Question: Need help with the above 2 questions. please show all work and calculations to get the answers. Thank you QS 15-11 Investment in associate-equity method

Need help with the above 2 questions. please show all work and calculations to get the answers. Thank you

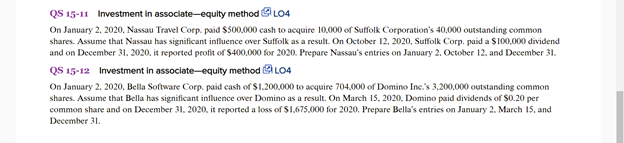

QS 15-11 Investment in associate-equity method L04 On January 2. 2020. Nassau Travel Corp. paid $500,000 cash to acquire 10,000 of Suffolk Corporation's 40,000 outstanding common shares. Assume that Nassau has significant influence over Suffolk as a result. On October 12, 2020, Suffolk Corp. paid a $100.000 dividend and on December 31, 2020. it reported profit of $400,000 for 2020. Prepare Nassau's entries on January 2. October 12. and December 31 QS 15-12 Investment in associate-equity method L04 On January 2.2020. Bella Software Corp paid cash or $1.200,000 to acquire 704,000 of Domino Inc.'s 3.200,000 outstanding common shares. Assume that Bella has significant influence over Domino as a result. On March 15, 2020. Domino paid dividends of $0.20 per common share and on December 31, 2020. it reported a loss of $1.675.000 for 2020. Prepare Bella's entries on January 2. March 15, and December 31

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts