Question: need help with the attachments below Table 12-11 Categories for depreciation write-off Class 3-year MACRS All property with ADR midpoints of four years or less.

need help with the attachments below

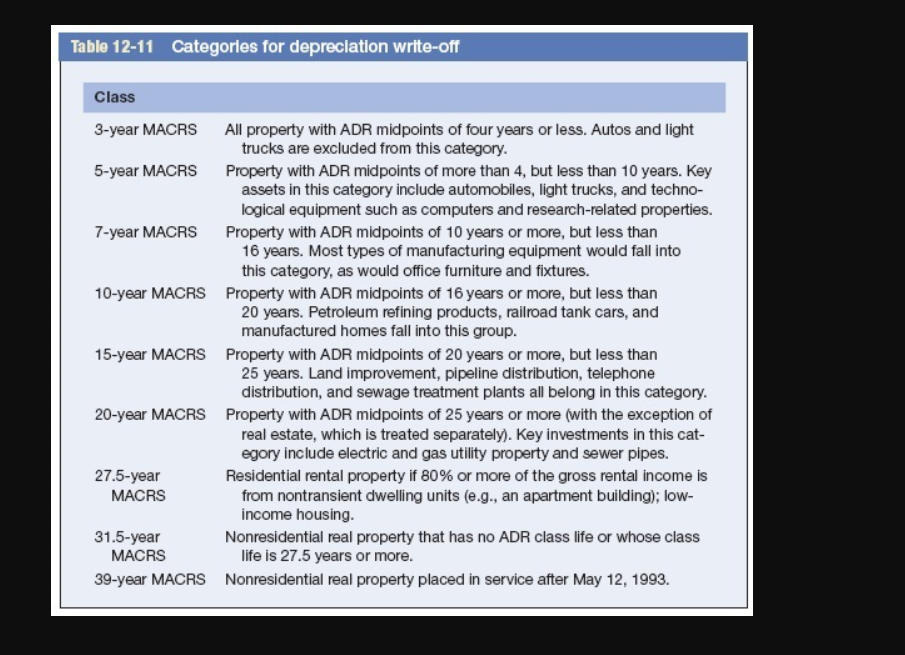

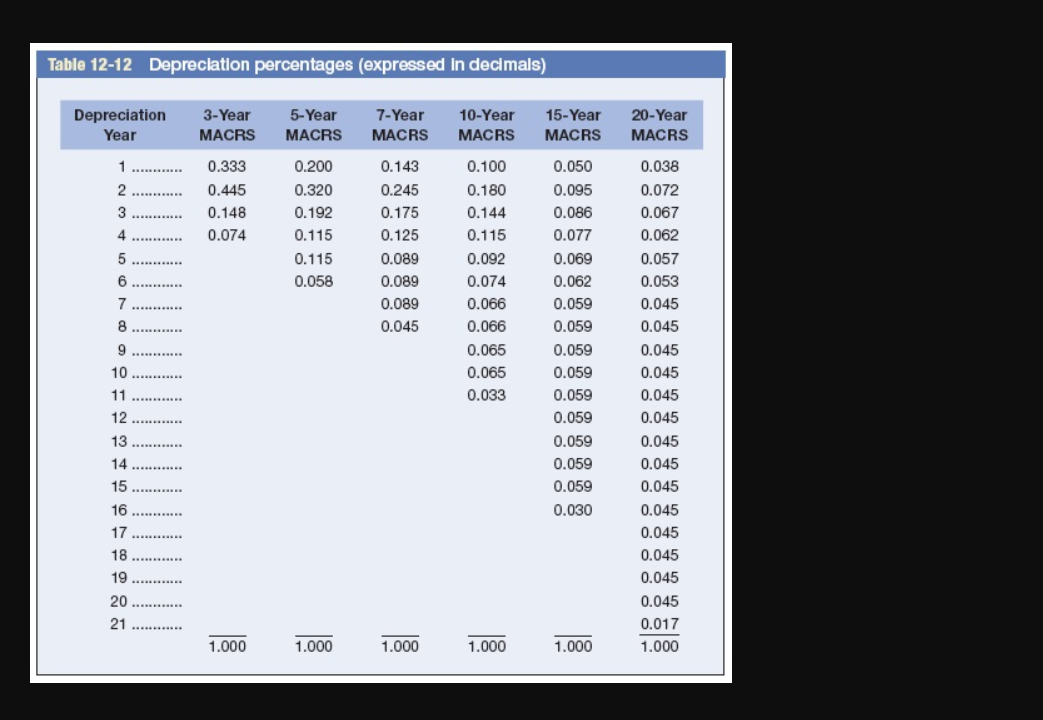

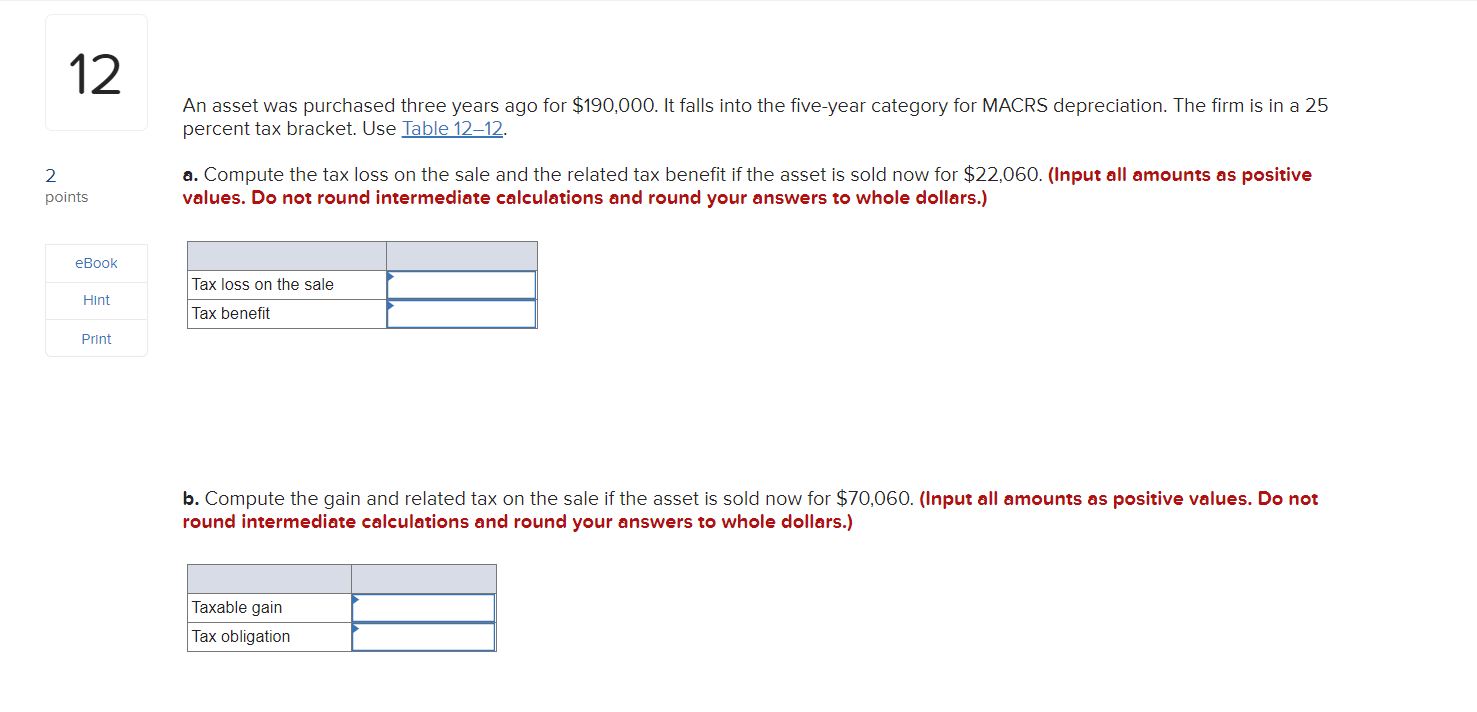

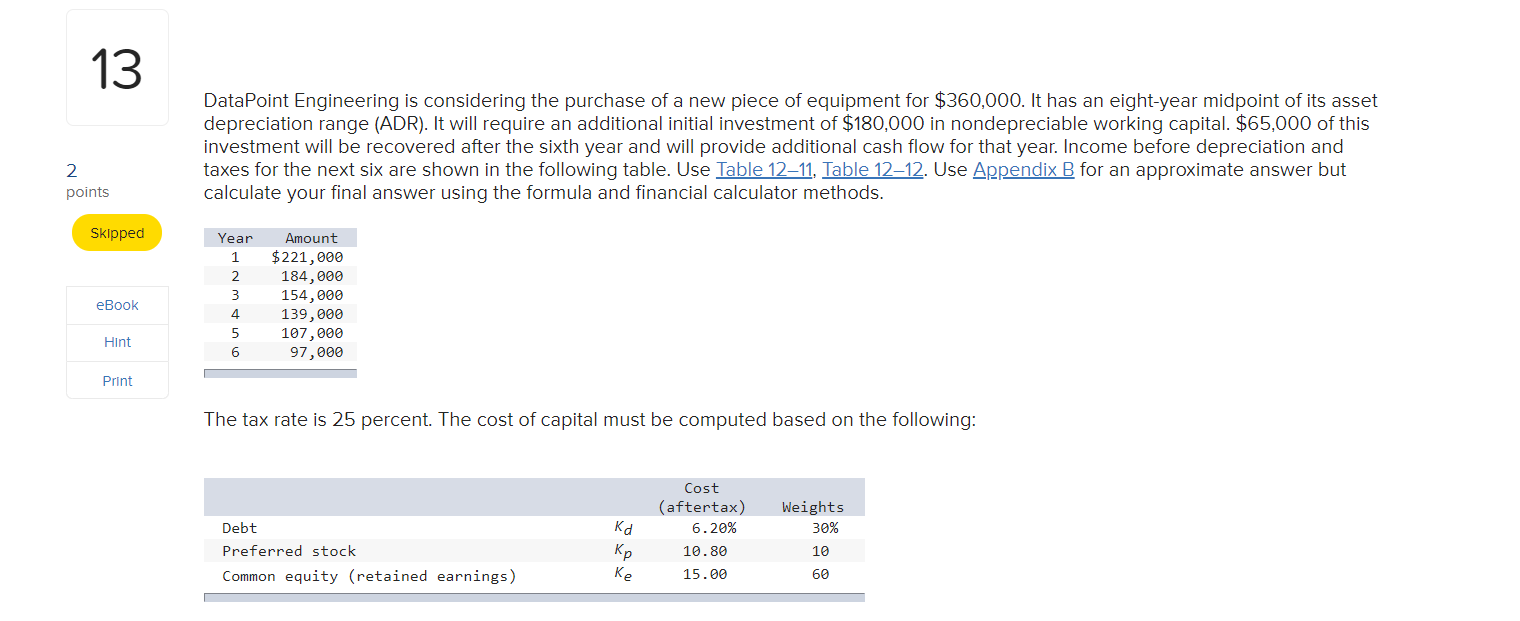

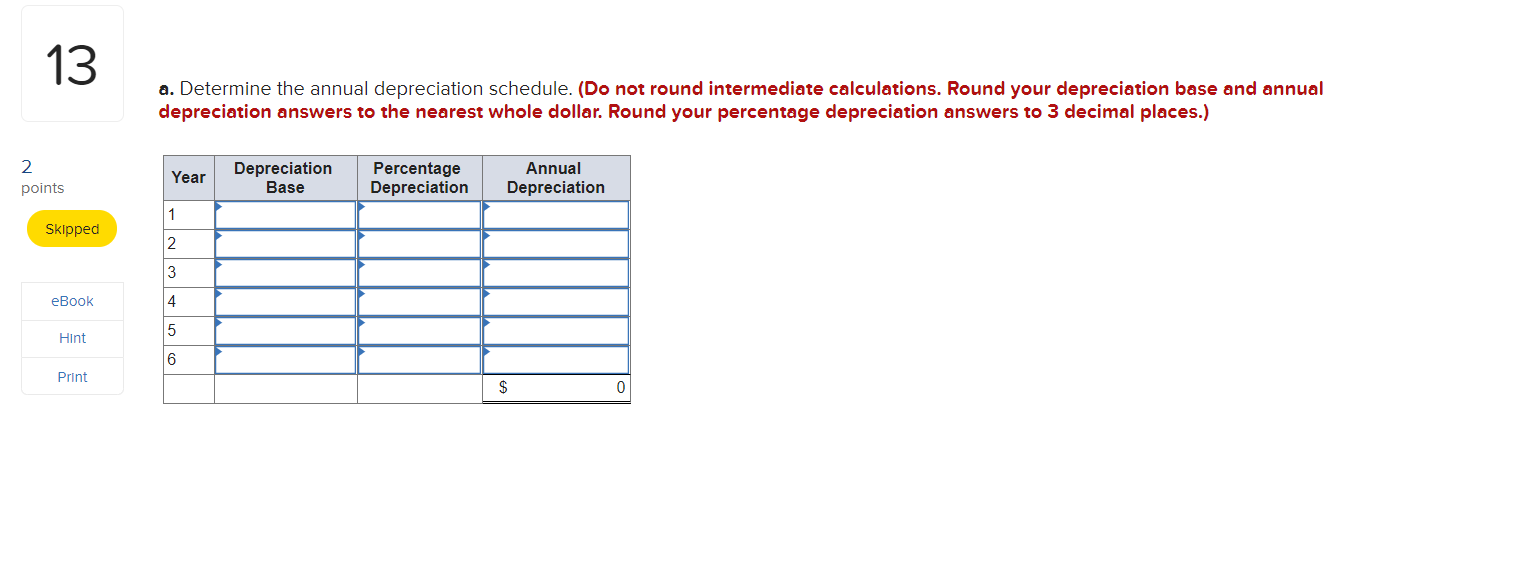

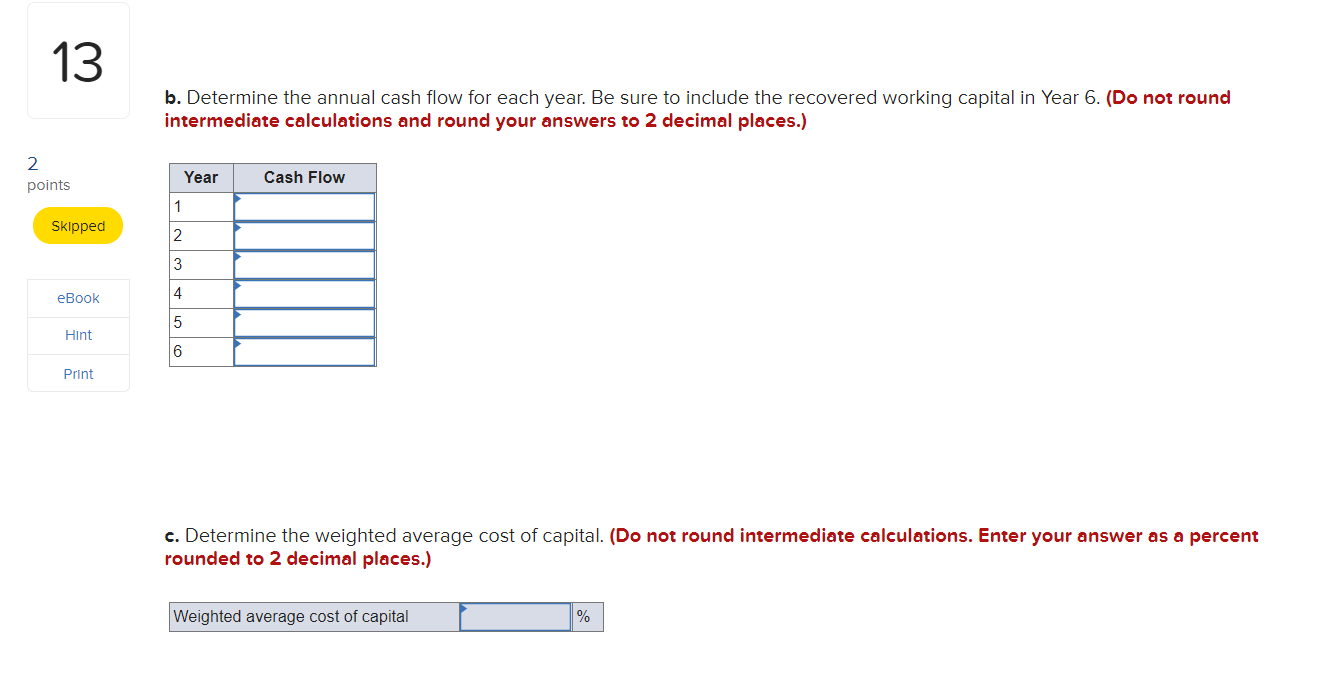

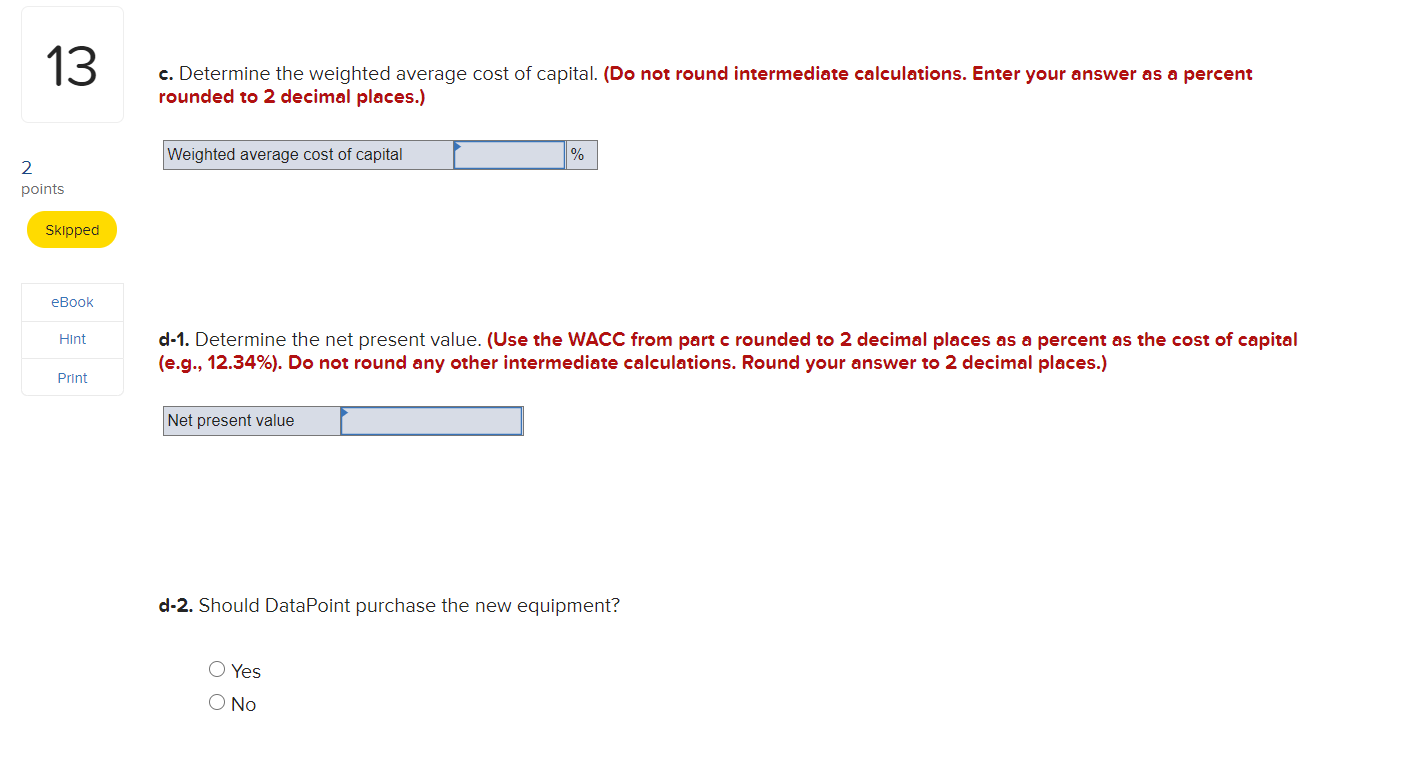

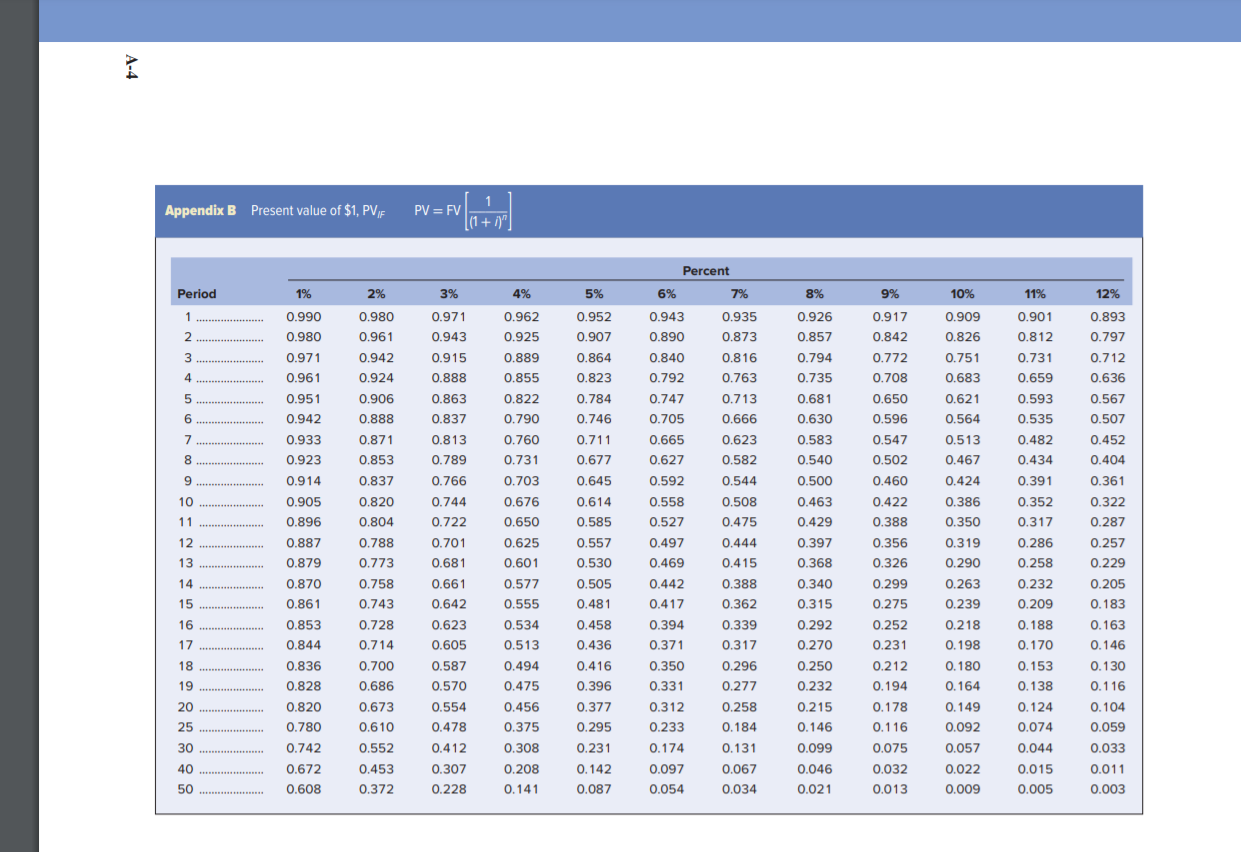

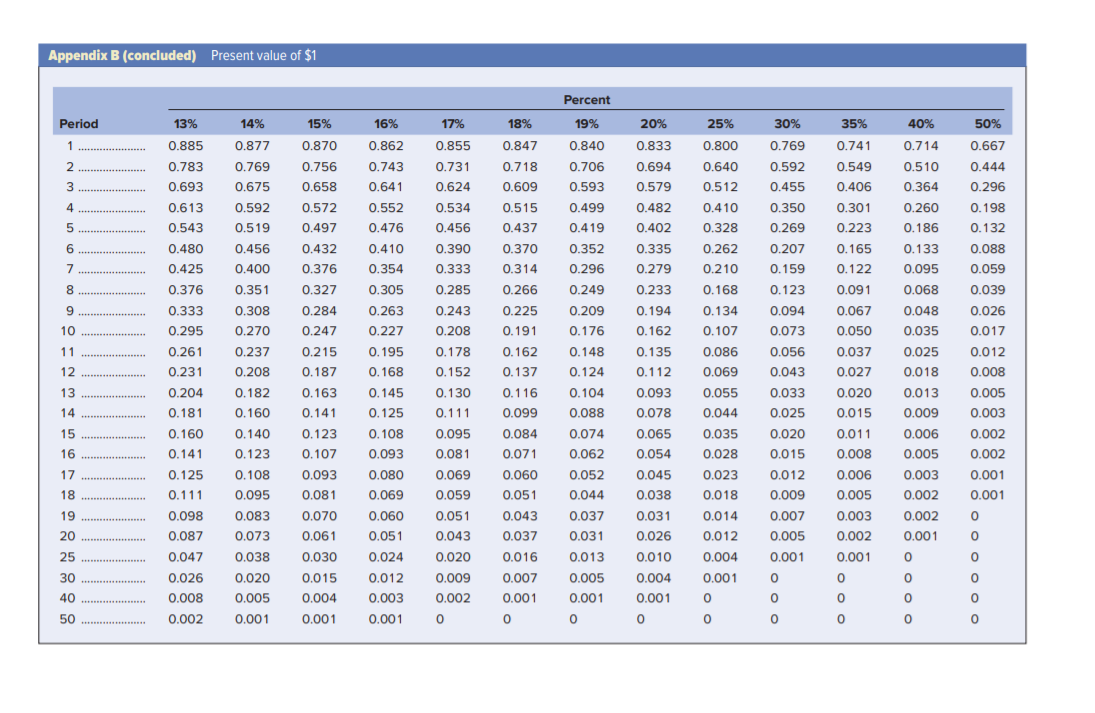

Table 12-11 Categories for depreciation write-off Class 3-year MACRS All property with ADR midpoints of four years or less. Autos and light trucks are excluded from this category. 5-year MACRS Property with ADR midpoints of more than 4, but less than 10 years. Key assets in this category include automobiles, light trucks, and techno- logical equipment such as computers and research-related properties. 7-year MACRS Property with ADR midpoints of 10 years or more, but less than 16 years. Most types of manufacturing equipment would fall into this category, as would office furniture and fixtures. 10-year MACRS Property with ADR midpoints of 16 years or more, but less than 20 years. Petroleum refining products, railroad tank cars, and manufactured homes fall into this group. 15-year MACRS Property with ADR midpoints of 20 years or more, but less than 25 years. Land improvement, pipeline distribution, telephone distribution, and sewage treatment plants all belong in this category. 20-year MACRS Property with ADR midpoints of 25 years or more (with the exception of real estate, which is treated separately). Key investments in this cat- egory include electric and gas utility property and sewer pipes 27.5-year Residential rental property if 80% or more of the gross rental income is MACRS from nontransient dwelling units (e.g., an apartment building); low- income housing. 31.5-year Nonresidential real property that has no ADR class life or whose class MACRS life is 27.5 years or more. 39-year MACRS Nonresidential real property placed in service after May 12, 1993.Table 12-12 Depreciation percentages (expressed In decimals) Depreciation 3-Year 5-Year 7-Year 10-Year 15-Year 20-Year Year MACRS MACRS MACRS MACRS MACRS MACRS 0.333 0.200 0.143 0.100 0.050 0.038 0.445 0.320 0.245 0.180 0.095 0.072 3 0.148 0.192 0.175 0.144 0.086 0.067 4... .. 0.074 0.115 0.125 0.115 0.077 0.062 0.115 0.089 0.092 0.069 0.057 0.058 0.089 0.074 0.062 0.053 0.089 0.066 0.059 0.045 0.045 0.066 0.059 0.045 0.065 0.059 0.045 0.065 0.059 0.045 0.033 0.059 0.045 0.059 0.045 0.059 0.045 14 ......4 0.059 0.045 0.059 0.045 16 ..... .4 545 84 0.030 0.045 0.045 0.045 0.045 0.045 21 ....... 0.017 1.000 1.000 1.000 1,000 1.000 1.00012 points EBDUk Hint Print An asset was purchased three years ago for $190,000. It falls into the fiveyear category for MACRS depreciation. The firm is in a 25 percent tax bracket. Use Table 1212. a. Compute the tax loss on the sale and the related tax benet ifthe asset is sold now for $22,060. (Input all amounts as positive values. Do not round intermediate calculations and round your answers to whole dollars.) Tax loss on the sale Tax benet b. Compute the gain and related tax on the sale if the asset is sold now for $70,060. (Input all amounts as positive values. Do not round intermediate calculations and round your answers to whole dollars.) Taxable gain Tax obligation 13 DataPoint Engineering is considering the purchase of a new piece of equipment for $360,000. It has an eightiyear midpoint of its asset depreciation range (ADR). It will require an additional initial investment of $180,000 in nondepreciable working capital. $65,000 of this investment will be recovered after the sixth year and will provide additional cash flow for that year. Income before depreciation and 2 taxes for the next six are shown in the following table. Use Table 1211. Table 1212. Use Appendix B for an approximate answer but points calculate your final answer using the formula and financial calculator methods. Skipped Year Alount 1 $221,999 2 184,999 3 154,999 SEW" 4 139,999 5 197,999 \"m 5 97,999 [ Print The tax rate is 25 percent. The cost of capital must be computed based on the following: Cost (aertax) Heights Debt Kd 6 . 28% 39% Preferred stock Kp 18.86 19 Common equity (retained earnings) Ke 15.68 69 13 a. Determine the annual depreciation schedule. (Do not round intermediate calculations. Round your depreciation base and annual depreciation answers to the nearest whole dollar. Round your percentage depreciation answers to 3 decimal places.) 2 Year Depreciation Percentage Annual points Depreciation Depreciation Sklpped EBDOK Him Print 13 points Skipped eBook Hlnt an b. Determine the annual cash flow for each year. Be sure to include the recovered working capital in Year 6. (Do not round intermediate calculations and round your answers to 2 decimal places.) c. Determine the weighted average cost of capital. (Do not round intermediate calculations. Enter your answer as a percent rounded to 2 decimal places.) Weighted average cost of capital I % 13 c. Determine the weighted average cost of capital. (Do not round intermediate calculations. Enter your answer as a percent rounded to 2 decimal places.) Weighted average cost of capital 2 points Skipped eBook Hint d-1. Determine the net present value. (Use the WACC from part c rounded to 2 decimal places as a percent as the cost of capital (e.g., 12.34%). Do not round any other intermediate calculations. Round your answer to 2 decimal places.) Print Net present value d-2. Should DataPoint purchase the new equipment? O Yes O No\f\f

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts