Question: Need help with the discussion questions based on the paragraph Let's Practise: Case Study over the nex CRYPTO (Part 1) Johnson & Smith (J&S), was

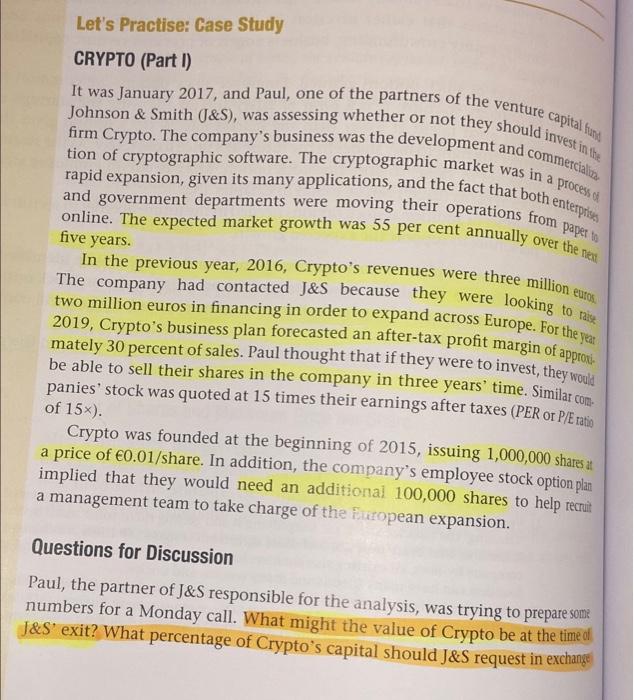

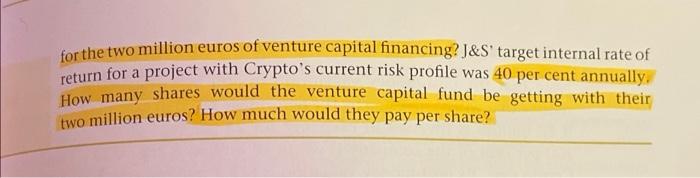

Let's Practise: Case Study over the nex CRYPTO (Part 1) Johnson & Smith (J&S), was assessing whether or not they should invest in the It was January 2017, and Paul, one of the partners of the venture capital and firm Crypto. The company's business was the development and commerciali, tion of cryptographic software. The cryptographic market was in a processo and government departments were moving their operations from paper to rapid expansion, given its many applications, and the fact that both enterprises online. The expected market growth was 55 per cent annually five years. In the previous year, 2016, Crypto's revenues were three million eutos. The company had contacted J&S because they were two million euros in financing in order to expand across Europe. For the year 2019, Crypto's business plan forecasted an after-tax profit margin of approxi. mately 30 percent of sales. Paul thought that if they were to invest, they would be able to sell their shares in the company in three years' time. Similar com panies' stock was quoted at 15 times their earnings after taxes (PER Or P/E ratio of 15x). Crypto was founded at the beginning of 2015, issuing 1,000,000 shares at a price of 0.01/share. In addition, the company's employee stock option plan implied that they would need an additional 100,000 shares to help recruit a management team to take charge of the European expansion. looking to raise Questions for Discussion Paul, the partner of J&S responsible for the analysis, was trying to prepare som numbers for a Monday call. What might the value of Crypto be at the time of J&S' exit? What percentage of Crypto's capital should J&S request in exchange for the two million euros of venture capital financing?J&S' target internal rate of return for a project with Crypto's current risk profile was 40 per cent annually How many shares would the venture capital fund be getting with their two million euros? How much would they pay per share? Let's Practise: Case Study over the nex CRYPTO (Part 1) Johnson & Smith (J&S), was assessing whether or not they should invest in the It was January 2017, and Paul, one of the partners of the venture capital and firm Crypto. The company's business was the development and commerciali, tion of cryptographic software. The cryptographic market was in a processo and government departments were moving their operations from paper to rapid expansion, given its many applications, and the fact that both enterprises online. The expected market growth was 55 per cent annually five years. In the previous year, 2016, Crypto's revenues were three million eutos. The company had contacted J&S because they were two million euros in financing in order to expand across Europe. For the year 2019, Crypto's business plan forecasted an after-tax profit margin of approxi. mately 30 percent of sales. Paul thought that if they were to invest, they would be able to sell their shares in the company in three years' time. Similar com panies' stock was quoted at 15 times their earnings after taxes (PER Or P/E ratio of 15x). Crypto was founded at the beginning of 2015, issuing 1,000,000 shares at a price of 0.01/share. In addition, the company's employee stock option plan implied that they would need an additional 100,000 shares to help recruit a management team to take charge of the European expansion. looking to raise Questions for Discussion Paul, the partner of J&S responsible for the analysis, was trying to prepare som numbers for a Monday call. What might the value of Crypto be at the time of J&S' exit? What percentage of Crypto's capital should J&S request in exchange for the two million euros of venture capital financing?J&S' target internal rate of return for a project with Crypto's current risk profile was 40 per cent annually How many shares would the venture capital fund be getting with their two million euros? How much would they pay per share

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts