Question: need help with the blanks please Comf Airways, Inc., a small two-plane passenger airline, has asked for your assistance in some basic analysis of its

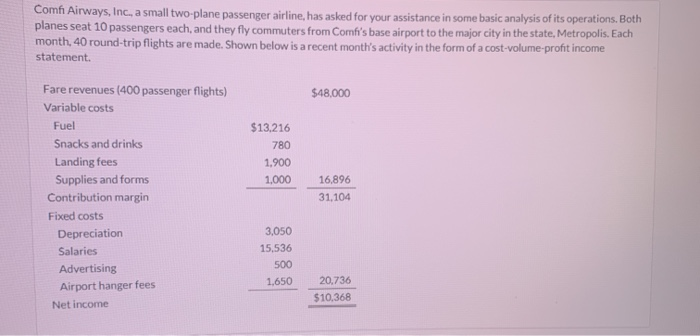

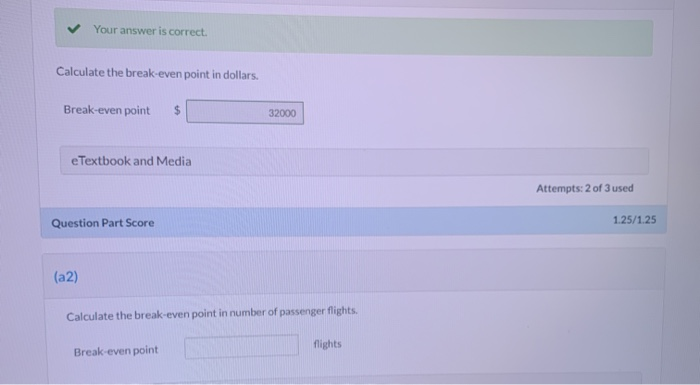

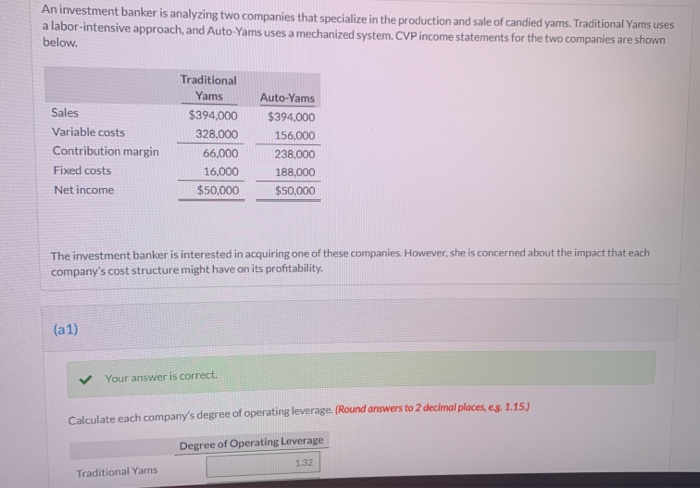

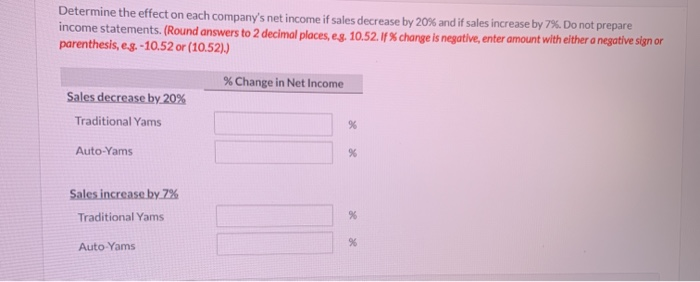

Comf Airways, Inc., a small two-plane passenger airline, has asked for your assistance in some basic analysis of its operations. Both planes seat 10 passengers each, and they fly commuters from Comf's base airport to the major city in the state, Metropolis. Each month, 40 round-trip flights are made. Shown below is a recent month's activity in the form of a cost-volume-profit income statement $48,000 $13.216 780 1,900 1.000 Fare revenues (400 passenger flights) Variable costs Fuel Snacks and drinks Landing fees Supplies and forms Contribution margin Fixed costs Depreciation Salaries Advertising Airport hanger fees Net income 16,896 31.104 3,050 15,536 500 1.650 20,736 $10,368 Your answer is correct. Calculate the break-even point in dollars. Break-even point $ 32000 e Textbook and Media Attempts: 2 of 3 used Question Part Score 1.25/1.25 (a2) Calculate the break-even point in number of passenger flights. flights Break-even point An investment banker is analyzing two companies that specialize in the production and sale of candied yams. Traditional Yams uses a labor-intensive approach, and Auto-Yams uses a mechanized system. CVP income statements for the two companies are shown below. Sales Variable costs Contribution margin Fixed costs Net income Traditional Yams $394,000 328,000 66,000 16,000 $50,000 Auto-Yams $394,000 156,000 238,000 188,000 $50,000 The investment banker is interested in acquiring one of these companies. However, she is concerned about the impact that each company's cost structure might have on its profitability, (a1) Your answer is correct. Calculate each company's degree of operating leverage. (Round answers to 2 decimal places, eg. 1.15.) Degree of Operating Leverage 1.32 Traditional Yams Determine the effect on each company's net income if sales decrease by 20% and if sales increase by 7%. Do not prepare income statements. (Round answers to 2 decimal places, es. 10.52. If % change is negative, enter amount with either a negative sign or parenthesis, e.g.-10.52 or (10.52).) % Change in Net Income Sales decrease by 20% Traditional Yams % Auto-Yams % Sales increase by 7% Traditional Yams % % Auto Yams

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts