Question: need help with the following accounting problem. Serial Problem Business Solutions LO P1, P2 Santana Rey is considering the purchase of equipment for Business Solutions

need help with the following accounting problem.

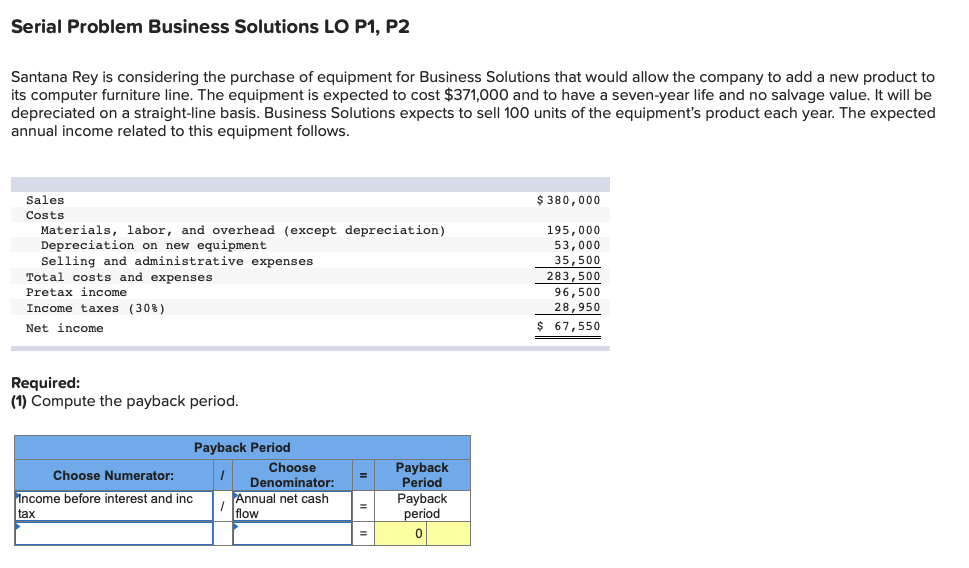

Serial Problem Business Solutions LO P1, P2 Santana Rey is considering the purchase of equipment for Business Solutions that would allow the company to add a new product to its computer furniture line. The equipment is expected to cost $371,000 and to have a seven-year life and no salvage value. It will be depreciated on a straight-line basis. Business Solutions expects to sell 100 units of the equipment's product each year. The expected annual income related to this equipment follows. $ 380,000 Sales Costs Materials, labor, and overhead (except depreciation) Depreciation on new equipment Selling and administrative expenses Total costs and expenses Pretax income Income taxes (30%) Net income 195,000 53,000 35,500 283,500 96,500 28,950 $ 67,550 Required: (1) Compute the payback period. Payback Period Choose Choose Numerator: Denominator: Income before interest and inc Annual net cash tax flow Payback Period Payback period 0

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts