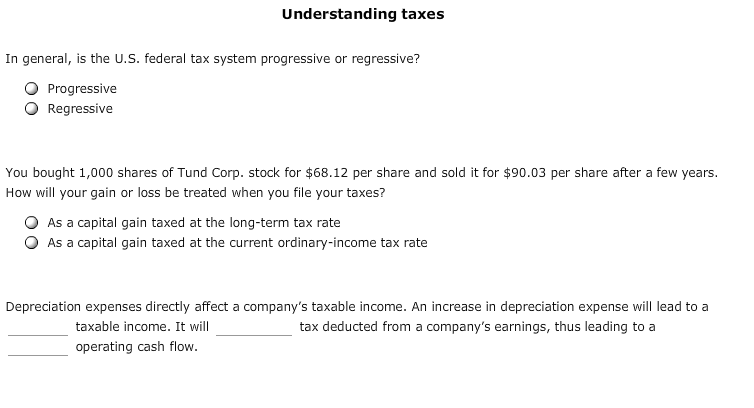

Understanding taxes In general, is the U.S. federal tax system progressive or regressive? O Progressive Regressive You bought 1,000 shares of Tund Corp. stock for $68.12 per share and sold it for $90.03 per share after a few years How will your gain or loss be treated when you file your taxes? O As a capital gain taxed at the long-term tax rate O As a capital gain taxed at the current ordinary-income tax rate Depreciation expenses directly affect a company's taxable income. An increase in depreciation expense will lead to a taxable income. It will tax deducted from a company's earnings, thus leading to a operating cash flow

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts