Question: Need Help with the following attachment. Please show work Product Lines Total $3,000,000 Sales revenue Variable costs Contribution margin Direct fixed costs Allocated fixed costs

Need Help with the following attachment. Please show work

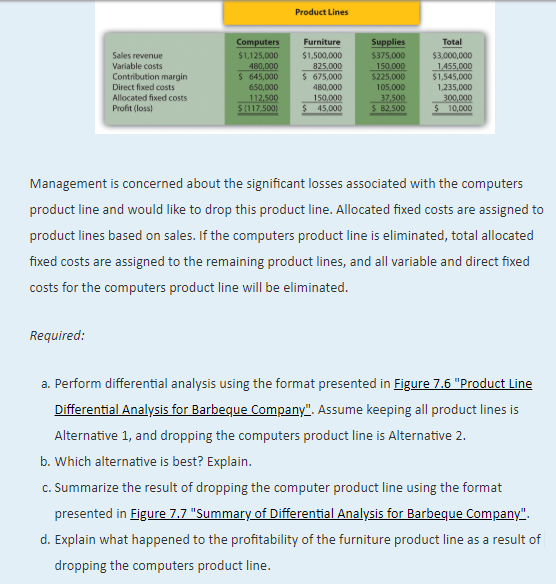

Product Lines Total $3,000,000 Sales revenue Variable costs Contribution margin Direct fixed costs Allocated fixed costs Profit (loss $375,000 $1,125,000 480 $ 645,000 $1,500,000 000150,000 1455,000 675,000 480,000 $225,000 105,000 $1,545,000 1,235,000 650,000 Puil3017 500090097.500000 Management is concerned about the significant losses associated with the computers product line and would like to drop this product line. Allocated fixed costs are assigned to product lines based on sales. If the computers product line is eliminated, total allocated fixed costs are assigned to the remaining product lines, and all variable and direct fixed costs for the computers product line will be eliminated Required a. Perform differential analysis using the format presented in Figure 7.6 "Product Line Differential Analysis for Barbeque Company. Assume keeping all product lines is Alternative 1, and dropping the computers product line is Alternative 2 b. Which alternative is best? Explain c. Summarize the result of dropping the computer product line using the format presented in Figure 7.7 "Summary of Differentia Aalysis for Barbeque Company" d. Explain what happened to the profitability of the furniture product line as a result of dropping the computers product line

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts