Question: need help with the attachments below 1 points Skipped eBook le'it Print Assume a corporation has earnings before depreciation and taxes of $111,000, depreciation of

need help with the attachments below

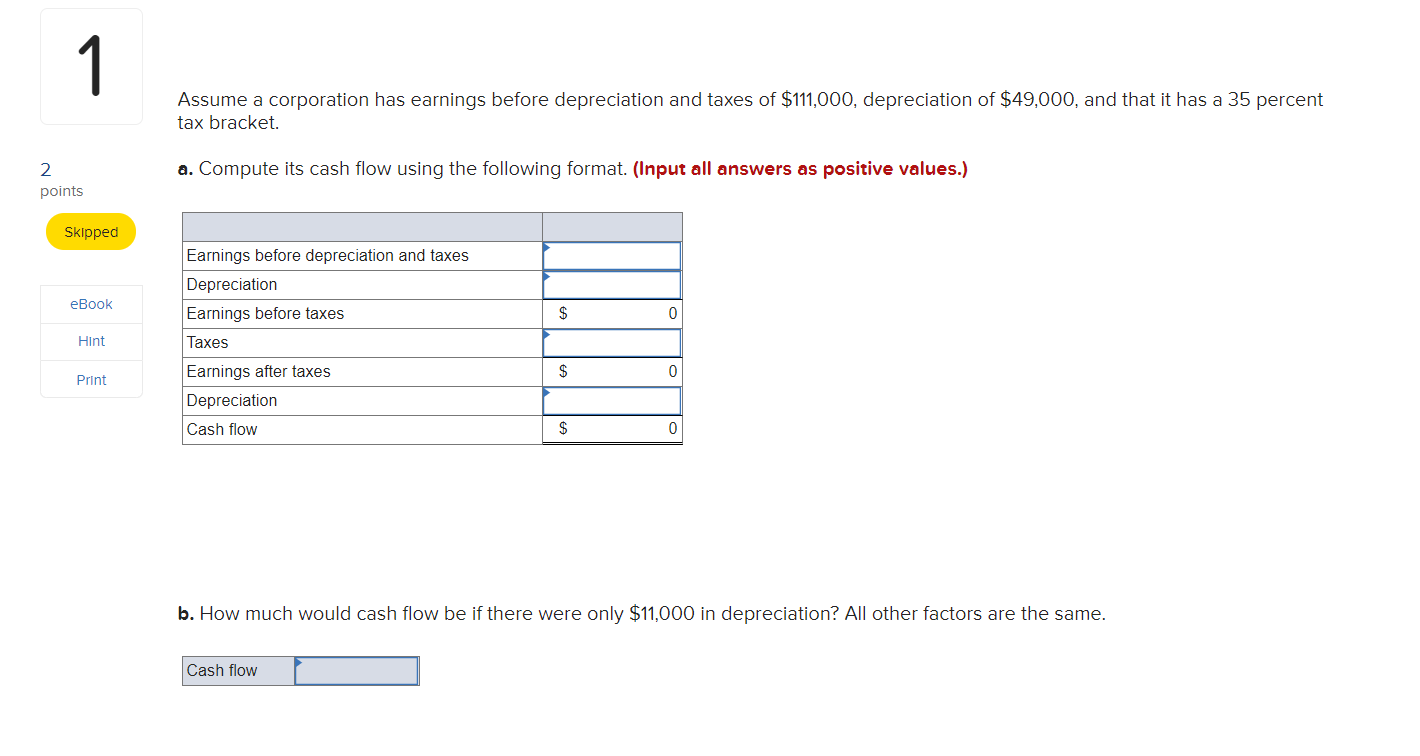

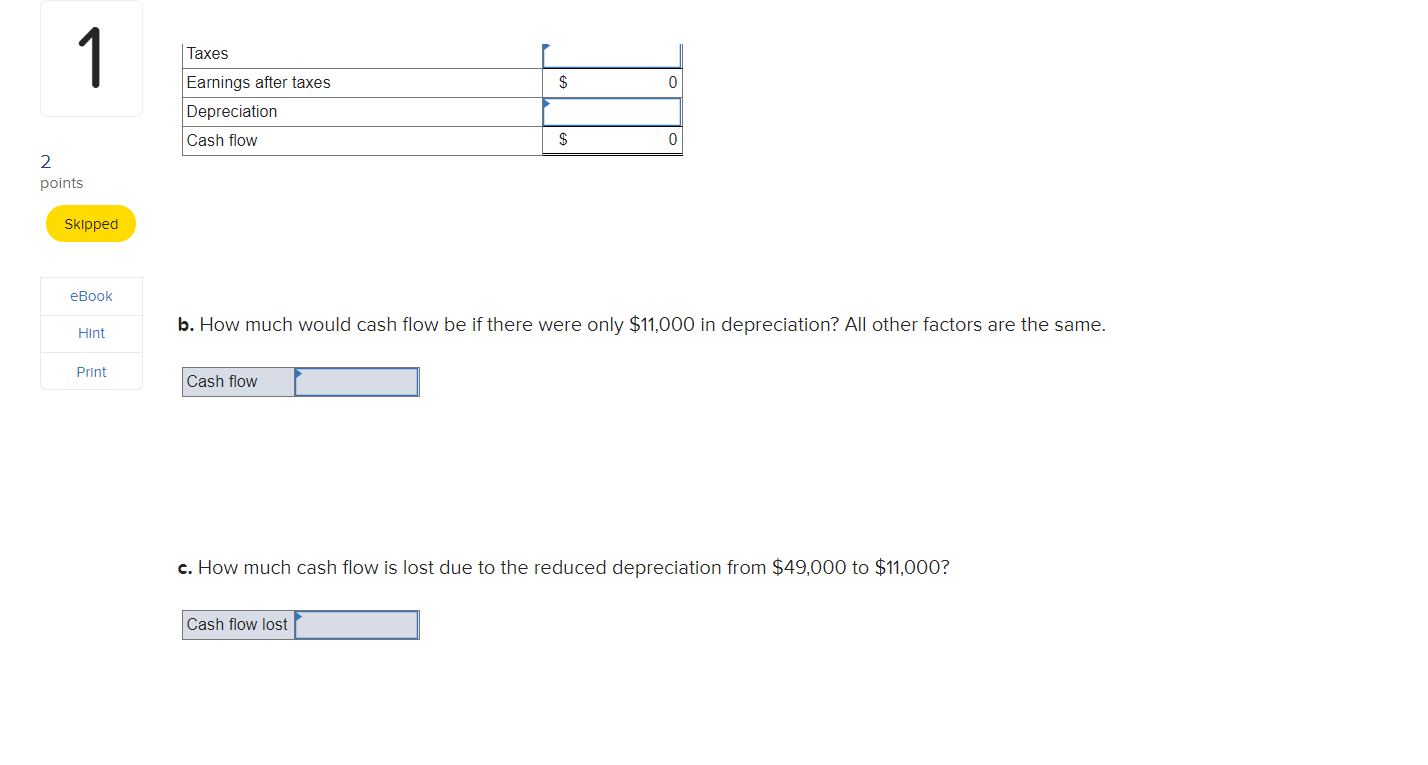

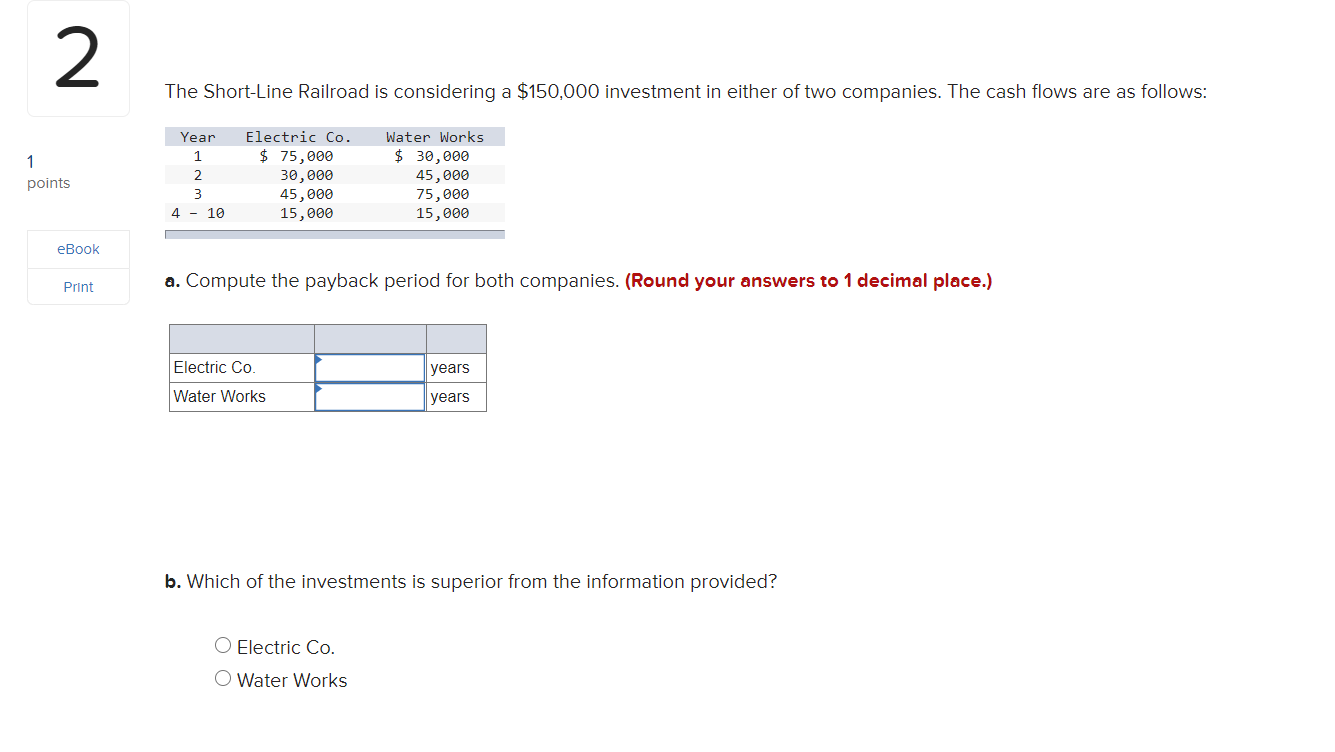

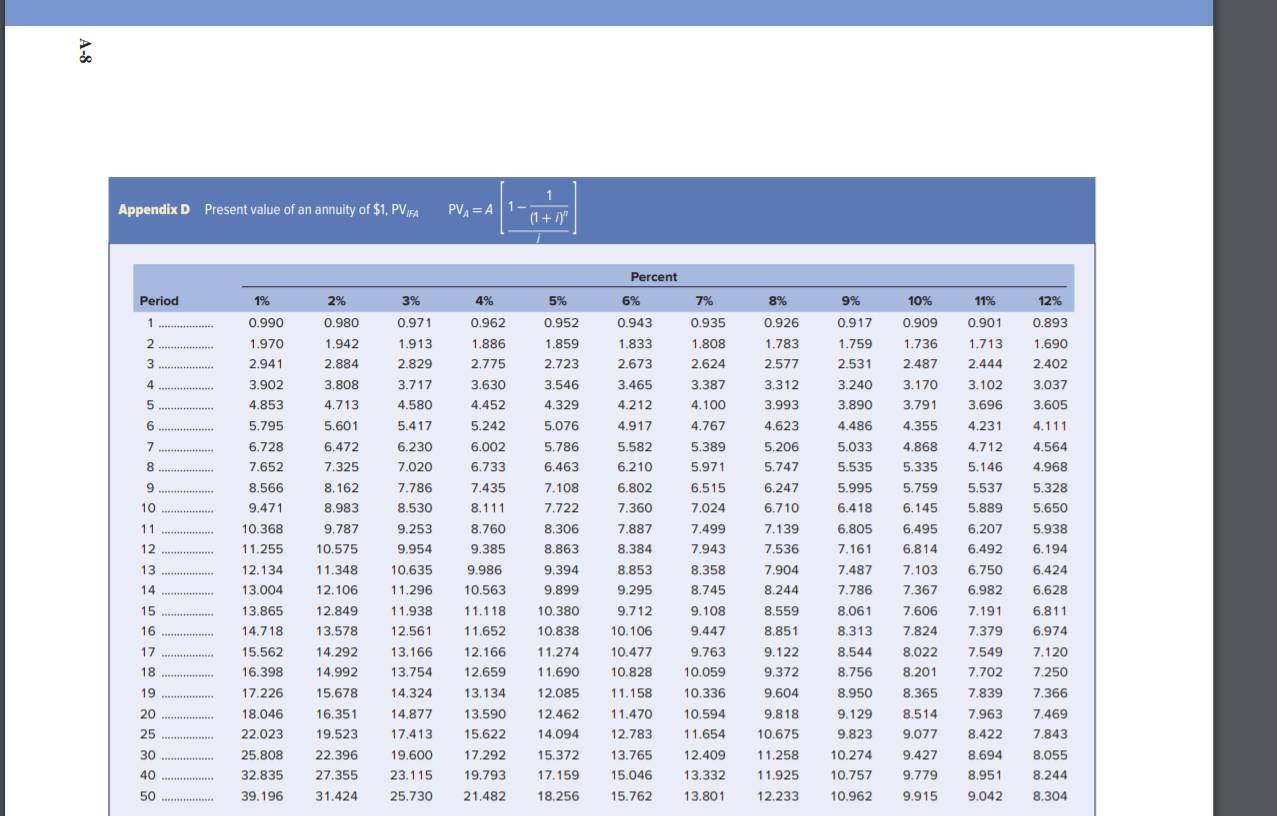

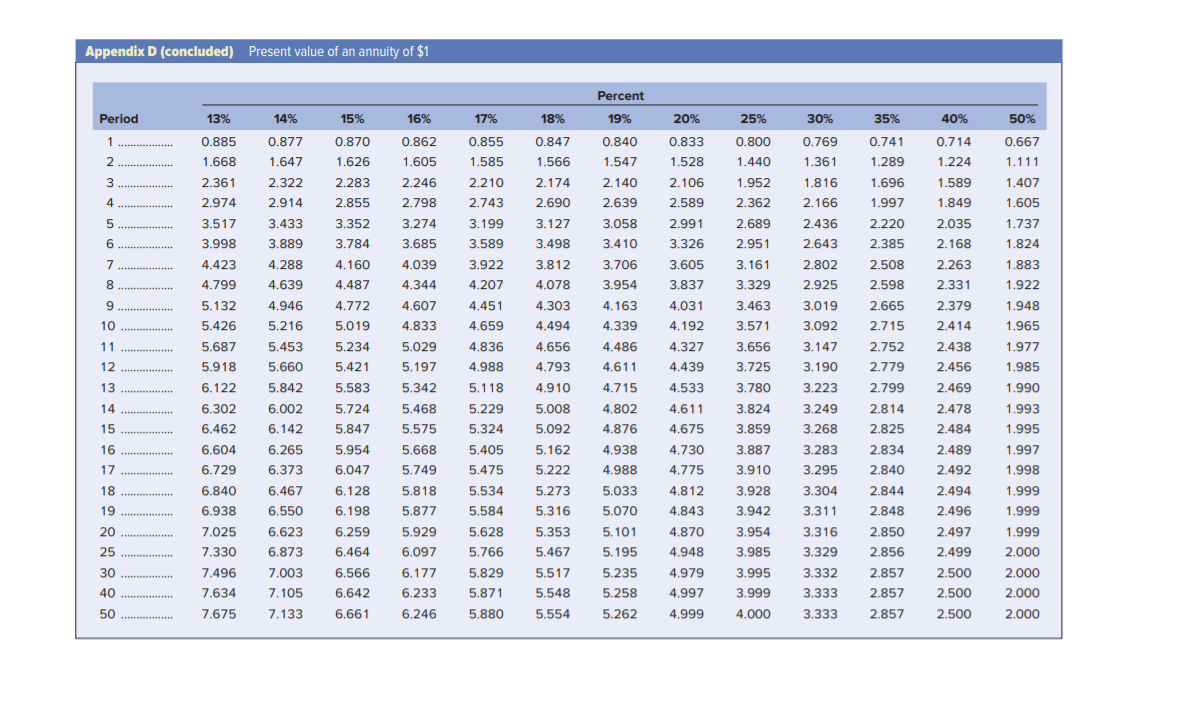

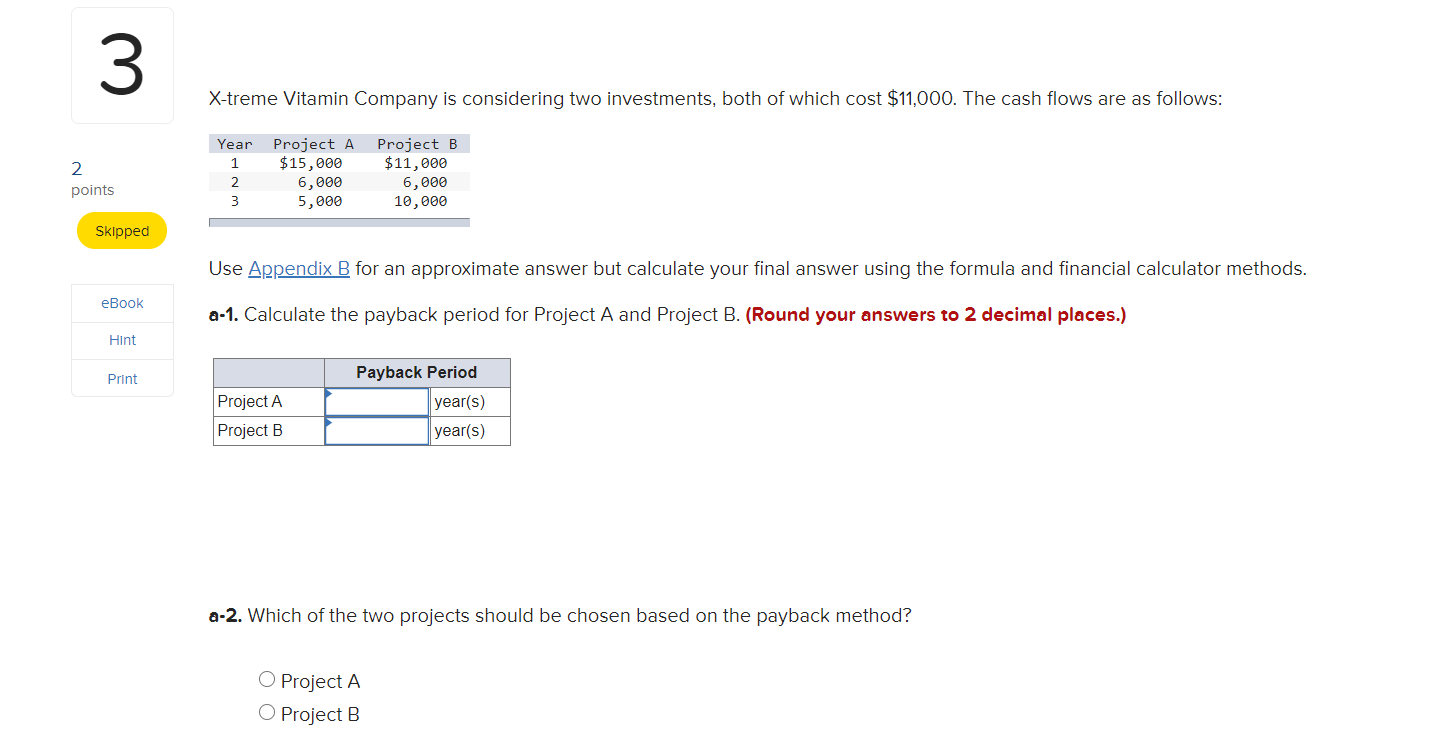

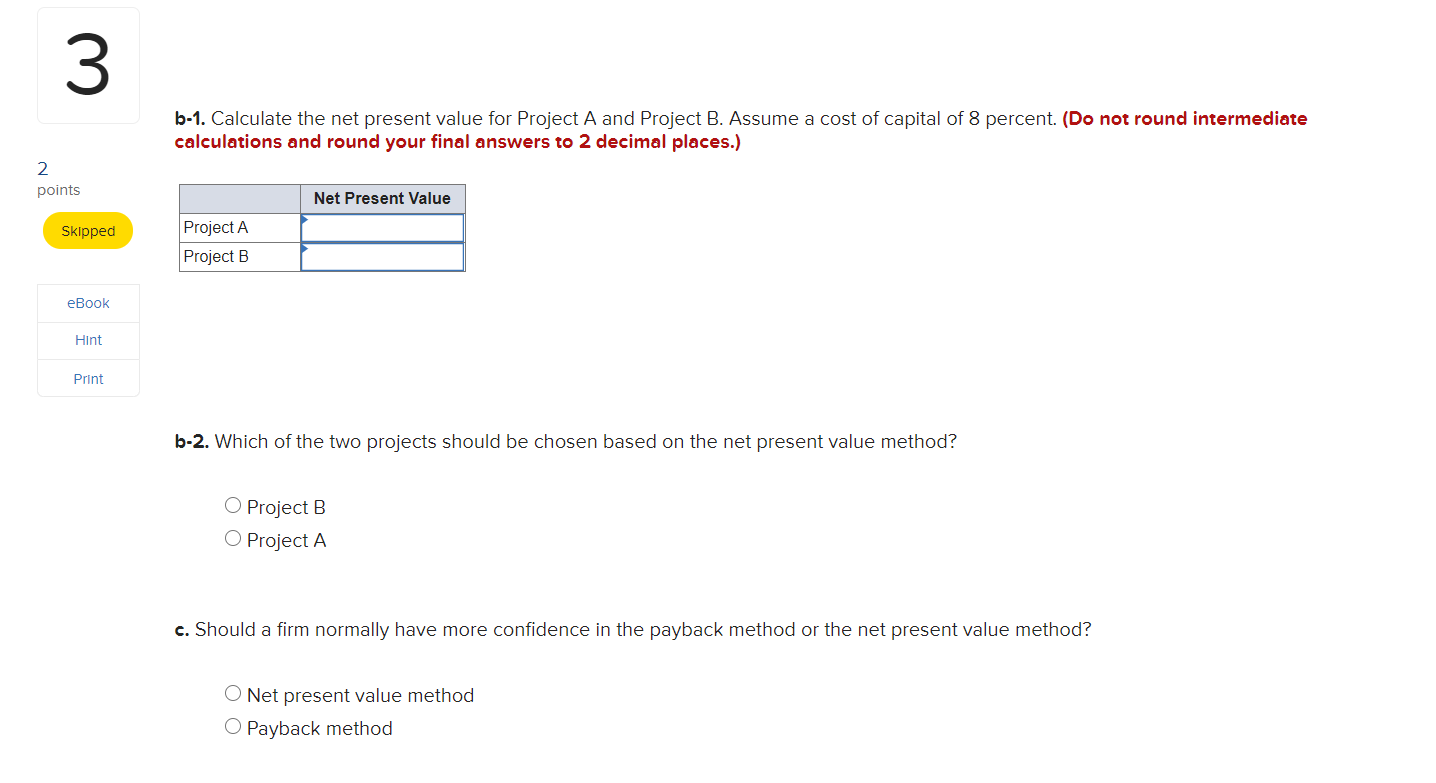

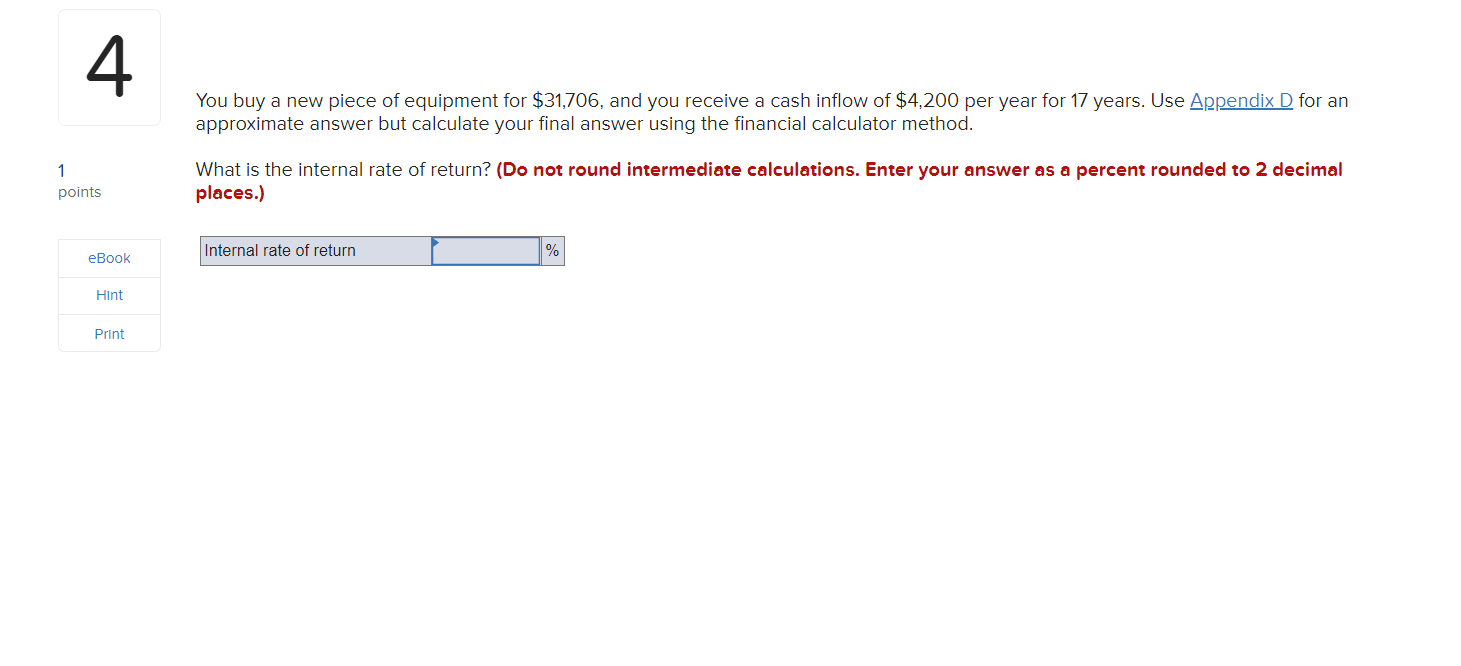

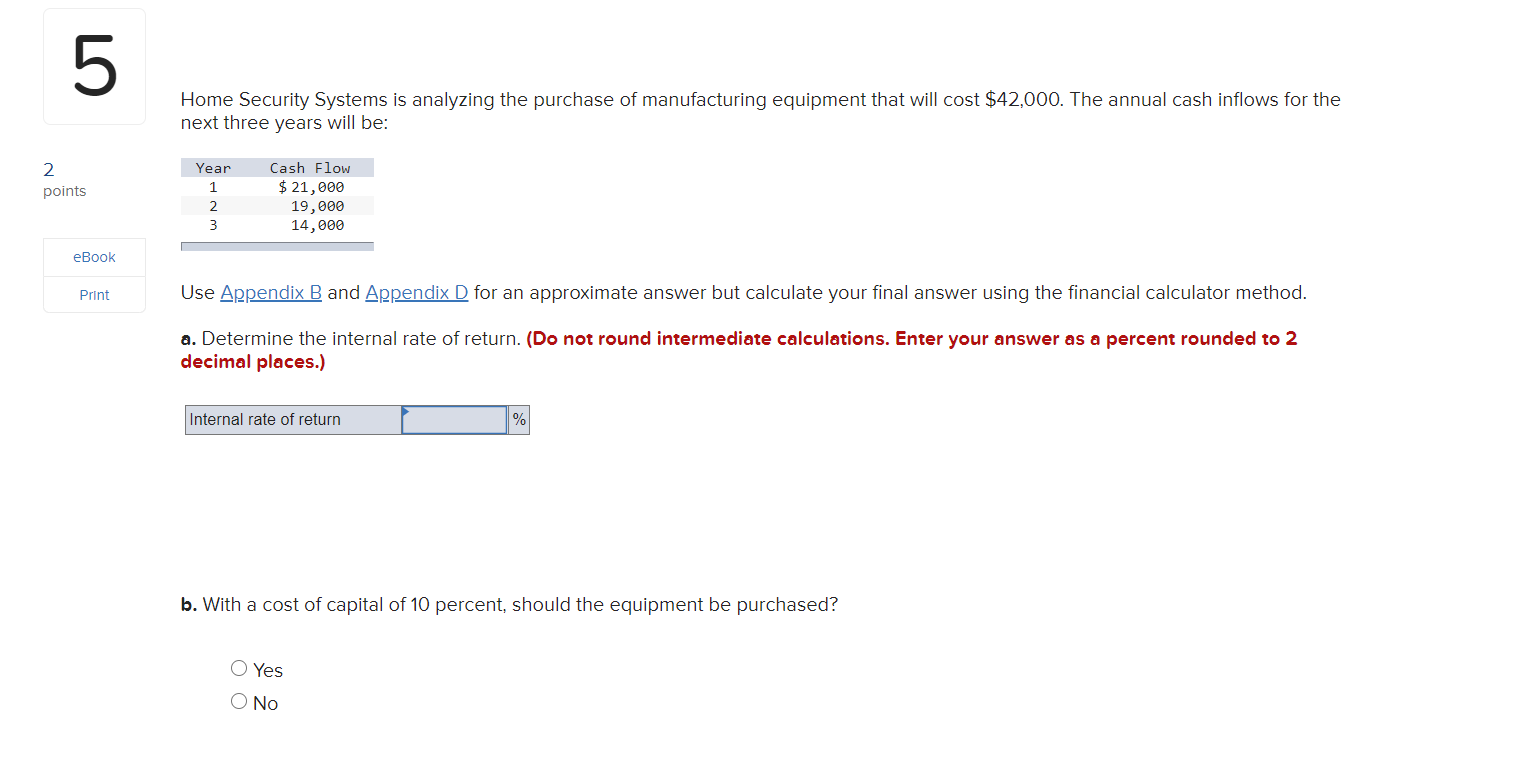

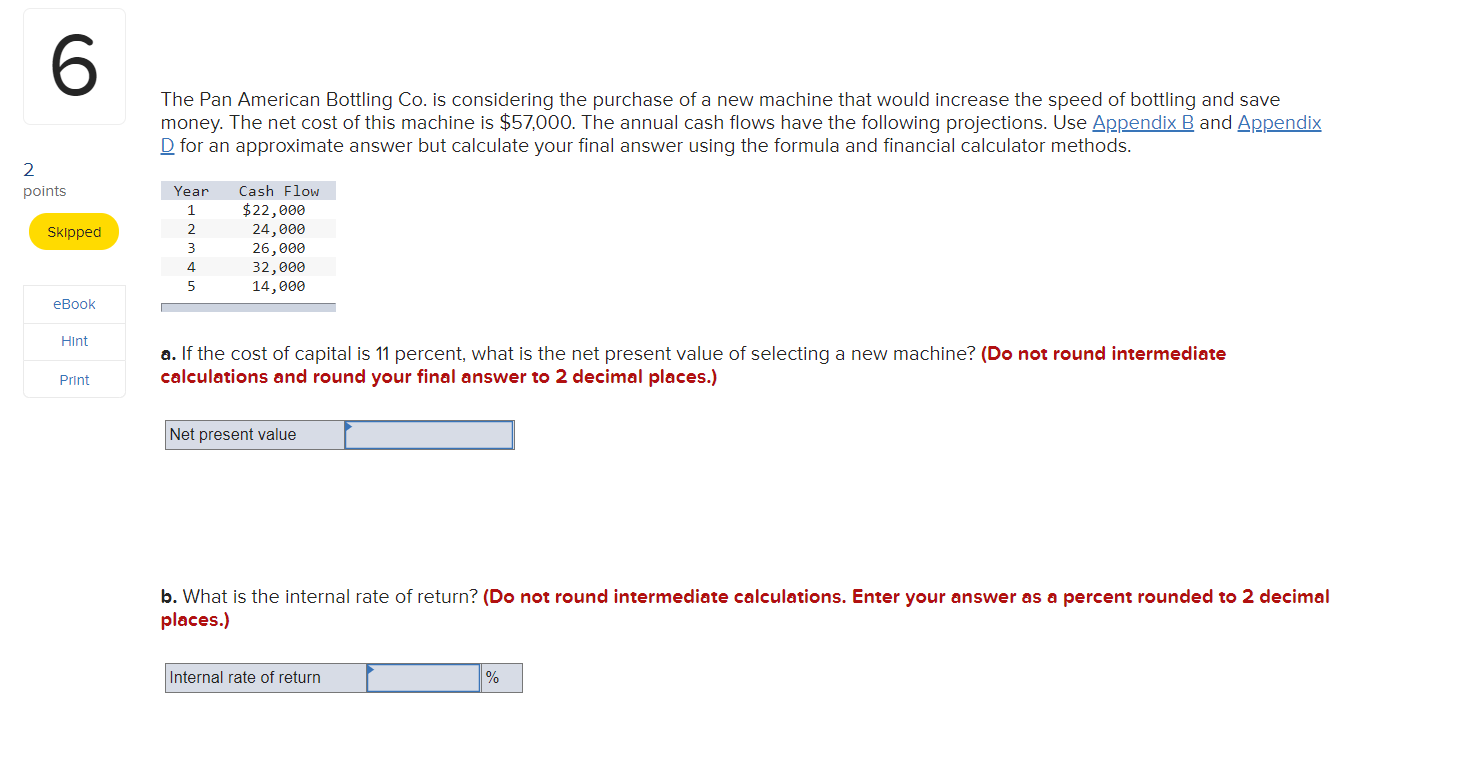

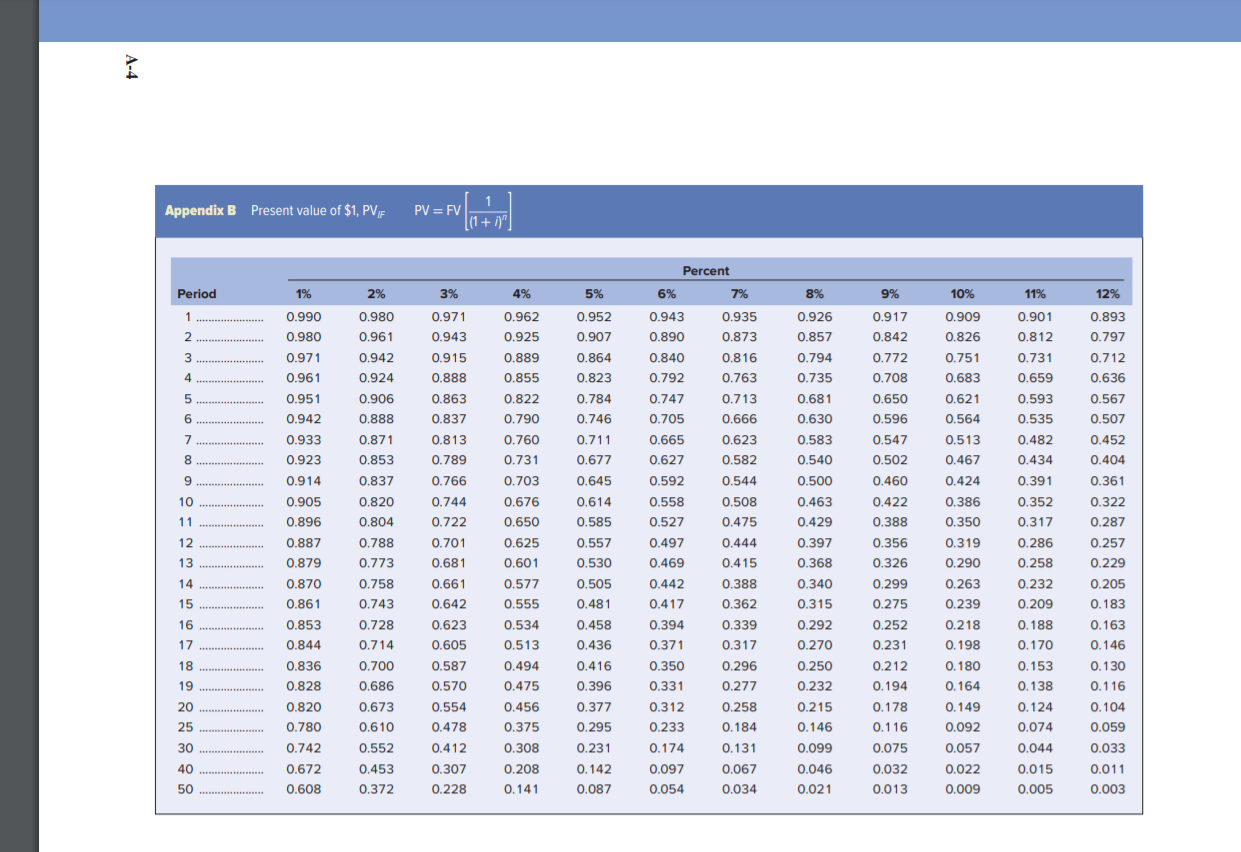

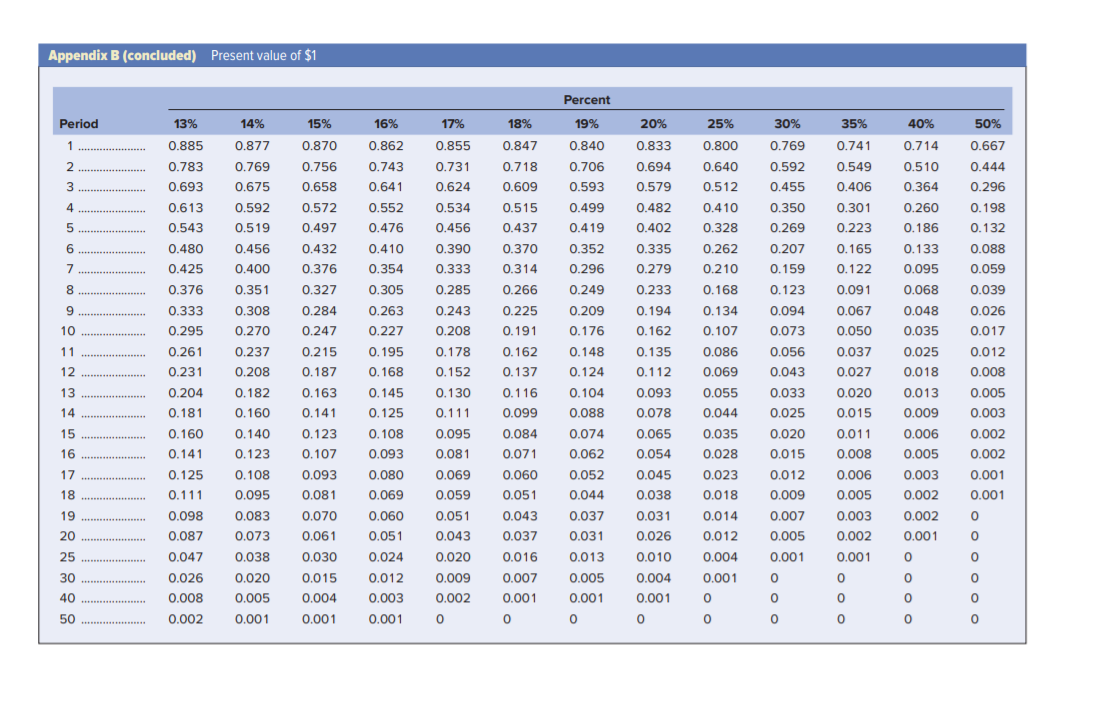

1 points Skipped eBook le'it Print Assume a corporation has earnings before depreciation and taxes of $111,000, depreciation of $49,000, and that it has a 35 percent tax bracket. a. Compute its cash ow using the following format. {Input all answers as positive values.) Earnings before depreciation and taxes Depreciation Earnings before taxes $ 0 Taxes I Earnings aer taxes $ 0 Depreciation : Cash ow $ 0 b. How much would cash ow be if there were only $11,000 in depreciation? All other factors are the same. m Taxes Earnings after taxes $ Depreciation Cash flow 0 2 points Skipped eBook Hint b. How much would cash flow be if there were only $11,000 in depreciation? All other factors are the same. Print Cash flow c. How much cash flow is lost due to the reduced depreciation from $49,000 to $11,000? Cash flow lostpoints EBOOK Print The ShortLine Railroad is considering a $150,000 investment in either of two companies. The cash flows are as follows: Year Electric Co. Water Works 1 $ 75,333 $ 33,3I3 2 33,333 45,333 3 45,339 75,333 4 7 1'3 15,999 15,999 3. Compute the payback period for both companies. (Round your answers to 1 decimal place.) Electric 00. Water Works years years b. Which ofthe investments is superior from the information provided? 0 Electric Co. 0 Water Works A-8 Appendix D Present value of an annuity of $1, PV IFA PVA = A 1- (1+ i)" Percent Period 1% 2% 3% 4% 5% 6% 7% 8% 9% 10% 11% 12% 0.990 0.980 0.971 0.962 0.952 0.943 0.935 0.926 0.917 0.909 0.901 0.893 1.970 1.942 1.913 1.886 1.859 1.833 1.808 1.783 1.759 1.736 1.713 1.690 3 .. 2.941 2.884 2.829 2.775 2.723 2.673 2.624 2.577 2.531 2.487 2.444 2.402 3.902 3.808 3.717 3.630 3.546 3.465 3.387 3.312 3.240 3.170 3.102 3.037 4.............. 4.853 4.713 4.580 4.452 4.329 4.212 4.100 3.993 3.890 3.791 3.696 3.605 5.795 5.601 5.417 5.242 5.076 4.917 4.767 4.623 4.486 4.355 4.231 4.111 6.728 6.472 6.230 6.002 5.786 5.582 5.389 5.206 5.033 4.868 4.712 4.564 7.652 7.325 7.020 6.733 6.463 6.210 5.971 5.747 5.535 5.335 5.146 4.968 8.566 8.162 7.786 7.435 7.108 6.802 6.515 6.247 5.995 5.759 5.537 5.328 10 9.471 8.983 8.530 8. 111 7.722 7.360 7.024 6.710 6.418 6.145 5.889 5.650 11 10.368 9.787 9.253 8.760 8.306 7.887 7.499 7.139 6.805 6.495 6.207 5.938 6.194 12 ...... 11.255 10.575 9.954 9.385 8.863 8.384 7.943 7.536 7.161 6.814 6.492 13 ..... 12.134 11.348 10.635 9.986 9.394 8.853 8.358 7.904 7.487 7.103 6.750 6.424 14 . 13.004 12. 106 11.296 10.563 9.899 9.295 8.745 8.244 7.786 7.367 6.982 6.628 13.865 12.849 11.938 11.118 10.380 9.712 9.108 8.559 8.061 7.606 7.191 6.811 16 14.718 13.578 12.561 11.652 10.838 10.106 9.447 8.851 8.313 7.824 7.379 6.974 17 15.562 14.292 13.166 12.166 1 1.274 10.477 9.763 9.122 8.544 8.022 7.549 7.120 18 ...... 16.398 14.992 13.754 12.659 11.690 10.828 10.059 9.372 8.756 8.201 7.702 7.250 17.226 15.678 14.324 13.134 12.085 11.158 10.336 9.604 8.950 8.365 7.839 7.366 20 2.. 18.046 16.351 14.877 13.590 12.462 11.470 10.594 9.818 9.129 8.514 7.963 7.469 25 . 22.023 19.523 17.413 15.622 14.094 12.783 11.654 10.675 9.823 9.077 8.422 7.843 30 25.808 22.396 19.600 17.292 15.372 13.765 12.409 11.258 10.274 9.427 8.694 8.055 40 32.835 27.355 23.115 19.793 17.159 15.046 13.332 11.925 10.757 9.779 8.951 8.244 50 39.196 31.424 25.730 21.482 18.256 15.762 13.801 12.233 10.962 9.915 9.042 8.304\fXtreme Vitamin Company is considering two investments, both of which cost $11,000. The cash flows are as follows: Year- Project A Project B 2 1 $15,333 $11,333 mm 2 6,333 6,333 p 3 5,333 13,333 skipped Use Appendix B for an approximate answer but calculate your final answer using the formula and financial calculator methods. 3 k . e no 3-1. Calculate the payback period for Project A and Project B. (Round your answers to 2 decimal places.) Hint an Payback Period Project A year(s) Project a yeariSD 3-2. Which of the two projects should be chosen based on the payback method? 0 Project A 0 Project B 3 b-1. Calculate the net present value for Project A and Project B. Assume a cost of capital of 8 percent. (Do not round intermediate calculations and round your final answers to 2 decimal places.) 2 points Net Present Value Skipped Project A Project B eBook Hint Print b-2. Which of the two projects should be chosen based on the net present value method? O Project B O Project A c. Should a firm normally have more confidence in the payback method or the net present value method? O Net present value method O Payback methodA You buy a new piece of equipment for $31,706, and you receive a cash inflow of $4,200 per year for 17 years. Use Appendix D for an approximate answer but calculate your final answer using the financial calculator method. 1 What is the internal rate of return? (Do not round intermediate calculations. Enter your answer as a percent rounded to 2 decimal points places.) eBook Internal rate of return Hint Print5 Home Security Systems is analyzing the purchase of manufacturing equipment that will cost $42,000. The annual cash inflows for the next three years will be: 2 Year Cash Flow points 1 $ 21, 000 IN 19, 000 14, 000 eBook Print Use Appendix B and Appendix D for an approximate answer but calculate your final answer using the financial calculator method. a. Determine the internal rate of return. (Do not round intermediate calculations. Enter your answer as a percent rounded to 2 decimal places.) Internal rate of return % b. With a cost of capital of 10 percent, should the equipment be purchased? O Yes O No6 The Pan American Bottling Co. is considering the purchase of a new machine that would increase the speed of bottling and save money. The net cost of this machine is $57,000. The annual cash flows have the following projections. Use Appendix B and Appendix D for an approximate answer but calculate your final answer using the formula and financial calculator methods. 2 points Year Cash Flow 1 $22,000 Skipped N 24,000 26, 000 32,000 14, 000 eBook Hint a. If the cost of capital is 11 percent, what is the net present value of selecting a new machine? (Do not round intermediate Print calculations and round your final answer to 2 decimal places.) Net present value b. What is the internal rate of return? (Do not round intermediate calculations. Enter your answer as a percent rounded to 2 decimal places.) Internal rate of return\f\f

Step by Step Solution

There are 3 Steps involved in it

Lets tackle each part of the problem stepbystep 1 Cash Flow Calculation a Compute Cash Flow with 49000 Depreciation 1 Earnings before depreciation and ... View full answer

Get step-by-step solutions from verified subject matter experts